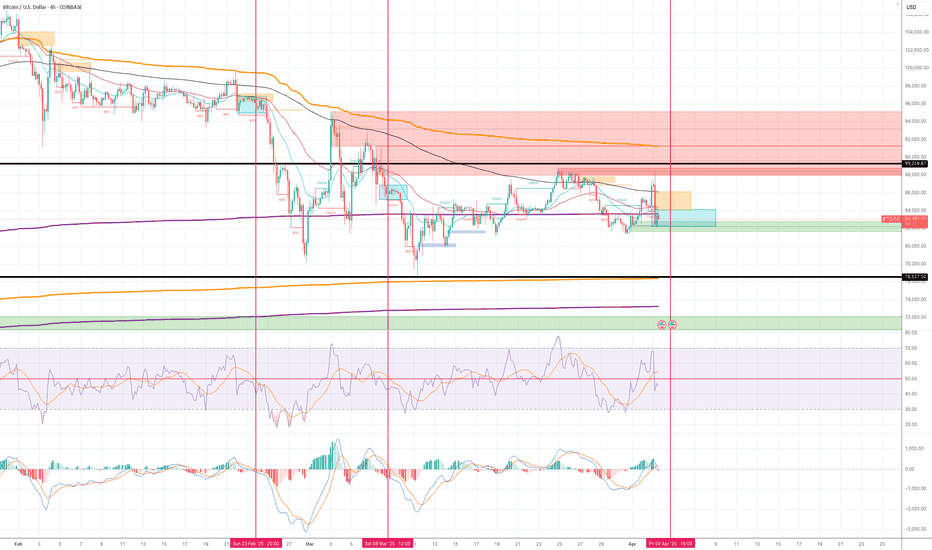

The price is consolidating between 89,000 and 76,500 zone. But I can see another downward move to 76,500 is developing. Where I drew blue rectangular blocks and red vertical lines in the chart (Feb and March 2025) are the very similar set up as the current situation as follows: 1) The market creates the set up where it looks like the price is slowly...

All weekly momentum indicators IMACD, RSI and Stochastic) are all bearish, so I have been looking for a short opportunity in 4H and daily charts. $151.85 is the major resistance and support zone (black horizontal line in the chart). On Feb 6, USD/JPY broke and closed below the area, but it failed to continue to the downside. In the following few days, it...

I opened two short positions yesterday. I have a few short positions that I opened last week, but I feel comfortable adding more now. Entry - blue horizonal line in the chart. Stop loss - red horizontal line in the chart. Target 1, 2, 3 - black horizontal lines in the chart. If it hit target one, I will move a stop loss to the entry position.Target 1 is the...

I have been thinking this Bitcoin cycle has already peaked. I am using a weekly chart here because I can fit in three BTC cycles on the screen, but it is more clear if you look at it in the Daily chart. I am analysing the chart by using VWAP - Volume weighted moving average. When you place VWAP (orange line) at the peak of each cycle you can see the pattern...

Yesterday, I opened a short position during the Asian session and published my trade set up , but I ended up manually closing the position before the US open becauseI was a bit anxious about US GDP data. But the main concern was the price was hovering around the major support and resistance area and I could see valid reasons to go long as well. The obvious...

This is a very bearish chart. I missed to opened a short position so now I have to wait for the second chance. I will open a short position if and when: 1. the price comes back up to fill the gap in the daily chart. 2. The price is going to roll back down at major fib level such as 0.618 and 0.5. 3. Momentum indicators in daily chart stay in the bear zone...

I invest in Bitcoin, and don’t usually trade. However, I can see a pretty bearish setup unfolding. Trade set up: Entry price: 85341.66 (black line in 4H) Stop loss: 87,962 (red line in 4H chart, just above the previous week high) Target 1 - 80.971 (green line, previous week low and Fib 0.5 level in Daily chart) Target 2 - 78, 253 (green line in 4H...

I had a few failed short trades in the last few weeks for this pair. My overall bias is bearish and I must admit having a strong bias cost me. I was too eager to execute a trade and I ended up front running and instead of reacting to the price action. This morning, I opened two short positions (1 position size divided into two) for USDJPY . Trade set...

I just opened three short positions. I waited for the price to come back to the fair value gap area that was created a few days ago (blue rectangular box in the chart). Please look at my previous publication on JPYUSD short positions. It explains the reasons for short entry. It is linked to this one. Entry: 149.40 S/L: 150.183 Target 1: 148.272 Target...

Opened 4 short positions (1 trading side divided into 4 small sizes): 148.622 has been the major support area USDJPY was struggling to break below since last December, however, it finally broke and closed below that level on March 4th 25 (red vertical line in 4H chart). Since then, USDJPY has been oscillating between 150.24 and 146.55, but this morning it...

I opened two long positions for USDJPY pair: My overall bias for USDJPY is bearish so I have been mainly shorting the pair but I saw a good set up wroth while to go long. Trade set up: Entry - 148.272 (black line in 4H chart)Target 1 - 149 (previous high and previous week mid price) - Green line in 4H chart)Target 2 - 149.82 (Green line in 4H chart)Stop...

I opened a short position this morning for the following reasons: Weekly: 1) The price closed below 38,113 (key support area) with a large bearish engulfing candle. 2) The candle closed below EMA 21. 3) MACD is still in the bull zone, but the lines have crossed and clearly pointing to the downside. Daily: 1) The price broke below the ascending parallel...

There is a strong line of support and resistance at 148.65 area, I have a short position I opened a few weeks ago. I am still patiently waiting for the price to break below this level. In October 2024, the price tried to break above the same support and resistance area and it took three weeks to properly break above and start the bull trend. (see blue...

I opened a short position based on the following reasons: 1) Daily candle on the 13th Feb decisively broke and closed below the support line around 1.430 zone and created fair value gap. 2) The price retraced to the FVG area and closed below the area this morning (I am looking at 4H and 1H for this). 3) Both MACD and RSI in Daily and 4H are in the bear...

I opened a short position yesterday based on 4H and daily chart. My reasoning is as follows: Daily 1) The price broked above the previous high (8525), failed it hold, and dropped and closed below the previous higher high. 2) It moved and closed below the ascending trendline. 3) All momentum indicators are now moving to the downside. 4H 1) The...

I can see a good short trade opportunity developing. 1)The price sharply dropped below the major support/resistance zone around 107 area and retraced up gently within the ascending parallel channel to fill the fair value gap. 2)The current 4H candle is moving below the bottom parallel channel. (developing) 3) MACD is in the bear zone and it looks like it is...

I opened a short position today based on the 4H chart and daily chart price set up. My reasonings are as follows: Japan225 has been in the range bound since Sept 2024. The price peaked at 42,420 area and sharply dropped to 30,480 on the 5th August 2024. The price started to recovered to 39,150 area on the 30th August 2024. Since then, that level is...

My overall bias for Solana is bullish. Solan price is dropping significantly at the moment probably due to Libra token. (just my guess). I have set buy orders at $130-145 area. I don't usually buy the dip, but this might be worthwhile buy the dip opportunity.