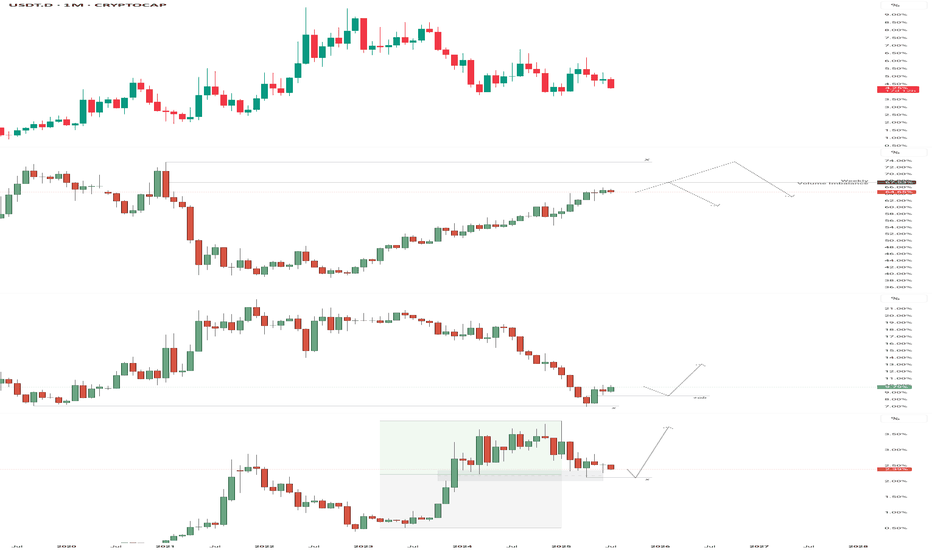

Over the past two quarters, Tether's (USDT) market cap has expanded by over 66%, rising from ~$95B in late 2024 to ~$159.5B by mid-July 2025. This confirms a strong capital injection into the crypto space — reminiscent of early bull market cycles. But where that capital flows tells the deeper story: USDT.D is in a clean downtrend, showing that capital is...

BTC dominance continues its climb toward the 73% region, with no significant signs of altcoin capital rotation at this stage. Market structure remains intact in favor of Bitcoin leadership.

After taking a loss yesterday, I had to reassess my outlook on Gold. The market behavior leading into and following the NFP event revealed significant discrepancies between Gold and Silver that can’t be ignored. Since April 24th — the day Gold printed its highest price in human history — the daily chart has shown consistent lower low formations. In contrast,...

I initially anticipated a deeper move toward 3225 — the 25–30% retracement zone of the discount array — but price bounced quickly during Monday’s open, then confirmed a market structure shift by breaking above 3350. However, the buy signal wasn’t convincing at the time, as Silver lagged and leaned bearish. Following the latest 4H chart, Silver has now...

In line with my previous projection, price dropped from the 3330 region toward the key level around 3224, bottoming out at 3245 after sweeping liquidity—forming what now appears to be a potential double bottom. However, the rally from 3245 looks more like a liquidity build-up than a true reversal. This suspicion is strengthened by Silver’s behavior, as it failed...

BTC’s failure to rally into a new all-time high (ATH) from the June 5th low can be attributed to the fact that price wasn't coming from a true discount zone. Similarly, key correlated assets like ETH and SOL also hadn’t reached their respective discount levels at that point. This misalignment created an unbalanced market structure, which necessitated a corrective...

Gold is currently trading at a premium level after rejecting recent highs. The market is showing signs of weakness with a series of lower highs, suggesting a potential retracement. A key level to watch for a possible reaction or turnaround is around $3,225, which aligns with previous structural support and falls near the discount zone of the recent range. If...