DeGRAM

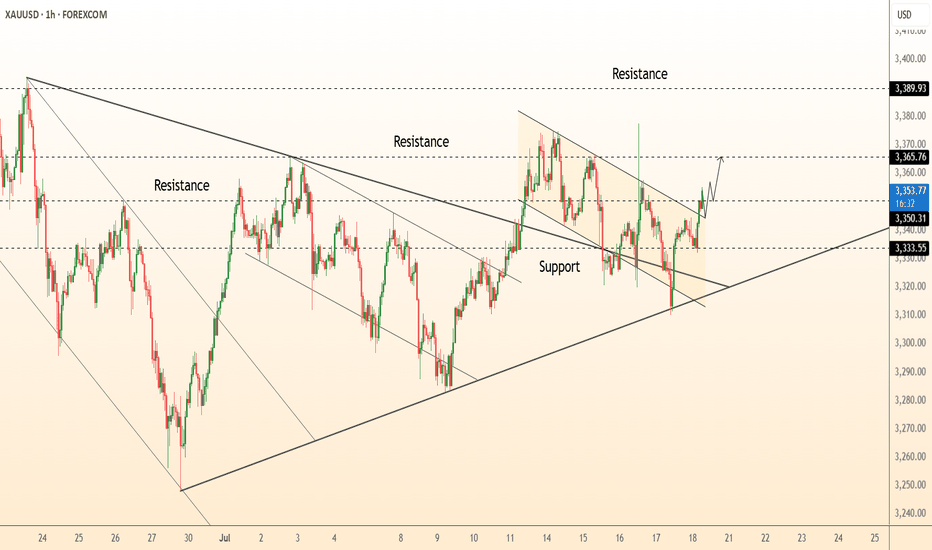

Premium📊 Technical Analysis ● Bulls defended the channel base at 3 333, snapping the intraday falling wedge and reclaiming the broken trend-line; successive higher-lows since 17 Jul signal fresh upside momentum. ● A clean H1 close over the former pivot 3 355 flips the wedge crest into support and activates the measured-move target at the upper horizontal barrier 3 366,...

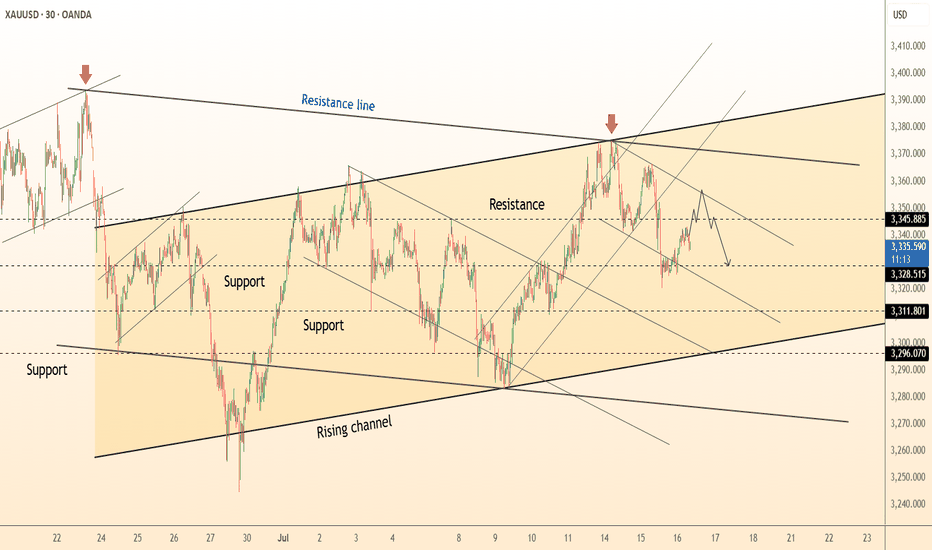

📊 Technical Analysis ● Repeated rejections at the channel mid-band (3 346) and the higher swing-highs marked by red arrows form a descending wedge inside the bigger rising channel. ● Price has slipped back under the intraday up-trend and is tracking a fresh 30 m falling channel; a close below 3 328 completes the bear setup and points to the lower channel rail /...

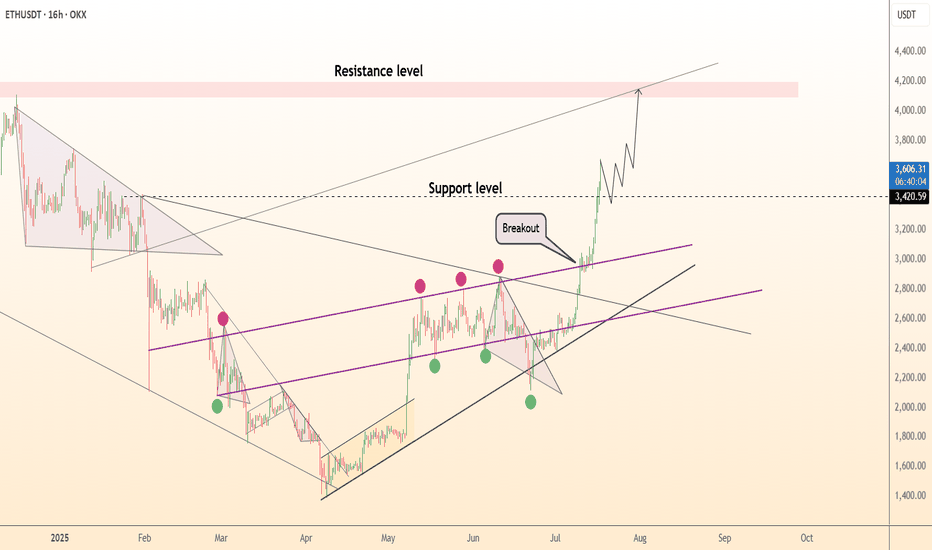

📊 Technical Analysis ● ETH exploded out of the purple median channel, invalidating March-July lower-highs; retest of 3 210 held as a fresh higher-low, confirming trend acceleration. ● Price is now travelling the channel’s outer parallel; flag pole projected from the 2 430→3 210 thrust aligns with the 4 150-4 250 supply zone shown in pink. 💡 Fundamental...

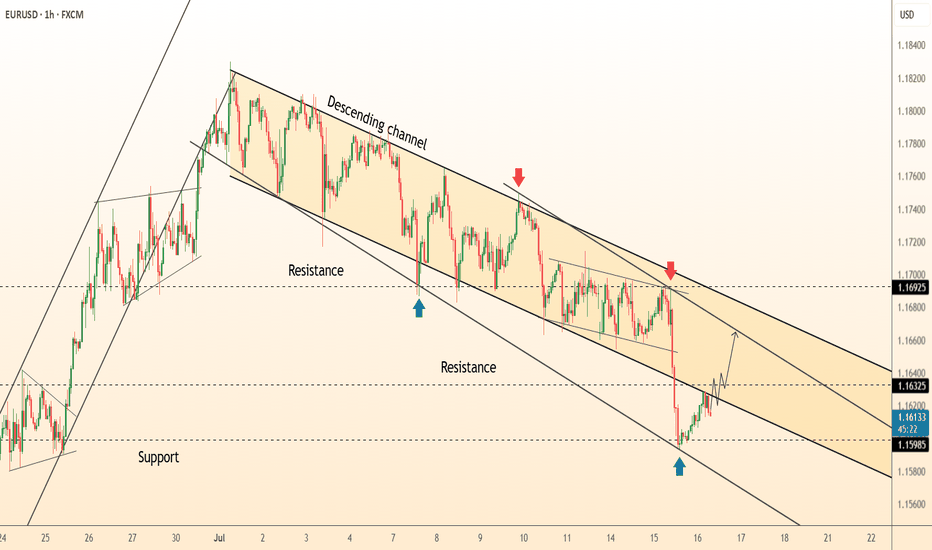

📊 Technical Analysis ● EUR/USD has reclaimed the inner resistance of the 8-day descending channel after a V-shaped rebound from the lower rail; candles are now riding a fresh micro up-sloper. ● A 30 min close above 1.1666 (channel roof / prior pivot) confirms trend reversal and projects the measured move to the higher congestion band at 1.1690-1.1700. 💡 ...

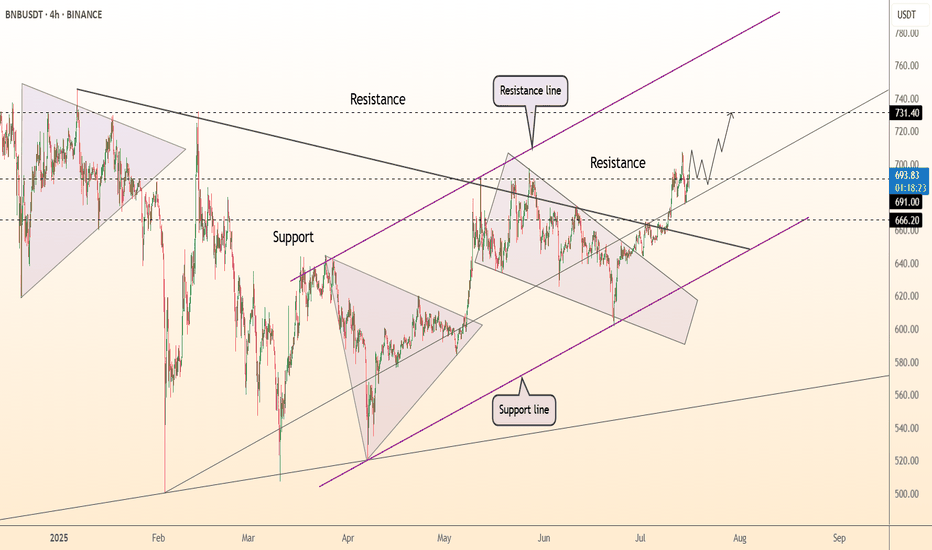

📊 Technical Analysis ● Candle closes have punched through the long-term black resistance and purple trend cap, turning the $666-673 breakout shelf into support as price tracks the grey inner up-sloper inside the rising channel. ● A pennant is coiling just beneath May’s peak; its measured pole and the channel geometry indicate $705 first, then the upper rail /...

📊 Technical Analysis ● Bulls pushed back inside the broad rising channel and pierced the five-week gray trend-cap; the breakout has been retested at the 147-150 pivot (green strip), now acting as support. ● Price is carving a tight bull-flag on diminishing volume; its 1.618 swing and the channel median intersect with the May swing high near 173, while the upper...

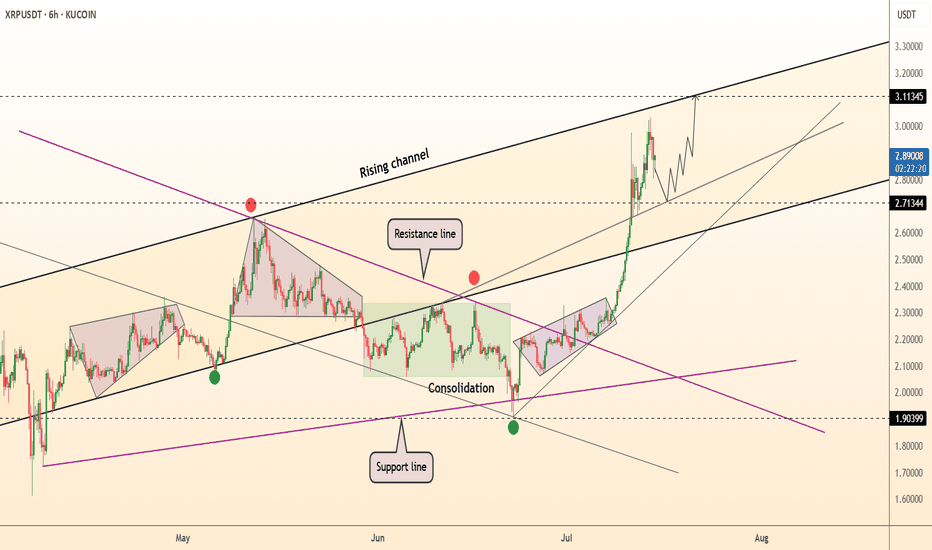

📊 Technical Analysis ● Aggressive breakout from the 8-week green consolidation box has pierced both the purple ’23 trend-cap and inner wedge roof; pull-backs are holding above the prior 2.71 swing, confirming a fresh demand flip. ● Price is now tracking the mid-July parabolic support inside the black rising channel; the next confluence lies at the channel crest...

📊 Technical Analysis ● Price burst through the 12-week compression roof, converting the 2 990 supply into support and printing the strongest close since March. ● The pull-back just retested both the purple trend-fan and the 2 960 flip zone; the active rising channel and flag depth map the next magnet at 3 410. 💡 Fundamental Analysis ● SEC’s 12 Jul request for...

📊 Technical Analysis ● Price printed a hammer and bullish RSI divergence on the lower rail of the 3-week descending channel (green arrow 1.1598), breaking the inner wedge that guided last leg down. ● First resistance is the channel mid-line / prior pivot 1.1632; a move through it exposes the upper band near 1.1692, where July supply and the larger bearish...

📊 Technical Analysis ● Price has just printed a third higher-low inside the green $2.60-2.75 demand zone and on the long-term purple trend line, forming a tight falling-wedge that is squeezing against $2.90 resistance. ● A 16 h close above $2.90 completes the wedge and opens the grey mid-channel target at $3.25; the pattern’s 1 : 1 swing and descending magenta...

📊 Technical Analysis ● Price is stalling against the upper band of a three-month rising channel (≈ 1.1790) after producing a false break and quick rejection—marking a potential bull-trap at trend resistance. ● Bearish divergence on the 4 h RSI and the first lower-high inside a micro rising wedge suggest momentum is fading; a slide through 1.1745 should trigger...

📊 Technical Analysis ● The break of the July descending cap at 3 355 has held as support; price is stair-stepping along a steep intraday channel whose lower rail coincides with the 3 350 pivot. ● Momentum is pressing the 3 368–3 393 supply; clearing that band opens the March swing objective at 3 430, while pullbacks into 3 350-3 355 are buffered by the former...

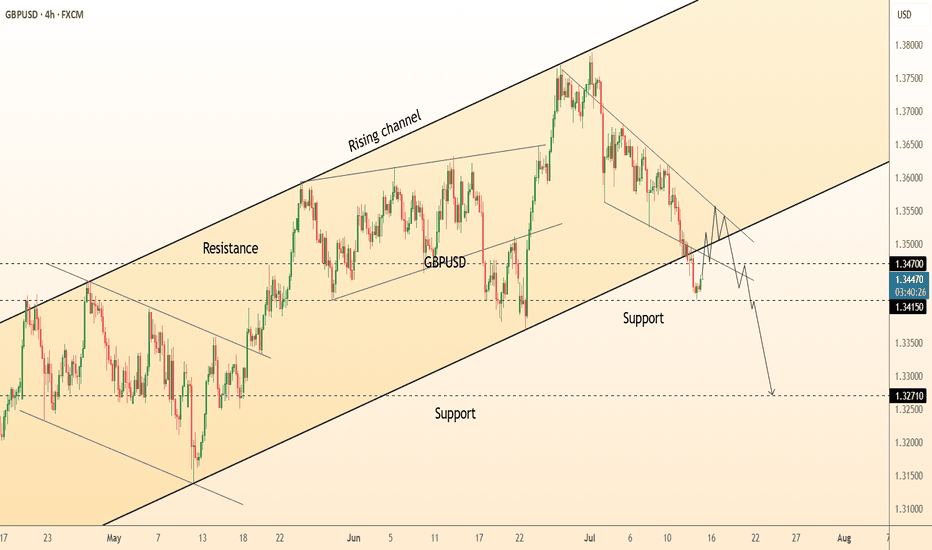

📊 Technical Analysis ● Cable’s bounce stalled at the channel base (≈1.3500); price is now carving a bear flag beneath that rail and the prior wedge-break line, signalling failure to regain trend support. ● A 4 h close under 1.3415 confirms channel loss, opening the mid-May pivot 1.3271; flag top at 1.3470 caps risk while lower-high sequence stays intact. 💡 ...

📊 Technical Analysis ● Price has punched through the month-long descending-channel roof and is holding the break, carving a tight bullish flag along a fresh up-trend line. ● Rebound from the 0.861 demand created an inverted H&S; its 1 : 1 projection aligns with the 0.8681 pivot and the March high at 0.8703, while RSI remains mid-range, leaving upside fuel. 💡 ...

📊 Technical Analysis ● ADA is testing the confluence of the long-term support line and the 0.54-0.63 demand zone; every prior touch of this area sparked a 20-30 % rebound. ● A falling wedge within the broader descending channel is close to completion; a 16 h close above the wedge roof (~0.66) activates a measured move to the first horizontal resistance at 0.73...

📊 Technical Analysis ● Bulls defended the channel‐base 3 280 zone, breaking the six-week falling wedge and reclaiming 3 312; structure flips to higher-highs within the rising channel. ● A close above the wedge lip at 3 355 should unlock the grey range ceiling where the May trend-cap and 3 430 – 3 450 intersect. Pull-backs into 3 300-3 312 are expected to attract...

📊 Technical Analysis ● Daily close above the purple 2-month trend-cap and 114.8 k horizontal flips both into support, confirming the grey ascending triangle break. ● Measured move and channel geometry aim at the 125 k supply band; higher-lows keep bulls in control while risk is contained by the 107 k–109 k demand shelf (confluence of mid-line and former wedge...

📊 Technical Analysis ● Price is testing the rising-channel floor (≈1.3500) while carving a bullish falling-wedge; momentum divergence and prior green arrows hint buyers defend this rail. ● A break of 1.3590 (wedge roof / minor trendline) would confirm reversal, opening 1.3680 mid-band, with 1.3770 channel cap next. Risk is limited to a clean H4 close beneath...