Dorr9011

EUR/JPY is currently bouncing off of a support zone (purple), showing similar reactions to other previous formed zones in this current parallel channel. I have just entered a buy position, risking 32.5 pips to catch 111.4. We also have a confirmed double bottom, which sums it up to 3 total confluences.

Confirmations: 1. In Current Downtrend, Looking @ Sell 2. At Top Line of Pitchfork Channel. 3. Miltiple Cash Machine Sell Indicators on Daily Timeframe 4. Hourly Chart is Forming Bearish Triangle

Regular Bullish Divergence: Price is making a higher low(HL) and the stochastic oscillator is making a lower low(LL) which is normally found at the continuation of an uptrend. I will be watching for price action to see if USDMXN will reject off of this trend-line. Priceline is also at the "Golden-Zone" fib retracement, which makes a total of 3 confirmations for...

On the higher timeframe, GBPUSD is touching a bullish trendline. We recently saw support from the 200 EMA the past couple days, and could see a continuation of the upward movement towards the next zone (1.411-1.428). We have additional confirmation on the 4H chart in the form of a fib retracement that has hit the "golden zone" or 61.8-70%. I will be looking on...

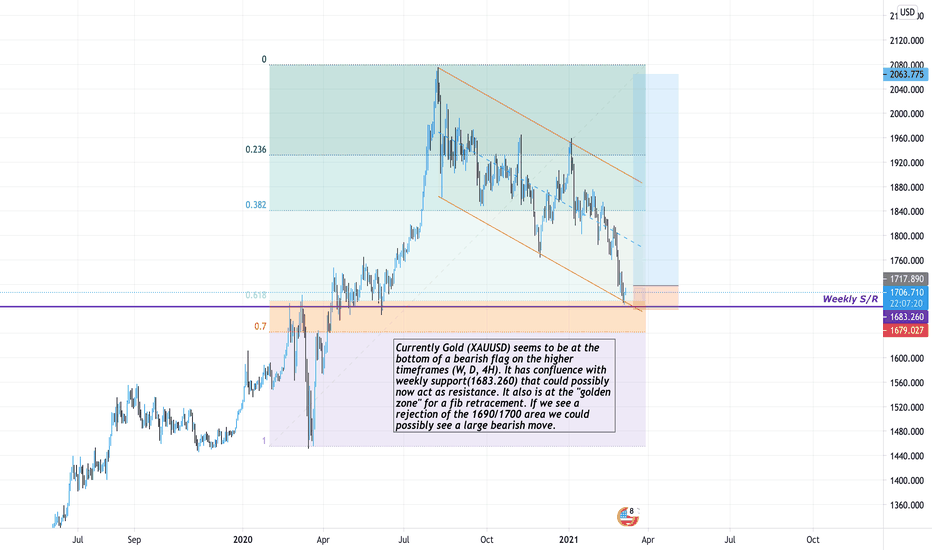

Currently Gold (XAUUSD) seems to be at the bottom of a bearish flag on the higher timeframes (W, D, 4H). It has confluence with weekly support(1683.260) that could possibly now act as resistance. It also is at the "golden zone" for a fib retracement. If we see a rejection of the 1690/1700 area we could possibly see a large bearish move.