*WE'VE ACCIDENTALLY PUBLISHED PRIVATE IDEAS* From a trade earlier this month, we traded a credit spread opportunity to the downside on Mattel ($MAT). Check out our articles for more about this trade as well as our trades on $TWTR and $WYNN this month.

*WE'VE ACCIDENTALLY BEEN PUBLISHING PRIVATE IDEAS* The fundamentals for Gold is looking bullish, and our trade we made back in the beginning of February has performed well using our first draft of the FriendlyTrend Signal. Our initial 5x contract entry at 1221 is not at an above-breakeven stop loss, and the spike up w/ a close allowed for a 4x contract entry with...

After poor earnings release, a major downgrade from Goldman Sachs, and an overall overinflated price, this break of the upward trend was an opportunity too good to pass up with a slightly OTM Skip-strike butterfly trade. See our site for more research and our trades in our case-study accounts as well as our personal accounts.

Two major buy signals occurred along with positive news for the company in the past two weeks. The Monthly and Weekly charts show a positive break to the upside, with a low-risk stop loss point. Average yearly return of a monthly dividend is 11% #StayFriendly

We went short today with a bear call spread and less than a month until expiration. Our risk reward for our contracts was an even 1:1, with the breakeven at the 37.50 strike price. Our stop loss is at breakeven to manage our risk to the lowest point possible.

We opened this position about 30 days ago and played the time premium after the huge up move in oil prices. Our initial risk was $200 for a total collection of $50.

Today we had a great setup of a short entry with relatively low risk on 1 crude oil contract. Our reversal bar appeared with a short entry below the low of the bar and the stop loss at the high, trailed three day bars behind the price.

This is a depiction of 2016 performance of opening both DITM Put and Call Options.

The name of the game in trading is knowing when to cut your losses short. Goldman Sachs upgraded MSFT in premarket trading today, which caused a gap up in the opening price. We're in the red about $105 from an originally $252 max credit trade. We're going to wait for market close before cutting our losses on the position. If the close looks to be as if it's...

It's Wildcard Wednesday and TWTR is showing a potential turn for a low-risk, long entry either on the underlying stock or a set of call options with a .65 Delta or higher and 2 months until expiration. It has already tested the previous up fractal, but with a no-go on closing above. Once a market close occurs above that level, we'll look to submit a buy order....

It may be too late to jump in on this one, as the risk is about $20/share in option value if it turns against us.However, if you can stomach that kind of risk and have the capital, a .75 Delta ITM Put with 2-3 months of time value could win big. Today's slight rebound allows for an equivalent entry to the closing price from 11/10/2016. Trail your stop to the Red...

TSLA began its downtrend awhile ago, so it's already a volatile and risky stock to jump in on at this stage in the game. However, with good trade management, we can do an ATM Bear Call Spread at the 185 price mark. Trail your stop to the Red line, because this could turn at any moment. 1 month until expiration.

TWTR tested it's last up fractal today. If within a few minutes of market close the closing price actually shows above the up fractal price point, we'll enter a Deep ITM Call Option with 2 months until expiration and an underlying stop loss at $18.17 on market close only.

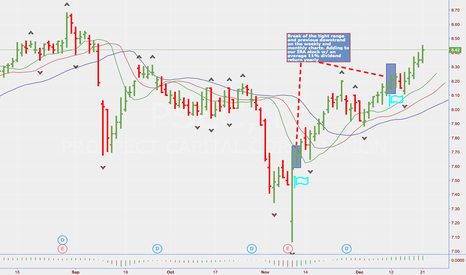

"Low Cost of Business" tight range fractal setup occurred on 10/25, with the lower fractal being broken and the subsequent lower fractal being broken on 11/9. Entered >.75 Delta Put Contracts with 2 months until expiration.

Small account trade; Sold 4 ATM Bear Call Spreads for $200. Lower fractal broken & a tad of AO divergence. Bad downgrade news on $MSFT adds to the mix.

We buy a .75 delta Put option with stop loss beginning on the previous candle's high. Another AO divergence from the price confirms due to no major reversal bars showing up; the previous bottom fractal was broken below the red line.

Fractal broken below Red line; no prior trend reversal bar; Twin Peaks AO Signal. Stop and reverse cent above high of entry bar. Profit taken a month later on 5/20 with close at/above red line.