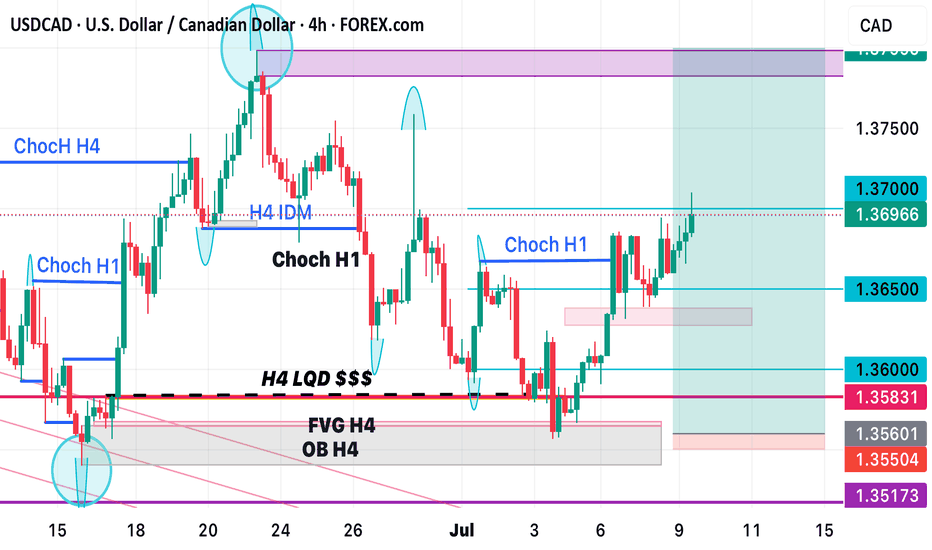

Smc trading strategy, we are entering with h1 OB after confirming inducement and liquidity.

Me and my team caught the buy. Purely smc strategy… inducement, liquidity and oderblock for market execution

BOS of H4 and H1 timeframe. And a reversal is about to happen because both h4 & h1 tfs have created new main low in market structure.

Smart money concept strategy, price has broken a pullback and cleared the liquidity above the SMT and now going low to sweep the OB(order blocks) at the lower LL

Price is in a consolidation due to buyers impulse not giving up but eventually the sellers will push the price lower and the buyers will have no choice but to give it and wait for a came back at the fib level 61.8 with the H4 tf All these after a sell as seen in the chart illustration.

H1 is still in a ⬆️ trend, and no break o structure (BOS)

This is for my swing traders. Apparently price has no resistance in the current trend so market can only retrace and then keep on buying.

Since price is in a range, it’s likely to breakout below the range channel in h4.

PA is in a range in the h4 timeframe and is now going in reverse (upwards) and price will breakthrough all the multiple resistance above.

Because of the PA range in 4H tf, there will be a sell from the current resistant level to the nearest psychological level.

Price just made a high cross of a strong 4hr tf zone and price was already in an uptrend!

After a retracement price action might go into play and continue its original direction to test a weekly support.

Price action broke previous resistance zone so it is likely to retest it for a sopport which is the 50.0 and 38.2 fib zone for a possible short and also a retest of price channel.

There is a rsi triangle and price is yet to retest the pitchfork and also it is approaching a strong weekly/monthly resistance so I think it will go long.