I am looking/waiting for a pullback to July's monthly open for a buy support trade in this strong bullish trend. Based on the close of the 3 month quarterly chart, the trend is EXTREMELY bullish. This doji candle on the monthly chart for the SP500 is EXTREME Bullishness. Below are examples of this setup. I jump ALL over this setup as soon as I see it.

Outlined below, I have come to the conclusion that there are 10, most probable trade outcomes of any given trade idea. After seeing these outcomes, one can see what outcome is the most challenging for a trader to handle. Everyone is different and can tolerate different scenarios.

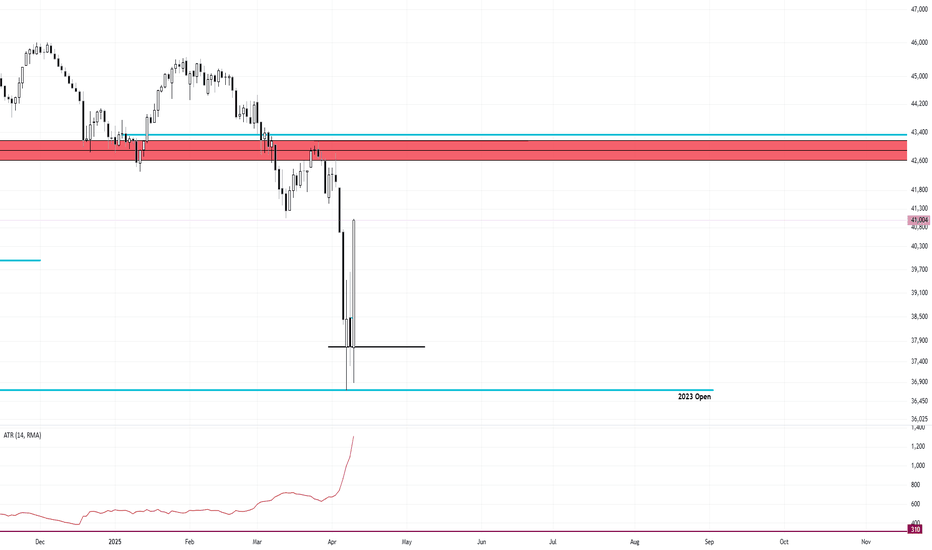

I am currently short Dow Jones aiming for a home run trade that I have been waiting to set up for days now. My thesis: Rising wedge into the 80% pullback of the Daily Doji bar Mean Reversion around March FOMC of 41,155 Break of the support zone of 42,000 If today will be the day it engulfs then I will probably hold all day short If I am wrong, then price...

This is just my rough draft estimation on what I am thinking Dow Jones will do in June. I am going to sit out the first week to gather data and let the market show its hand to me first. I have two key levels marked using the weekly candle of April 7th. The 80% retracement and the candle open. I am thinking the first week of June to be a sideways candle of...

After I thought we would see a sell continuation off of the March FOMC level of 42,155, price continued bullish. I am using Thursday and Friday's opening price as support for a pullback. 41,912-41,968 I am expecting Wednesday and Thursday to be profit taking, pullback days in an upward trending bias. This monthly candle is expecting to close near the highs....

The ramped volume accumulation above the monthly open is the target for liquidity. I am going to be looking for a pullback to form the high of week and a continuation of the down move. Next week is a short week due to the holiday. Therefore, should be a slow drift down. This monthly bar is forming a market maker cycle. Instead of Wednesday being the midweek...

Using the 8-hour chart on the Wednesday of an FOMC release, I use a purple line on the 10am EST 8-hour candle's open as the FOMC release price point. I then use a purple highlighter to signal the date of the release. I have come to the conclusion that the Dow Jones Futures moves and finds support/resistance using the FOMC releases. Nothing else on the chart...

On my long term swing trading account, I will be placing a limit order sell right on the 2025 open at 43,275 and will be using a 1400 ticks stop. I will be using 2 micros and will risk $1400. I am targeting the two equal lows for around 7000 ticks or $7000. This will be a potential 5 to 1 risk to reward. I have drawn two candles that I would like to see happen....

Just some observations but I can see NUMEROUS similarities between the two charts There are 8 instances that are EXACTLY the same between the two. This is more than random chance. 1. Range 2. Yearly Open at top of the range before the spike down 3. 1962 and Covid Dump 4. Bullish grind 5. Bearish downtrend STOPPING right AT the top of the...

The first 10 days has trades in May and it has now shown its hand on what type of cycle this is. It is not a trending cycle nor a market maker cycle but a range bound cycle. Just like in February, the Monthly open, in orange, is going to be major support until it breaks through it. The purple line is May's FOMC release. Look for a flush of the two equal lows...

I missed the 2 hour breakout at 41,365. If I can get a pullback with the 15 minute chart, I will jump in. My ideal trade will be 41,365 Stop is 180 ticks Target is 550 ticks

I am going into May with a bearish outlook. I am treating the end of April as a pullback/sideways resting consolidation before the continuation of the move down. This is in my opinion, the halfway mark of the move down. We had the first leg and now the second leg is setting up. Leg two WILL take out all three lows from the prior up move. True support is at the...

April 2nd, the market tagged the September FOMC by a hair and dumped off. Where did this 6000 tick dump end up stopping? To the 2023 yearly open by a hair. Price has found support at the 2023 yearly open 5 times before the monster rip. Now we are in a range. I am waiting for price to run a high in order to take a sell. So far, this week, price is oscillating...

The weekly trend is bearish. Price is short term bullish to pullback into bearish resistance. I have marked resistance as the red box. This is the bottom of the two bullish weekly candles that got eliminated. This pullback will accomplish multiple things. First, it will start to shake out people already short and get them to get out while they watch...

Following this 30% pullback into the 2020 opening price support, this will take out the 2022 lows, find support at the COVID highs and bounce. 60,000 is the measured move from 2020 open to 2024 highs. Expect some resistance there. Price support of 31,000 After further thinking, I don't think price will return to 2018 open as I previously thought. Instead just...

Don't be suckered into this bear market rally. Price is still bearish and will continue to be so until the 2018 Open price has been hit of 27,500. A clue the market has shown is the bodies of the last three days are suspended above a key level. This is a sign that price will return. When prices find a low at a key level, the bodies are AT the level. Case in...

The market's goal is to return to the Covid peak formation low, the 2018 yearly open and the middle of the 2018 range. Along the way, all the lows will be taken to achieve this goal. Middle of Range: COVID Peak Formation Low: Returning to 2018 Open: It is very clear to me now that this is the gameplan. I will remain a bear until the 2018 Yearly...

I am looking for a false break reversal after no follow through of a bullish bar. I will enter on the close of the bear candle that takes out the high bull. Trend is bearish until 30,000