EmpireConsulting

Essentialabout to clear their debt and be a profitable business

Celestica looking like it could repeat the same pattern shown in

I received a suggestion to invest in this stock in Brazil the back story and fundamentals seems strong but at first glance the technicals look weak. Im just putting this here to look back at it and see how it plays out will the fundamentals win or will technicals drive price down lets see

Here we see that the current market is massively over valued from a PE and PB ratio perspective SP500 is not a good value investment at these levels and we expect further downside maybe up to 30% or more.

We have come to the end of Money Supply. High inflation means money printing needs to stop and be reversed. The Stock market achieved 200% increase during a period of absurdly low-interest rates and huge quantities of money being pumped into the system. Now inflation is high interest rates are rising and money supply is ending. In spite of this the SP500 trades...

I have looked at the effects of rising rates on the stock market. Bullard showing signs that he wants a 7% rate. Expect a big drop in stocks as history shows higher rates equal lower stock prices. Think of the impact on corporate profits house prices debt repayments etc.

I have traded this stock a few times. The Tesla and NIO mania seems to be applicable here so a risky trade but very high pay off

When making the decision of when to convert currency people tend to have a short-sighted view of what good value exchange rates are. What most people don't take into account are the 4 most important factors when it comes to a currency: Inflation, Interest Rates, Economic Health, Political Risk. Inflation is the first aspect to look at. Typically a currency will...

The Mexican Peso has had an average of 5% inflation YOY over 10 years. The value of MXN compounded as an asset price would have a fair value of true value of approximately 20.66. Inflation is just one contributor to a currencies value. A higher interest rate can attract foreign investment from investors but a low-interest rate will make investors less willing to...

Most people think the Brazilian Real is cheap and will suddenly go back down to 4-1 with USDBRL. What most people don't take into account are the 4 most important factors when it comes to a currency: Inflation, Interest Rates, Economic Health, Political Risk. Inflation is the first aspect to look at. Typically a currency will stay in a range whilst inflation...

When looking at currencies we tend to look at the short term and not the bigger picture. I put together this chart to show why emerging market currencies are not as undervalued as many think. Inflation of asset prices dilutes currencies over time otherwise emerging markets would become extremely rich their assets appreciate in line with inflation yet the currency...

Movements depend on corporate news but when good new is announced it has hge upside potential. Traders might play the technical break out too. However you may just have to sit on it for a while you never know when biotechs are going to pop but the wait is worth it when they do.

Long OIL price is rising the demand for their services big upside

Speaks for itself BRK.B buy and hold investor favourite disconnected from the market either market catches it or it catches market so get the SL in and its a easy trade

This chart will show when you should start accumulating a higher percentage of Euros or AUD. It will also show you where strong historic levels of support and resistance. In a Euro AUD portfolio, I would suggest 50-50 in the mid-range, 65-35 in the light range and 80-20 to 90-10 in the dark range.

This chart will show when you should start accumulating a higher percentage of Euros or AUD . It will also show you where strong historic levels of support and resistance. In a Euro AUD portfolio, I would suggest 50-50 in the mid-range, 65-35 in the light range and 80-20 to 90-10 in the dark range.

This chart will show when you should start accumulating a higher percentage of Euros or CAD . It will also show you where strong historic levels of support and resistance. In a Euro CAD portfolio, I would suggest 50-50 in the mid-range, 65-35 in the light range and 80-20 to 90-10 in the dark range.

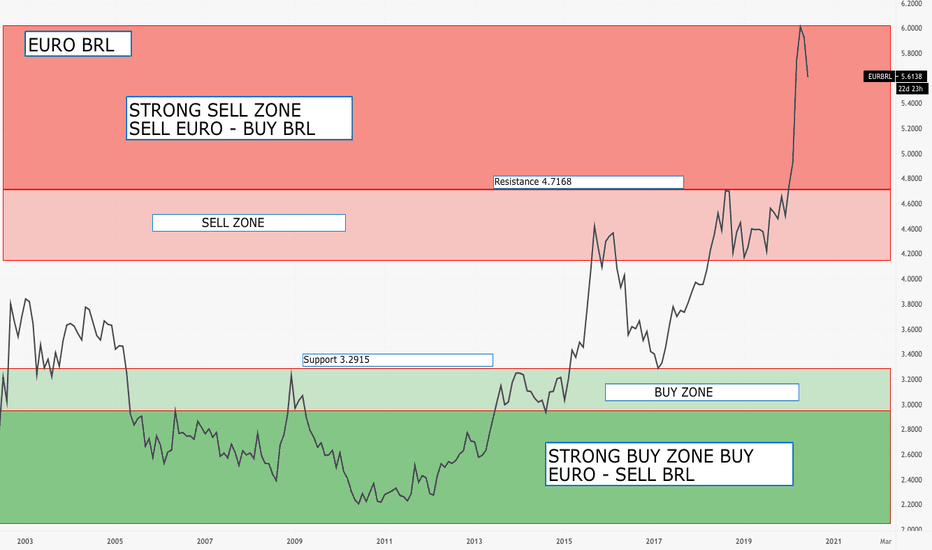

This chart will show when you should start accumulating a higher percentage of Euros or BRL. It will also show you where strong historic levels of support and resistance. In a Euro BRL portfolio, I would suggest 50-50 in the mid-range 65-35 in the light range and 80-20 to 90-10 in the dark range. It is important to take into account other economic data and...