DiazAdrian

Coal has been on the rise and it is now at the same level as in 2012 before it collapse all the way to 50s in 2016. This prediction is a bit shabby, but I tried my best because this commodity has been supporting Indonesia's economy since late 2017, and another reason that this analysis is shabby because I'm not using the candle, I used Heikin Ashi in order to...

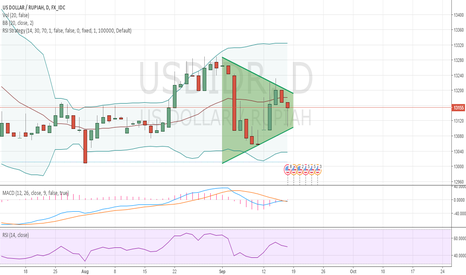

Ok, so IDR just passed psychological level of 15k, it happened right the next day after I posted my analysis where you can see it here . Low inflation create worries in the market because analysts are speculating that there might be a lower demand in the market. The September data shows a deflation of 0.18% MoM which driven from a lower food prices - broiler...

This has been a tough one to make a prediction because it is at the same level during the crisis in 1998, but notice it is the new normal for Rupiah, even though nominal term seems horrifying, but in terms of percentage it is tamer than of that in 1998, 2008/2009 and 2015. Looking at the 3 flags pattern there are probability that IDR may hit 15k in the near term....

So, Oil has been really volatile on the upside considering sanctions against Iran's Oil and India has also take action in regards to the matter. The price is already on the upside of the Bollinger, hence it should normalize a little and crude oil inventory announcement is this Wednesday, the forecast is -1.279M whilst the previous announcement was resulted a...

The consolidation might lead to a stronger dollar in coming week, considering the FOMC meeting will be on Tuesday which can be a very volatile market in the USDIDR market, shorting the IDR would be a wise move.

After 5 consecutive trading days of positive result, RSI and MacD for the Jakarta Composite is finally in the oversold territory. Bollinger bands also agree that the price will fall for tomorrow and next week. Price fall maybe around 4852 to 4718 or slightly below the 5000 price line