ElSalehTrading

PremiumThe 2960 zone is the first target, offering the potential for a moderate downside move. Here's why: Previous Support: The 2960 level has acted as support in the past, with price bouncing upward several times from this region. If the sell-off begins from 3065, we could expect the price to dip toward this support area before encountering potential buying...

The 3065 price level is acting as a strong resistance zone for XAU/USD. Here’s why: Previous Resistance Test: Gold has tested the 3065 level multiple times in recent weeks and has failed to break above it, resulting in price rejections. These rejections create a pattern where institutional and retail traders are likely to sell at or near this level, anticipating...

At the time of analysis, XAUUSD is consolidating and has broken above key resistance levels. The long trade setup is based on several factors: Strong Bullish Trend: XAUUSD has been in a strong uptrend over the past several weeks/months, supported by global inflationary fears, potential economic uncertainty, and dovish central bank policies. Fibonacci Extension...

Several technical indicators are pointing to a strong bearish outlook for XAU/USD, signaling that a move lower could be on the horizon: RSI (Relative Strength Index): The RSI on the daily chart is currently hovering around the 50 mark, suggesting a neutral momentum. However, if the RSI begins to turn lower, it would indicate that the bears are taking control,...

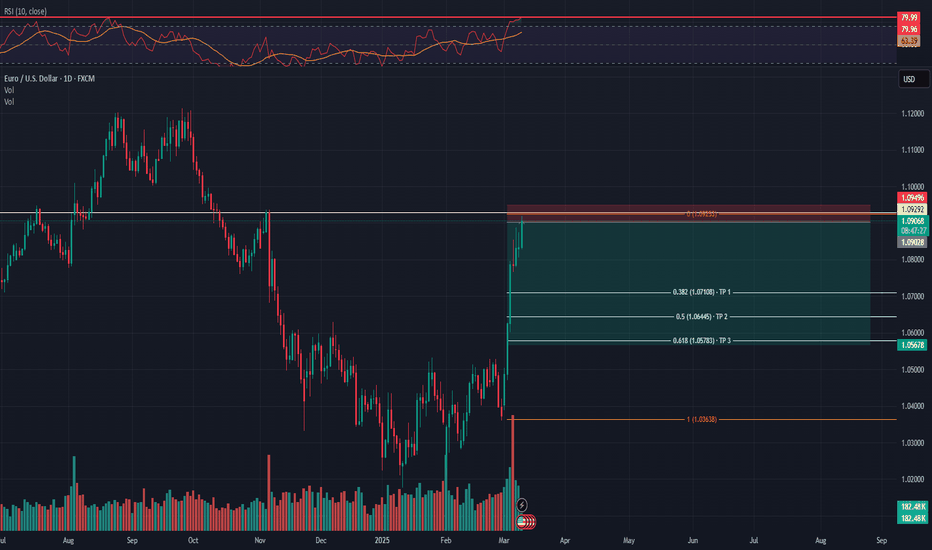

The EUR/USD pair has recently shown signs of weakening after reaching key resistance zones around 1.0900 and 1.0850. With the U.S. dollar holding strong due to solid economic data and market expectations of further tightening from the Federal Reserve, the euro appears to be struggling under the weight of weaker economic performance in the Eurozone.

Trend Overview: The DXY has been in a strong bullish trend recently, driven by market sentiment favoring the US dollar due to strong economic data and expectations of continued Federal Reserve hawkishness. The index has shown resilience at key support levels and is trending upward. Current Price Action: The DXY is currently trading around the 104.20-104.50 level...

Trend Overview: Bitcoin has been consolidating near the $77,580 to $80,000 range after a significant uptrend. This area is critical because it could serve as a major resistance zone if BTC fails to break above it, or a breakout point that could propel prices higher. Market Sentiment: The market sentiment around BTC is still predominantly bullish, with increasing...

To assess the potential for a breakout, it’s essential to understand the critical levels that will guide price action in the near term: Resistance Level at 90,000 USD: The 90K zone is the primary resistance level, and it has held up several times in recent months. If Bitcoin successfully breaks above this level, the bulls will likely gain significant momentum,...

Gold will drop again more, Looking forward to see this happening. Gold has been experiencing a strong uptrend for some time, driven by macroeconomic factors such as inflation concerns, geopolitical risks, and monetary policies implemented by central banks around the world. However, like any market, trends do not last indefinitely, and corrections are a natural...

The Ukrainian leader stressed that, despite Friday’s clash, Ukraine and the US “remain strategic partners. But we need to be honest and direct with each other to truly understand our shared goals.” He said that Ukraine is ready to sign the minerals agreement that he had traveled to the US to hammer out, but noted that “it’s not enough.” “We need more than just...

Over the past several months, the EUR/USD pair has experienced substantial volatility due to a range of factors, including the European Central Bank (ECB) and Federal Reserve monetary policies, inflationary pressures, and global economic uncertainty. Following a period of significant bullishness, the pair has started to show signs of exhaustion, with recent price...

Shorting Gold to the main support, using volume profile to show the most volume liquidation.

3 Targets already on the chart 2909 , 2880 , 2840, also there is strong support maybe flashing soon thats because the politics and war situation.