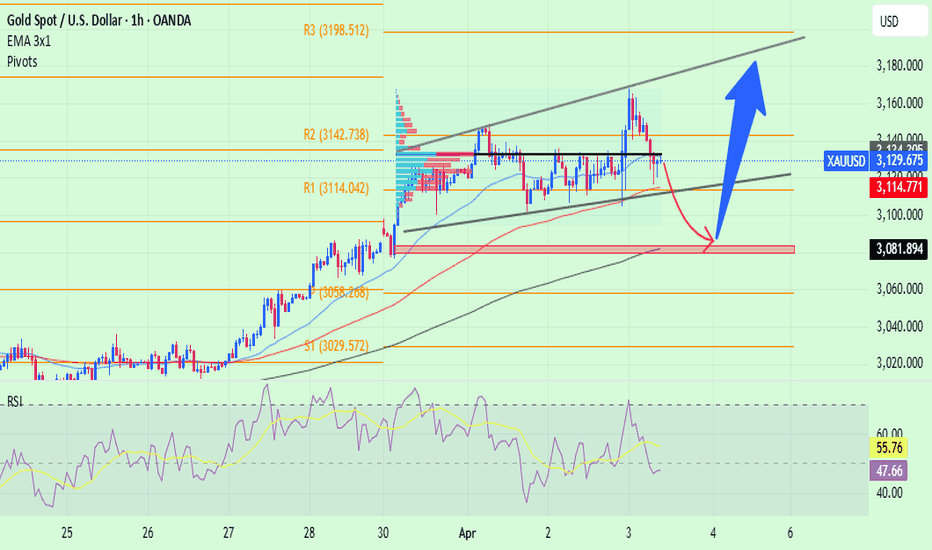

🔔🔔🔔 Gold news: ➡️ The spot gold price struggled to maintain the $3,100 level during US trading, dropping from a new record high of $3,167.68. The XAU/USD pair surged during Asian trading hours yesterday as market participants panicked following the "Liberation Day" announcement by US President Donald Trump. ➡️ Financial markets were in turmoil amid speculation...

✍ ✍ ✍ USD/CAD news: ➡️ The USD/CAD pair continued its downtrend for the fourth consecutive day as selling pressure on the US dollar remained dominant. ➡️ Concerns that Trump's tariffs could lead to a US recession, prompting the Fed to cut interest rates, weighed on the greenback. ➡️ Meanwhile, overnight declines in crude oil prices weakened the Canadian...

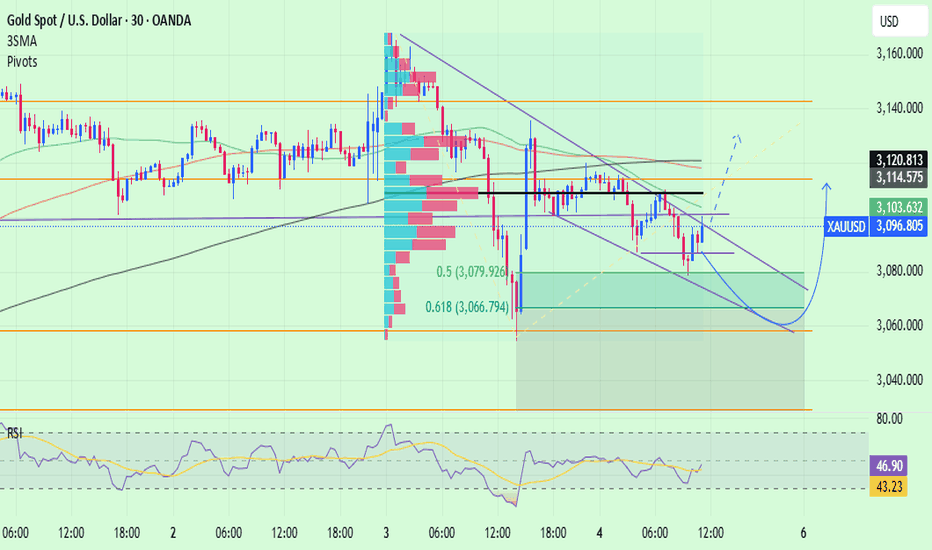

✍ ✍ ✍ Gold news: ➡️Gold extended its correction ahead of Friday's Non-Farm Payrolls release, falling below $3,100 as markets remained volatile. Investors remained uncertain about the direction of the market following Trump's retaliatory tariff announcement. Meanwhile, gold continued to face profit-taking pressure while seeking support for its recovery. ...

🔔🔔🔔 AUD/USD news: ➡️ The Trump administration announced that the US would impose a base tariff rate of 10% on all imports into the country. China was particularly affected, facing tariffs of at least 54% on many items. In response, the Chinese government threatened retaliation after Trump imposed the highest US tariffs on any nation. This, in turn, could put...

🔔🔔🔔 Gold news: ➡️ The price of gold (XAU/USD) continues its decline after reaching an all-time high on Thursday, though it remains above the $3,100 level in early European trading. Optimistic traders are taking profits and scaling back their positions amid mildly overbought conditions. However, persistent concerns over potential economic harm from President...

✍ ✍ ✍ AUD/USD news: ➡️ AUD/USD is struggling to extend its previous day's recovery and remains below the 0.6300 mark early on Wednesday, as markets await U.S. President Trump's tariff announcement later in the day. However, buyers continue to find support from optimism surrounding Chinese stimulus measures and the RBA's cautious stance on policy outlook. ➡️...

✍ ✍ ✍ Gold news: ➡️ Gold prices fell on Tuesday as traders took profits while awaiting Liberation Day on April 2 in the United States, an event where President Donald Trump is expected to announce additional tariffs aimed at addressing trade deficit imbalances. ➡️ Market sentiment remains mixed, as reflected in U.S. stock markets. Investors are anticipating...

✍ ✍ ✍ USD/JPY news: ➡️ Federal Reserve officials have indicated that interest rates should remain in the current range of 4.25%–4.50% for an extended period until they can assess the impact of Trump’s tariffs on inflation and economic growth. ➡️ Stronger-than-expected US ADP data provided significant support for the sharp rise in USD/JPY. ➡️ Meanwhile, the...

✍ ✍ ✍ GBP/USD news: ➡️ The US dollar is showing weakness against the British pound ahead of Trump's tariff announcement. The pair is currently trading near the 1.3000 level, following weak macroeconomic data released during the US trading session on Tuesday. The ISM Manufacturing PMI fell to 49 in March from 50.3 in February, while the JOLTS Employment Number...

💢💢💢 EUR/USD news: ➡️ Retail sales in Germany increased by 0.8% month-on-month (MoM) in February, following a 0.2% increase in January. This figure significantly exceeds market expectations of 0%. The euro seems to be receiving support from this data. ➡️ On the other hand, there is additional support from the easing of concerns over the EU-U.S. trade war. In...

✍ ✍ ✍ EUR/USd news: ➡ Disappointing macroeconomic data from the United States makes it difficult for the US Dollar (USD) to strengthen on Tuesday, allowing EUR/USD to find support. However, the cautious market sentiment prevents the currency pair from gaining significant traction. ➡ Later in the day, the ADP Employment Change data will be released as part of...

🔔🔔🔔 Gold news: ➡️Gold surged to another record high on Monday, surpassing the $3,100 mark for the first time and reaching an all-time peak of $3,137 during the Asian session before slightly retreating. Ongoing uncertainty surrounding U.S. trade policies and the upcoming Liberation Day on April 2 has kept market sentiment cautious, prompting investors to seek...

🔔🔔🔔 USD/CAD news: ➡️ The USD/CAD pair extended its rally for the third consecutive day on Monday, climbing toward 1.4360 as investors anticipate the impact of reciprocal tariffs imposed by U.S. President Donald Trump on Canada, set to take effect on Wednesday, also known as "Liberation Day." ➡️ Last week, President Trump indicated that Canada would face...

🔔🔔🔔 USD/CAD news: ➡️ The USD/CAD pair reached a two-and-a-half-week high on Tuesday, though it struggled to gain acceptance or extend its intraday advance beyond the 1.4400 mark. Nevertheless, spot prices held onto their recent recovery gains as traders awaited U.S. President Donald Trump’s announcement on reciprocal tariffs before making fresh directional...

💢💢💢 Gold news: ➡️ Gold (XAU/USD) continues its upward trend during the first half of the European trading session on Monday, currently hovering near its all-time high just above $3,120. Uncertainty surrounding former U.S. President Donald Trump's so-called reciprocal tariffs, along with growing fears of a U.S. economic recession and geopolitical risks, continue...

💢💢💢 GBP/USD news : ➡️The GBP/USD pair surged sharply to nearly 1.2965 during Asian trading hours on Monday. Concerns that U.S. President Donald Trump's tariffs could drive inflation and slow economic growth have put pressure on the U.S. dollar (USD), acting as a catalyst for the major currency pair. ➡️ Last week, Trump announced a 25% tariff on imported cars...

📌 📌 📌 Gold news: ➡ Gold prices have reached a record high, surpassing the $3,100 mark for the first time, driven by growing fears of a potential global trade war. The surge in gold prices remains unabated as buyers push beyond this threshold, spurred by concerns over a possible trade conflict and the looming threat of a recession in the United States, which...

🔔🔔🔔 Gold news: 👉 Gold prices surged to a new all-time high above $3,070 during Asian trading on Friday as escalating global trade tensions, uncertainty over Trump's reciprocal tariffs, and risk-off sentiment continued to drive safe-haven demand. Expectations that the Federal Reserve may soon resume its rate-cutting cycle further supported bullion. 👉 Despite...