DennyP

Hopefully history repeats itself. NUGT and JNUG in stochastic "oversold". The last few times the long stochastic red line was in oversold territory (< 20.0) there was a day or two in the same area, then price moves back up. The last time this didn't work was in summer of last year, so usual 10% stop loss applies here. Don't want to catch a falling knife. I'm...

Breakout up over $19.50 range. With WTI and Brent oil going up, stocks like PE, and WPX will do well. I still have FANG, which is stuck in the 100 - 106 range. Usual 10% stop loss in-play here. Long @ 20.25.

With WTI oil > $60 a barrel, I'm sure there's computer algorithms (based off futures or derivatives or whatever) that will buy oil-based equities. I like FANG and WPX in this space. Hopefully FANG can break out of the resistance of 106 level. If close > 106, I like the upside here.

With Fed reserve saying "no more rate hikes this year", and wages increasing, unemployment dropping, what does this lead to? Inflation. Going long JNUG here (small caps seem to be performing better as of late over large caps). Also note the MACD crossover over the 0-line, and fast line moving over the slow line. Let's see what happens over the next week or two.

I've been silent the last few days. Last trade I got stopped out for a profit. No regrets there. I'm taking a small position here, as NUGT is oversold. The red slow line in the stochastics is below 15 now. The last few times this happened in the past, a small rally occurred. I expect the same here (and this position is a hedge against market weakness). I...

Ugh... had a limit order which missed by $0.25 last week, and never got filled. Now look at CRSP today. People dream of scenarios like this today, as they can make YEAR profits in one day. I'm pissed I missed it. Congrats to those who did. I'll be watching from the sidelines, as I expect massive profit taking occurring this week.

Let's see. TLT is up. VIX is up. Gold price up. DXY cannot break though 97 again. Stock market indexes neutral. I think some big money is moving into defensive positions. I'll open a position in NUGT as a hedge. Watching DXY to see if it goes higher than 97. If DXY drops from 97, NUGT should see a good return (hopefully).

MACD cross above 0 = new uptrend starting. Breakout on high volume. I'll take a position here. In @ 22.50, standard 10% stop losses in place.

I initially went long @ 60.25 late last week, as this was near breakout. Closed today @ 68.30 for the weekend. I'm happy with my gains. Chart shows run may continue, but I'm taking profit here as overall market may be choppy as SPY and QQQ starts to run into resistance. I'll keep my eye on this one for a pullback. Stay safe out there.

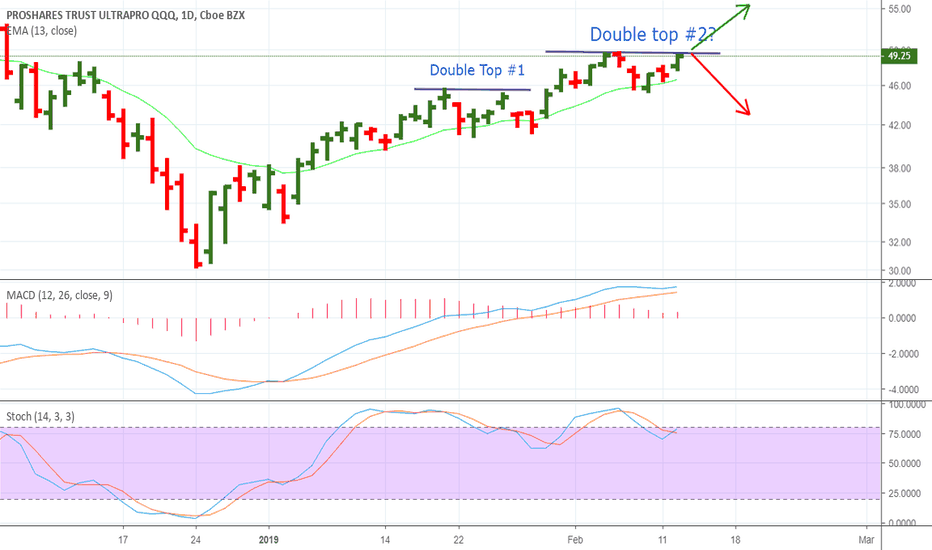

Went long TQQQ in 46's a few days ago (same time as TWOU long position, I didn't publish the TQQQ long... and apparently the TWOU long position, sorry). Now TQQQ has hit a decision point. Previous resistance at $49.50 range. Double top, can either: 1) Break through resistance and go higher 2) Small sell off back to $46's. I don't see any catalysts RIGHT NOW...

I may be late to this one, but UCTT. Look at the chart! Hopefully this continues to $15 and above. I will sell before earnings report in a couple of weeks. Standard 10% stop loss in place.

Breakout on CBLK. Above recent trading range, and MACD has now turned positive. Let's see how far this momentum goes. I'd like to see this in the $19 range, but keep an eye out for earnings. No date has been posted yet. Should be soon. First stop is a close above $16. First resistance around $16.50. Stay safe out there. Make sure your stops are in place.

The trend is your friend here. It does look like January will be a good month after all. MACD finally > 0, so new uptrend established. I figure the NASDAQ probably has a good 5% more before the end of January. Let's ride this trend for some upswing. TQQQ in at 44.70. Target = $49 (if NASDAQ 100 goes up 3%).

I keep an eye on these 3 "CRISPR" stocks: EDIT CRSP NTLA Now all 3 of these have sold off from highs last summer, to 52-week lows in December. The concern is the amount of debt, and no real revenue for the foreseeable future. Another concern probably has to do with that Chinese scientist who CRISPR'd a human baby. That's concerning to say the least... due to...

Here ZS MACD fast line crosses over the slow line (at around 0 level). Also prices closes above 13-day EMA. New uptrend starting. Price now above 52-week high, no resistance. I'll let this one ride with a trailing stop.

GDX has had support at around the $21 level since the beginning of 2017. Each time GDX has hit $21, the stochastic has hit oversold. Buying at that point, and holding until stochastic > 50 (or even stochastic overbought) would have brought decent profits. Well, GDX has hit support at $21 again, and stochastic is oversold. There's several ways to play this...

Looking at chart of VNET today. Looks like a breakout: 1) MACD fast line crosses over slow line. 2) MACD crossover occurs above 0. 3) New 52-week high 4) Increased volume on breakout. I took a long position on VNET today. (Just a smallish position). In at $10.60 (just above the high on July 3, and above the previous day's high). My stop-loss is slightly...

I had a limit order on UXIN at $7.10 based on other 2 prior lows. UXIN went as low as $7.18 before ripping higher yesterday and today. I missed my limit order by 8 cents. Now UXIN is at $8.45, up about $1.20 from the lows of yesterday. I missed a big one here. There will be another time and place.