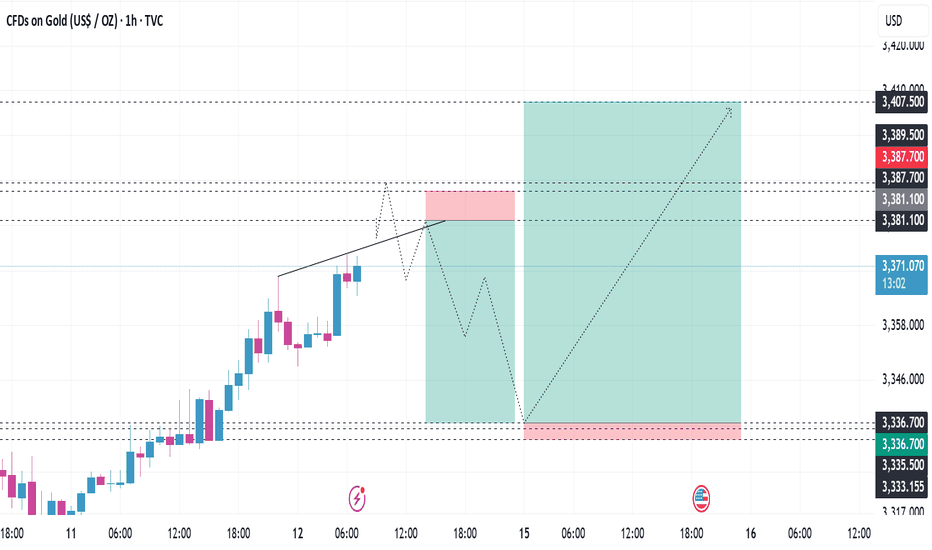

I checked on the 15 minute time frame and saw liquidity points for us to consider trading, Gold price is being supported, candlestick patterns are showing signs of breaking resistance so consider volume for the sell-off plan. If you do not have a buy order in the idea below 👇 then set up a buy order according to this trading idea, good luck to you and us.

With this idea combined with ichimoku, I found a confluence entry point with a short stop loss, the target is 98500, then I will consider gradually accumulating goods there.

Gold next week the main plan is to sell down. We will wait for a good entry point from there to get the shortest stop loss. If the price does not recover to sell, I will wait for a confirmation signal and accept to sell at a low price. Target is 3178

Gold currently has a hard stop on the daily frame. If the price breaks the 3350 threshold, we wait for the old supply to recover to buy at the above 2 thresholds. I am still short gold on this idea at the moment with a stop loss of 3248. In case the market reverses the plan to break through 3248, we should consider capital management by cutting losses, and...

With this strategy, I found a position to buy with small volume and short stop loss. Gold broke the 4 hour pin, now we wait for the price to come back to test the broken pin and continue to sell Gold down. Good luck!

Gold has entered a major downtrend, however the market needs a high increase to break out. Looking at the clouds, I see that in the coming days, the gold price fluctuation range is very large. So everyone should consider allocating volume to suit investment assets as well as adjusting leverage appropriately. Good luck!

With this idea we can buy the smallest possible volume to probe, because the current price is at the 2.618 profit level. If the price goes up, we will also make profit with a small volume of buying. I still prefer the price to return to where it started to increase, take all the liquidity and then increase strongly, however this is unlikely but not impossible.

With this idea, we have a pretty high stop loss of 200 pips. So allocate the volume to suit the account. About 1% capital loss, when reaching profit, it will increase by 4%. Good lucky

I really wanted to sell at a higher price. But the selling pressure was very strong, not overcoming the resistance, so I came up with a new strategy to sell gold at a lower price. Do you have any other ideas? Leave a comment. Limit sell 3255 sl65 Limit sell 3272 sl 82 ( fake break) Take profit 3178- 3070 --- Limit buy 3070 SL 3048.5 TP 3178 --- Limit buy 2994-...

At this stage, I think that if BTC wants to increase strongly in the long term, there must be a sustainable accumulation factor. We need to stand aside and consider and pay the market price lower than the nearest bottom. Don't be hasty to fomo with the crowd because of the weekly candle!

Gold is gradually filling the upper wedge Next week we wait for gold to react in the 1970-1980 price range and sell off to 1890 Note: No fomo buy at the moment Even if DXY falls deeply, Gold can fall with DXY Historically, gold wants to go up in the long run, it needs to converge many factors. 1. create wedges 2. make 2 or 3 bottoms 3. recovery between...

Price range and time to buy gold late January early February. Price buy 1985 sl 1970 tp 2073-2108-2283-2840 Purchase only between January 26 and February 3. Satisfy the conditions during this time to create a wedge or 2 bottoms. Our job is to wait.

With this idea, we can easily see the confirmation for a breakout in the weekly frame, which is usually true when the price has passed through the boundary of the second butterfly wing according to this butterfly pattern. In addition, I have a profit taking level according to this model combined with a 4-year cycle. Good lucky.!!

Update plan with Tesla Tesla stock has touched the daily line which is good support, however you need to consider taking partial profits when the price hits the price holding zone that is eventually broken down which is also the horizontal resistance level. In case the price continues to break out of that horizontal range, we will continue to hold the order. On...

Gold dropped 1000 pips in early June, our plan is to wait for the confluence of the two lines to prepare for selling gold, the idea is to just formalize the price line and trading time corresponding to the model. In this case, if the price is under or overchecked corresponding to the time before or after the line then this idea is abandoned. Good luck!

It is forecasted that there will soon be a bullish phase when all signals break for the uptrend. In my opinion, that is a bullish trap. Please stick to the sell-off scenarios according to the price arrow I draw, every scenario has a stop loss level, don't expect too much from forcing and letting loose stop loss orders in this non-agricultural news for orders. buy....

I don't know what to say about gold in general and gold in particular in this analysis. It's just like the plan when the price returns to the time point within the entry price range to set up orders and set stop loss management as shown in the picture, specific plan. Good luck

Gold dropped 1000 pips in early June, our plan is to wait for the confluence of the two lines to prepare for selling gold, the idea is to just formalize the price line and trading time corresponding to the model. In this case, if the price is under or overchecked corresponding to the time before or after the line then this idea is abandoned. Just wait for sell Buy...