🔔🔔 AUD/USD news: 👉The AUD/USD pair experienced a sharp decline to around 0.6280 during North American trading hours on Thursday. The Australian Dollar faced significant selling pressure as the US Dollar strengthened amid a cautious market atmosphere. Investors shifted towards safe-haven assets due to concerns that US President Donald Trump’s "America First"...

🔔🔔🔔 Gold news: 👉 February’s data increased the odds that the Federal Reserve (Fed) might cut interest rates thrice in 2025. Nevertheless, Fed officials, led by Chair Jerome Powell, had expressed that they did not look at just one month of data. 👉 In the meantime, US Treasury yields climbed amid fears that the global trade war could push prices higher....

🔔🔔🔔 GBP/USD news: 👉The Pound Sterling (GBP) holds onto its gains, trading slightly above 1.2900 against the US Dollar (USD) during Monday’s European session. The GBP/USD pair continues to strengthen as the US Dollar struggles to find momentum amid rising concerns about the US economic outlook. The US Dollar Index (DXY), which measures the Greenback’s value...

🔔🔔🔔 Gold news: 👉A cautious atmosphere dominates ahead of the release of US consumer inflation data, keeping Gold prices fluctuating within a tight range. The US Dollar (USD) sees a slight rebound as traders take profits after its recent decline. 👉The renewed strength in the USD and rising US Treasury bond yields are limiting Gold's recovery. However, if the...

🔔🔔🔔 USD/CAD news: 👉DXY is currently at 103.4, its lowest since November 5, 2024. A break of this level could see DXY fall further. The pair has been losing ground as the US dollar struggles amid concerns that tariff uncertainty could push the US economy into recession. 👉The RSI (1H) is currently entering extreme overbought territory and shows no signs of...

🔔🔔🔔 Gold news: 👉Amid Trump's protectionist policies, market concerns over a potential US recession persist, raising expectations that the Federal Reserve (Fed) may opt for interest rate cuts this year. This outlook continues to exert downward pressure on the US Dollar (USD) and US Treasury bond yields, helping to support Gold prices. 👉During a Fox News...

🔔🔔🔔 USD/JPY news: 👉The Japanese Yen (JPY) maintains its upward momentum against a broadly weaker US Dollar (USD) during the early European session on Monday, driven by expectations of further interest rate hikes from the BoJ. Market participants are increasingly convinced that the BoJ will tighten its policy again, a sentiment reinforced by data released earlier...

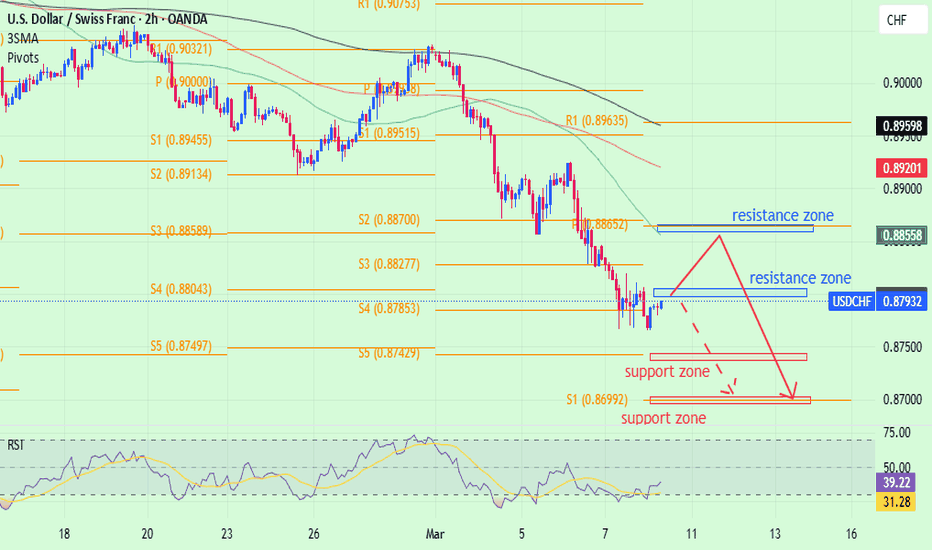

🔔🔔🔔 USD/CHF news: 👉The February labor market report in the US closely matched expectations, with job growth reaching 151K (forecast: +160K, previous: +143K). Despite the recent layoff of 30,000 public sector workers and a decline in labor supply due to stricter immigration policies set for this summer, employment gains remain solid. The unemployment rate inched...

🔔🔔 🔔AUD/USD news: 👉The AUD/USD pair experiences a strong surge, reaching around 0.6330 during North American trading hours on Monday. The Australian Dollar notable gains support as the US Dollar (USD) remains subdued, with investors adopting a cautious stance regarding the economic outlook of the United States (US). 👉Meanwhile, the S&P 500 has dropped nearly...

🔔🔔🔔 Gold news: 👉DXY bounced sharply in the Asian and European sessions after falling to 103.47, the lowest level since 5/11/2024. 👉There is no news today to motivate gold so the price may run in the range of 2890 - 2930 👉RSI (1H) is entering the overbought zone, watch this area closely to create a buy order at a good price. 👉The US 10-year bond yield is down...

USD/CHF news: 👉The USD/CHF pair continues its recovery from the mid-0.8800s—its lowest level since December 12—gaining upward momentum for the second consecutive day on Thursday. During the Asian session, spot prices climb back above the 0.8900 level, although the upward movement remains limited due to ongoing bearish sentiment surrounding the US Dollar...

🔔🔔🔔 EUR/USD news: 👉The EUR/USD pair began the week on a positive trajectory, trading around 1.0860 during Monday’s Asian session. This upward movement is primarily driven by growing concerns over a potential slowdown in the US economy. On Sunday, San Francisco Fed President Mary Daly noted that increasing uncertainty among businesses could weaken demand in the...

🔔🔔🔔 Gold News: 👉Gold is back on the rise due to a severe weakening of the US dollar. The precious metal has regained above $2,900 after suffering heavy losses in late February. 👉Inflation data from the US and political headlines could continue to boost gold prices in the near term. The short-term picture shows buyers struggling to maintain control. The bullish...

🔔🔔🔔 Gold news: 👉Gold prices (XAU/USD) continue to struggle to gain significant buying interest but remain above the $2,900 level during the Asian session on Friday. Traders appear hesitant, preferring to wait for the release of the closely-watched US Nonfarm Payrolls (NFP) report before making new directional moves. This cautious approach has resulted in a...

🔔🔔🔔 EUR/USD new: 👉The EUR/USD surged 1.75% on Wednesday, approaching the 1.0800 level as market sentiment improved following another shift in U.S. President Donald Trump's trade policy. Trump has once again eased off his previous stance of imposing heavy tariffs on imports, a strategy he had used to retaliate against perceived unfair treatment by other...

🔔🔔🔔 Gold news: 👉Gold prices held steady on Thursday as speculation grew that U.S. President Donald Trump might ease some tariffs, particularly those related to automobiles under the USMCA trade agreement. However, uncertainty persists, and XAU/USD remains largely unchanged at $2,919. 👉On the economic front, ADP data showed a significant slowdown in...

🔔🔔🔔 USD/JPY news: 👉The USD/JPY pair continues its downward trend for the second consecutive day, edging closer to the multi-month low reached last week following Trump's warning to Japan about the weak yen. Additionally, rising expectations of further interest rate hikes by the Bank of Japan (BoJ) and a broader risk-off sentiment are bolstering demand for the...

🔔🔔🔔Gold news: 🔆Trump imposed tariffs on Canada, Mexico and China. Soon after, Canada and China followed suit with the US. This raised the risk of a global trade war and hurt investor sentiment, which sees gold as a safe haven. 🔆The Institute for Supply Management (ISM) manufacturing PMI fell to 50.3 in February from 50.9 the previous month, while the Prices Paid...