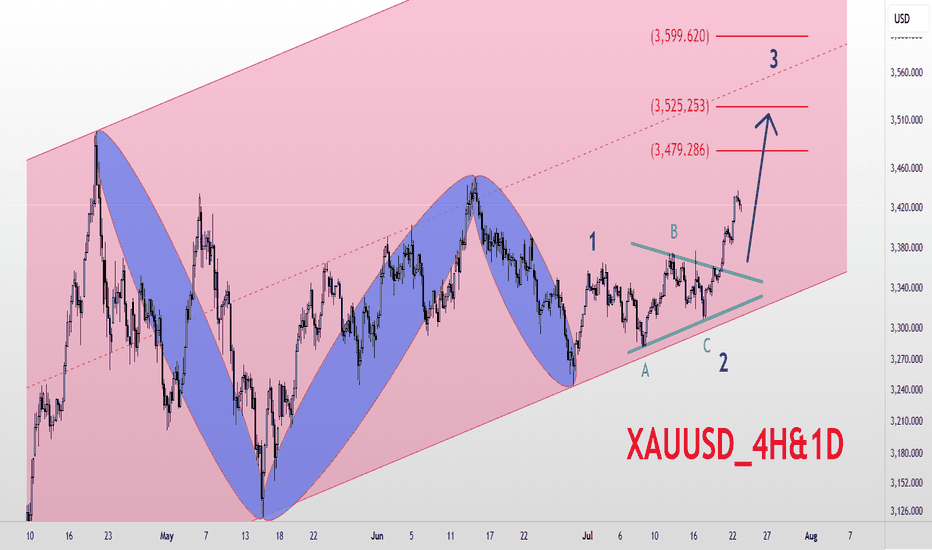

Gold Analysis 4-hour and Daily Medium-term Time Frame Elliott Wave Analysis Style Gold is in a long-term ascending channel Based on Elliott Waves, the market is expected to have entered a new upward trend and has broken waves 1 and 2 and is currently in a large wave 3. The targets for wave 3 are $3480, $3525, and $3600, respectively. Good luck and wish everyone...

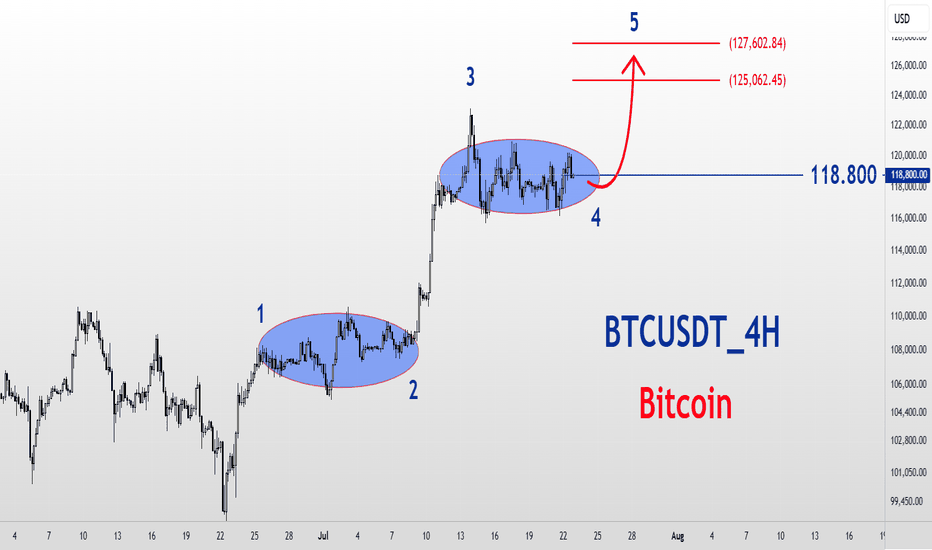

Bitcoin Analysis 4-Hour Medium-Term Time Frame Elliott Wave Analysis Style The cryptocurrency market leader is rising in the form of five Elliott waves, which we are currently in wave 4 correction and can move up for wave 5 by completing the correction time. Important number $118,800 Target $125,000 to $127,000

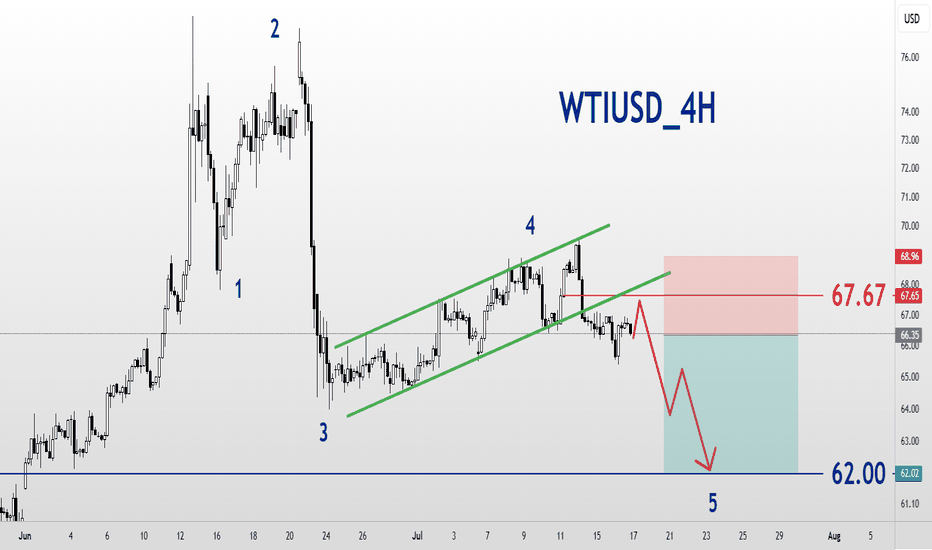

West Texas Intermediate Oil Analysis Short-term Time Frame Elliott Wave Analysis Style The market can only continue to decline by holding the resistance at 67.67 and moving towards the target of wave 5 at $62.

FILUSDT Cryptocurrency Analysis Daily Medium and Long Term Time Frame Main Support 2.320 Targets 3.486 and 5.948

Gold Analysis Short-term Time Frame Elliott Wave Analysis Style The market could enter a decline due to the completion of five waves from the major wave 5, and as long as the price maintains the resistance of 3342, the trend could turn bearish and move towards the target of 3322 and finally 3315.

Eurodollar Analysis Short and Medium Term Elliott Wave Analysis Style The most important resistance in the long term is 1.1770 and as long as we are below this number, the trend is downwards Target 1.1638 and 1.15925

Anas Gold Analysis Short-term 15-minute time frame Elliott Wave Analysis Style The market has completed five downwaves in the short term and needs an upward correction. Target $3326 and $3333

World Gold Analysis Long -term frame time Eliot wave analysis style The market is in five waves of climbing and we are expected to be in the 4th wave, with the main and important number being $ 3333, and if the price is maintained as a resistance, it will continue to reform and move to $ 3000, which can be modified for up to 3 months and enters the next wave on...

Bitcoin Analysis Medium-Term Time Frame Elliott Wave Analysis Style The market is in five waves of ascent and can continue to rise by maintaining the $103,000 level. The target for wave 5 is $125,000.

EURUSD Analysis Daily Time Frame Medium and Long Term Elliott Wave Analysis Style EUR is at the end of Elliott Wave 5 and is a sell position. Last resistance 1.2024 Downward targets 1.1272 and 1.0666 respectively

Weekly Gold Analysis The market may have entered a new uptrend due to the upward trend line break We will only buy gold if the price maintains above the important number 3390, moving towards the main target of 3595 and even 3724

Eurodollar Analysis Daily Time Frame Medium and Long Term Elliott Wave Analysis Style The market is in 5 waves of ascent, which is expected to be in wave 5, which can move towards the target of 1.1717 by maintaining the price above 1.1280 and after completing 5 Elliott waves, enter a decline towards 1.0660 Important short-term number and for this week 1.1414

Hello Gold Analysis Short-Term Time Frame Elliott Wave Analysis Style The market is in five waves of decline and is expected to move down for wave 5 and move towards the target of 3282 as long as the main level of 3338 is maintained as resistance.

Gold Analysis Elliott Wave Analysis Style We are buying again To a stop loss of 3350 And a take profit of 3400 In the meantime, we will have short resistance for scalping at 3377

Anas Gold Analysis Elliott Wave Analysis Style Short-term Time Frame and Scalping Position Type from Buy to Sell Main and Important Support Level $3355 Given the completion of 5 downwaves and the formation of the corner pattern, by maintaining the main support and breaking the pattern upwards, it can enter the upwave and move towards $3376 and $3382 If the...

Gold Analysis Medium and long-term time frames Elliott Wave Analysis Style Gold can continue to rise as long as it can maintain the ascending trend line The important short and medium term numbers and ranges are $3280 to $3300.

Canadian Dollar Analysis Four-hour and medium-term time frame Elliott Wave Analysis Style Five waves down, with the top of wave 4 at 1.4000 and we are currently in wave 5 down towards the targets of 1.3680 and 1.3600

Gold Analysis Daily Time Frame Medium and Long Term Elliott Wave Analysis Style In the long term, the market could have completed the big wave 3 and entered a medium-term correction and completed the big wave 4. In the meantime, the main and important number is 3250, and by maintaining the price below this number, we will enter a correction towards the number...