This chart shows a bearish price setup for GBP/USD on the 1-hour timeframe, with smart money concepts, key EMAs, and a clear projection of price movement. 🔍 Technical Analysis Breakdown 1. Price Context Current Price: 1.28987 Trend: Price has broken market structure to the downside, suggesting a potential shift from bullish to bearish. Key Indicator...

EMA 30 (Red): 1.09984 EMA 200 (Blue): 1.08869 🧠 Trade Idea: Long (Buy) Setup 📍 Entry Zone (Support/Buy Area): Entry Point: Around 1.08868 – 1.08869 This zone aligns with the 200 EMA, acting as dynamic support. There's also a clear demand zone (purple box), indicating historical buying interest. ⛔ Stop Loss: Set at 1.08080 Placed below the demand zone to...

200 EMA (blue): 3085.72 (bearish as price is below it) 30 EMA (red): 3033.52 Current Price: 3034.10 🟪 Key Zones (Highlighted in Purple) Resistance Zone: Around 3045.54–3065.70 Support Zone: Around 2968.27 Previous High Zone / Target Area: 3158.42 📉 Short Trade Setup (Blue Arrow Going Down) Entry Area: If price rejects the resistance zone around...

1. Support Zone (Purple Box at Bottom): The price has tested this zone multiple times (marked by green arrows), indicating strong demand and a potential double or triple bottom pattern forming. This support zone ranges roughly between 0.93150 and 0.93350. 2. Projected Bullish Move: A projected move is drawn from the current price level (around 0.93638) to a...

EMA 30 (Red): 2.35352 EMA 200 (Blue): 2.39026 🧠 Trade Setup: Potential Long Opportunity 📍 Current Price: 2.35026 📌 Key Levels: Entry Zone (Demand Zone): Around 2.31857 – 2.34500 Strong historical support (highlighted in purple). Market is expected to pull back here before bouncing. Stop Loss: 2.31857 Placed below the demand zone to avoid false...

EMA 30 (red): 160.813 EMA 200 (blue): 161.441 --- Highlighted Zones & Points: 1. Entry Point: Marked around 160.719 (just below EMA 30) Positioned in a demand/support zone (highlighted purple box) 2. Resistance Point: Marked at 161.799 Serves as a minor resistance level before the major target 3. EA Target Point: Final target is 163.880 This...

Asset: ODOS/USDT Timeframe: 2H Current Price: 0.005070 EMAs: 200 EMA (blue): 0.006703 30 EMA (red): 0.005546 🟩 Trade Setup (Long Position) Entry Zone: Around 0.004778 Stop Loss: Below support at 0.004229 Target 1 (TP1): 0.006082 Target 2 (TP2): 0.007054 📈 Risk-to-Reward & Potential TP1 Gain: ~27.3% TP2 Gain: ~47.36% This is a high R:R trade from a key...

This is a 1-hour BTC/USD (Bitcoin/US Dollar) chart showing a bearish setup. Here's the breakdown: --- Key Observations: 1. Bearish Rejection Zone (Purple Box - ~83,174.62): Price is showing rejection at a key resistance zone. Both the 30 EMA and 200 EMA are above current price, adding downward pressure. 2. EMA Analysis: 30 EMA (Red Line): ~83,174.62 –...

Timeframe: 30 Minutes (M30) Indicators: EMA 30 (Red): 1.41932 EMA 200 (Blue): 1.42196 🧠 Trade Setup: Potential Short Opportunity 📍 Current Price: 1.42252 📌 Key Levels: Entry Point (Supply Zone): 1.42582 Strong resistance zone, overlapping with EMA 200 and a previous consolidation zone. Price has entered a rising wedge pattern—a potential bearish reversal...

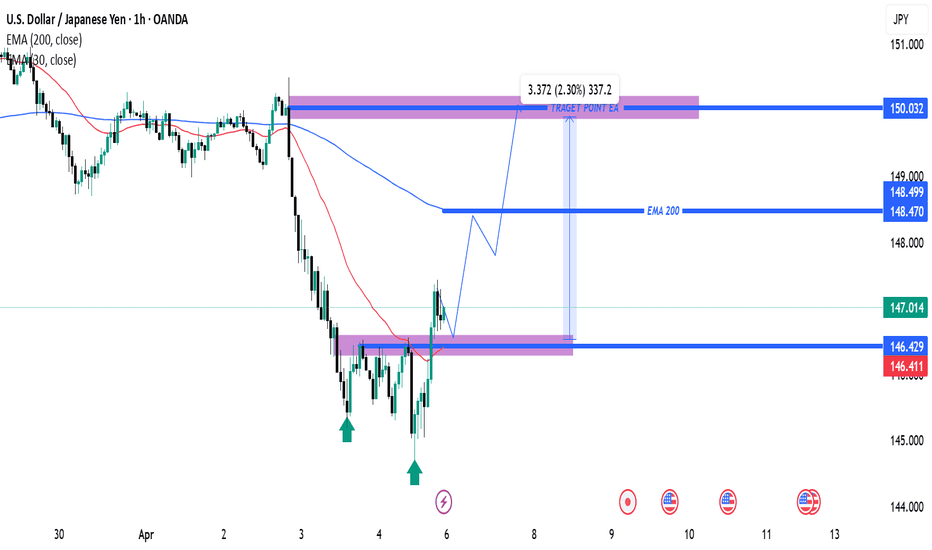

This is a USD/JPY 1-hour chart analysis, and it looks like a bullish setup is being anticipated. Here's a breakdown: Key Observations: 1. Support Zone (Purple Box - Around 146.411 - 146.429): Multiple bullish rejections (green arrows) indicate a strong support level. Price bounced off this support recently, forming a potential double bottom. 2. EMA...

This chart shows a potential bullish setup for Gold (XAUUSD) on the 15-minute timeframe, with some key technical elements and a projected trade idea. Here's a breakdown of the analysis: 1. Current Market Overview Price: Trading around $3,038.51. Trend: Recent downtrend followed by a minor recovery. Indicators: EMA 200 (Blue): Currently at $3,090.41, acting...

This chart represents a GBP/JPY (British Pound / Japanese Yen) 30-minute timeframe analysis. Here are the key takeaways: Technical Indicators & Levels Exponential Moving Averages (EMAs) 200 EMA (Blue Line): 193.586 – A long-term trend indicator. 30 EMA (Red Line): 193.182 – A short-term trend indicator. Key Levels Resistance Zone (Stop Loss Level):...

This chart represents a Gold (XAU/USD) 30-minute timeframe analysis from TradingView. Here are the key takeaways: Technical Indicators & Levels Exponential Moving Averages (EMAs) 200 EMA (Blue Line): 3,110.97 – A long-term trend indicator. 30 EMA (Red Line): 3,134.65 – A short-term trend indicator. Key Levels Resistance Point: Around 3,136.56. Support Zone...

200 EMA (Blue Line): 84,124 – This is a long-term trend indicator. 30 EMA (Red Line): 83,925 – A short-term trend indicator. Key Levels Resistance Point: Around 83,925 (marked in blue). Support Zone: Around 82,184 (Stop Loss zone). Target Point: 88,197, indicating a potential 6.34% upside. Potential Trade Setup Scenario 1 (Bullish Case): If price breaks...

This chart is a technical analysis of the USD/CAD currency pair on a 3-hour timeframe. Here’s a breakdown of the key elements: Key Observations: 1. Exponential Moving Averages (EMAs): 200 EMA (Blue Line) at 1.43318 – A long-term trend indicator. 30 EMA (Red Line) at 1.43135 – A short-term trend indicator. The price is currently trading above both EMAs,...

This chart appears to show a technical analysis of the EUR/USD currency pair on a 30-minute timeframe. Here’s a breakdown of the key elements: Key Observations: 1. Support & Resistance: A support zone is marked in purple around 1.07679 - 1.07845. A resistance level is marked at 1.07895, suggesting a potential breakout. 2. Exponential Moving Averages...

The image is a technical analysis chart for the EUR/JPY currency pair on a 3-hour timeframe. Here’s a breakdown of the analysis: Key Elements of the Chart: 1. Support & Resistance Levels: A resistance level is marked near 161.100. A support zone is highlighted in purple around the 160.820 - 161.100 area. A stop-loss level is indicated below 160.820, around...

This is a technical analysis chart of the Australian Dollar (AUD) against the Polish Zloty (PLN) on a 30-minute timeframe from TradingView. Here are the key observations: 1. Resistance Zone (Purple Box at the Top): The price is approaching a key resistance area around 2.4350 - 2.4450. This zone has previously acted as resistance, suggesting a potential price...