🔔🔔🔔 USD/JPY news: ➡️ Buying interest in the Japanese Yen (JPY) remains strong for the second consecutive day on Wednesday, as investors continue to seek safety in the traditional safe-haven currency amid growing concerns over a global recession driven by tariffs. Additionally, reports that U.S. President Donald Trump had agreed to meet with Japanese officials...

🔔🔔🔔 USD/ JPY news: ➡️ The Japanese Yen (JPY) maintains its upward bias against a weaker U.S. Dollar (USD) during Asian trading on Tuesday, despite a lack of strong follow-through buying. While escalating concerns over the negative impact of intensification U.S. tariffs on Japan's economy persist, investors appear confident that the Bank of Japan (BoJ) will...

🔔🔔🔔 EUR/USD news: ➡️ EUR/USD is extending its rebound above the 1.0950 level in early European trading on Tuesday, supported by a weakening U.S. Dollar. Improved risk sentiment is reducing safe-haven demand for the greenback, giving the pair a lift. Additionally, dovish expectations surrounding the Federal Reserve are putting further pressure on the dollar....

🔔🔔🔔 GBP/USD news: ➡️ GBP/USD is paring gains and retreating toward the 1.2750 level during Tuesday’s European session. The pair remains supported by renewed weakness in the U.S. Dollar and improved risk sentiment, though upside momentum is being capped by concerns over President Trump’s tariff war and fears of a global economic slowdown. ➡️ Meanwhile, in...

🔔🔔🔔 Gold news: ➡️ Gold rebounded from its monthly lows to test the $3,000 level during Asian trading on Tuesday, ending a three-day losing streak. Concerns over a potential trade war impacting the U.S. economy and triggering a recession, combined with growing expectations of more aggressive interest rate cuts by the Federal Reserve, have renewed interest in...

🔔🔔🔔 Gold news: ➡️ Major stock indexes plunged on Monday as U.S. President Donald Trump showed no signs of backing down from his sweeping tariff plans, prompting investors to bet that rising recession risks might force the Federal Reserve to cut interest rates as early as May. ➡️ Futures markets quickly priced in nearly five quarter-point rate cuts by the Fed...

🔔🔔🔔 USD/JPY news: ➡️ The Japanese yen (JPY) started the week on a positive note as U.S. President Donald Trump’s broad-based tariff measures heightened fears of a global economic downturn, boosting demand for traditional safe-haven assets. At the same time, concerns that harsher reciprocal tariffs from the U.S. could negatively affect Japan's economy led...

🔔🔔🔔 Gold news: ➡️ Gold prices opened the week with a sharp decline, hitting a one-month low below the $3,000 mark. However, buyers quickly stepped in, driven by the narrative that rising risks of a U.S. economic recession—fueled by Trump’s tariff war—pose a greater concern than inflation. This has increased expectations that the Federal Reserve will implement...

🔔🔔🔔 Gold news: ➡️ Gold (XAU) continued to decline on Friday, hitting a seven-day low of $3,015 before recovering slightly following a speech by Federal Reserve (Fed) Chair Jerome Powell, who warned that inflation could reaccelerate due to tariffs. XAU/USD is trading at $3,037, down 2.70%. ➡️ Financial markets remain volatile as the trade war between the United...

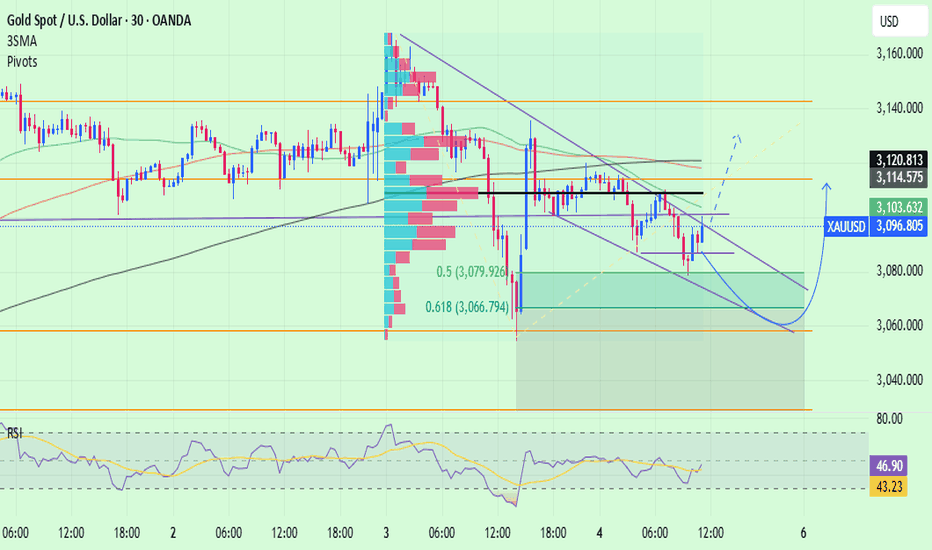

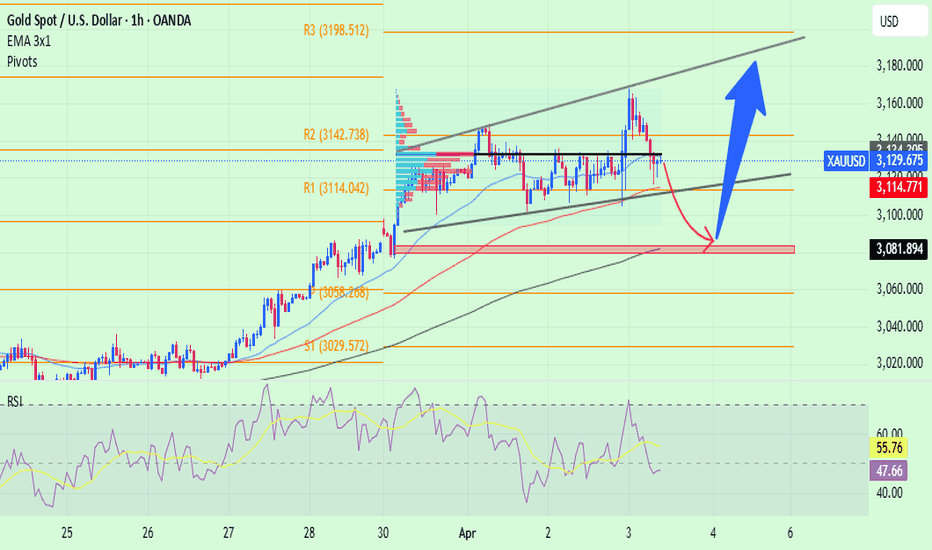

🔔🔔🔔 Gold news: ➡️ The spot gold price struggled to maintain the $3,100 level during US trading, dropping from a new record high of $3,167.68. The XAU/USD pair surged during Asian trading hours yesterday as market participants panicked following the "Liberation Day" announcement by US President Donald Trump. ➡️ Financial markets were in turmoil amid speculation...

✍ ✍ ✍ USD/CAD news: ➡️ The USD/CAD pair continued its downtrend for the fourth consecutive day as selling pressure on the US dollar remained dominant. ➡️ Concerns that Trump's tariffs could lead to a US recession, prompting the Fed to cut interest rates, weighed on the greenback. ➡️ Meanwhile, overnight declines in crude oil prices weakened the Canadian...

✍ ✍ ✍ Gold news: ➡️Gold extended its correction ahead of Friday's Non-Farm Payrolls release, falling below $3,100 as markets remained volatile. Investors remained uncertain about the direction of the market following Trump's retaliatory tariff announcement. Meanwhile, gold continued to face profit-taking pressure while seeking support for its recovery. ...

🔔🔔🔔 AUD/USD news: ➡️ The Trump administration announced that the US would impose a base tariff rate of 10% on all imports into the country. China was particularly affected, facing tariffs of at least 54% on many items. In response, the Chinese government threatened retaliation after Trump imposed the highest US tariffs on any nation. This, in turn, could put...

🔔🔔🔔 Gold news: ➡️ The price of gold (XAU/USD) continues its decline after reaching an all-time high on Thursday, though it remains above the $3,100 level in early European trading. Optimistic traders are taking profits and scaling back their positions amid mildly overbought conditions. However, persistent concerns over potential economic harm from President...

✍ ✍ ✍ AUD/USD news: ➡️ AUD/USD is struggling to extend its previous day's recovery and remains below the 0.6300 mark early on Wednesday, as markets await U.S. President Trump's tariff announcement later in the day. However, buyers continue to find support from optimism surrounding Chinese stimulus measures and the RBA's cautious stance on policy outlook. ➡️...

✍ ✍ ✍ Gold news: ➡️ Gold prices fell on Tuesday as traders took profits while awaiting Liberation Day on April 2 in the United States, an event where President Donald Trump is expected to announce additional tariffs aimed at addressing trade deficit imbalances. ➡️ Market sentiment remains mixed, as reflected in U.S. stock markets. Investors are anticipating...

✍ ✍ ✍ USD/JPY news: ➡️ Federal Reserve officials have indicated that interest rates should remain in the current range of 4.25%–4.50% for an extended period until they can assess the impact of Trump’s tariffs on inflation and economic growth. ➡️ Stronger-than-expected US ADP data provided significant support for the sharp rise in USD/JPY. ➡️ Meanwhile, the...

✍ ✍ ✍ GBP/USD news: ➡️ The US dollar is showing weakness against the British pound ahead of Trump's tariff announcement. The pair is currently trading near the 1.3000 level, following weak macroeconomic data released during the US trading session on Tuesday. The ISM Manufacturing PMI fell to 49 in March from 50.3 in February, while the JOLTS Employment Number...