The Yen is gleaning traction from a relatively favourable yield backdrop and fragile risk sentiment to offset Japan’s deteriorating COVID-19 situation. Finally a continuation to the downside has occurred with the potential now to continue into fresh lows. 127.50 would be a nice landing spot over the next week or so.

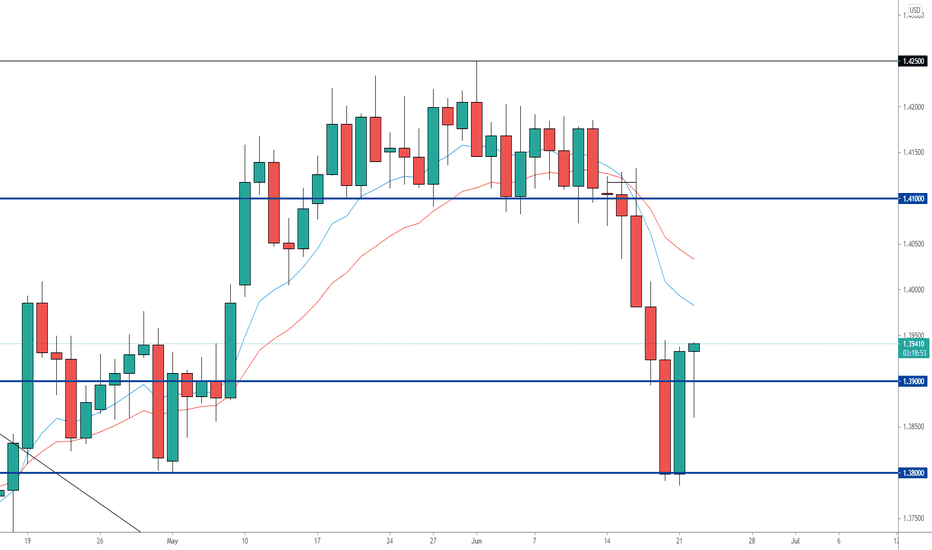

GBP mixed against its US peer and relatively rangebound, as Sterling tries to secure a firmer grip of the 1.3600 handle following a scrape with the weekly moving average on Tuesday. Expect manipulation around current levels.

As Westpac puts it, the Dollar is effectively in a win-win situation, as it retains a firm underlying bid when sentiment turns bearish due to heightened concerns about the adverse impacts of this so called Delta variant, but also during periods of less anxiety and when attention switches back to the more hawkish-leaning FOMC alongside risks that inflation may not...

Prior chart: The Yen is pressuring lower level and the overall trend and may glean sufficient momentum to challenge earlier July pinnacles at 129.00 against the EUR if risk appetite continues to plunge before attention turns to Japanese inflation data on Tuesday. Potential for a minor pullback from this level now.

Euro appears somewhat reluctant to deviate far against the Dollar, albeit more responsive to moves elsewhere, as it meanders mostly below 1.1800 in tight confines, but the Franc and Yen are lagging against the backdrop of recovering risk sentiment due to their stronger safe-haven properties. Providing dollar strength continues EUR/USD is headed for 1.1720 next...

The Yen staged a rebound today amid the dollar downside and fall in US yields, seeing EUR/JPY briefly fall back beneath the 131.00 handle. Note, the BoJ meeting is overnight. Considering the dollar, I am now anticipating further downside movements to wrap this week off.

The dollar was softer with DXY sub-92.50 this afternoon after a rather dovish Fed Chair Powell, who in his testimony reiterated that inflation was likely to remain elevated in the coming months before easing and expectations are broadly consistent with the Fed target, suggesting he is not concerned following yesterday’s hot CPI. He also struck his dovish tone,...

Loonie is also staring at support from a rebound in oil ahead of Canadian labour data with Usd/Cad now eyeing 1.2500 to the downside having faded around 1.2590 only yesterday. Bearish bias is now in play for this pair...

EUR/USD main idea on todays watchlist. 1.1910 is the target for today. A small rally will be expected off the back of the ECB Lagarde speech. Hope everyone has had a great week in the markets and trade safe!

The Buck repelled more downside pressure and seems braced for another boost from the Fed via the account of June’s policy meeting that was hawkish in terms of the median dot plots projecting earlier tightening and two 25 bp hikes by the end of next year, while the much vaunted talk about when to discuss tapering occurred and it’s now a question of making the...

The Loonie’s luck continues to ride on or rest with the fortunes of oil in the main, and another and more pronounced fallout in WTI and Brent has pushed it back down to the bottom of the G10 pile as USD/CAD rebounds circa one big figure from the low 1.2400 area irrespective of upbeat Canadian Ivey PMIs. Further bullish moves anticipated into new high territory.

The Dollar looks reset and almost literally recharged after losing some impetus intermittently yesterday when crude oil was gushing, as it continues to rally and pick off more technical or psychological levels in index and Usd/other currency pair terms. The DXY has now been up to 92.699, leaving just a high from early April guarding the next big figure (92.790...

The dollar was choppy today and started the day lower but remains sub 92.00, whilst holding above the 91.60 support level in wake of a weak initial jobless claims print yet again this week at 411k, a similar pace to last week. CAD was a underperformer despite a partial recovery in Canadian manufacturing sales and failed to benefit from a later recovery bid in oil...

The Pound is hovering over 1.3900 after fading heavy momentum to the downside. It remains to be seen whether the Dollar index continues to secure a firm grasp of the 92.000 handle, and for once it seems that US housing data won’t present too much of an impediment as existing home sales came in a tad above consensus, albeit slightly down from the prior...

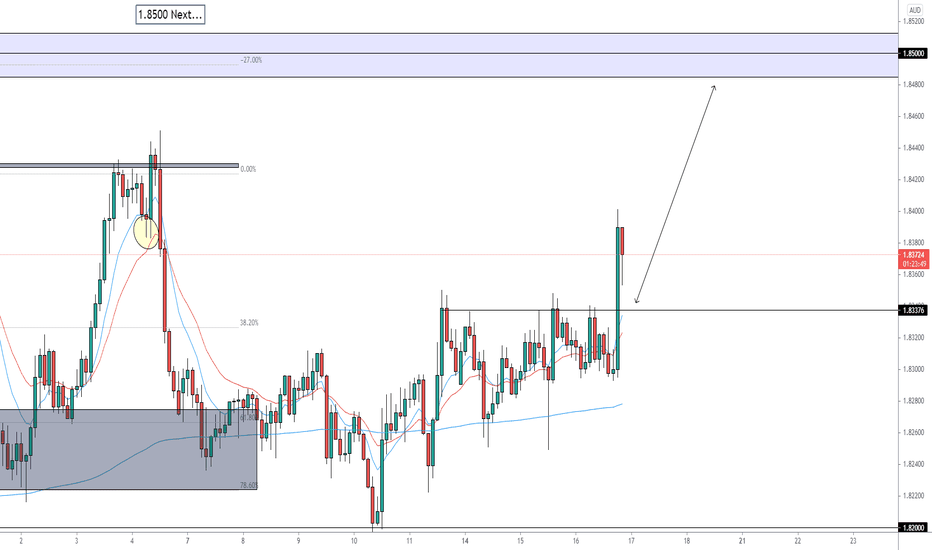

Prior chart: 1.8500 Tapped! Possibly now set for a pullback and bearish momentum to follow heading into next week!

RBA Governor Lowe due to come out with relapse in base metal prices at the hands of Chinese efforts to quell the rally in copper, zinc and aluminium etc. Similarly, the Pound has found it tough to maintain post-UK inflation momentum through resistance. Overall further upside to come on GBP/AUD.

Sterling has made a partial recovery to reclaim 1.4100+ and 0.8600+ status vs the Buck and Euro respectively, as it tentatively moves in wake of firmer than forecast UK CPI data (headline and core). However, the Pound is also weighing up and being hampered by the ongoing rift on NI protocol with the EU, as remarks from Frost indicate little sign of a...

The broader Dollar and index trimmed earlier gains as news flow remained light but as the broader sentiment improved. A pullback in yields further put more pressure on the Buck with some seeing a bullish Treasury quant piece as one of the catalysts at the time. Elsewhere, the data and speaker slate remained spared as eyes turn to the US May CPI on Thursday which...