The EUR/JPY is still contained inside 131.00-.70 with option expiry interest from 131.50 (1.1 bn) perhaps keeping EUR/JPY underpinned on return of Japanese markets following Golden Week. Meanwhile, the Euro may have derived some comfort or momentum from better than expected Eurozone data as retail sales and German industrial orders both beat expectations. Next...

Prior chart: USD/CAD retreats through 1.2300 compared to just over 1.2350 at one stage yesterday. However, 1.1 bn option expiries at the round number could well keep the Loonie in check short term. Overall the Target is 1.2250, and a break beyond this could send USD/CAD a further 100 pips down.

Spot gold and silver benefit from the softer Buck but remain around recent ranges with the former around USD 1,780/oz and the latter around USD 26/oz at the time of writing. $1,780 seems to be a tough barrier for Gold to break through however the support seems solid. Further upside anticipated for this week on XAU/USD. Next upside target is $1,8200

The Dollar index looks quite comfortable at the moment above the 91.000 handle after Friday’s rebound to register a late peak for the week, but is off best levels between 91.190-390 parameters as several components claw back some losses and other majors derive a degree of traction via supportive fundamental and technical impulses. However, trading conditions are...

Only one day left for the Dollar to avoid any residual month end selling, and so far its holding above support as it continues to counter bearish rebalancing signals and the ongoing dovish overtones imparted by the Fed with some assistance from a back-up in yields and curve re-steepening. However, the Buck is also benefiting at the expense of others and a...

The Dollar index briefly climbed above the 91.000 level that was proving elusive after a narrow miss at 90.989 on Monday, but whether it can sustain gains above and the close higher remains to be seen given chart resistance in the form of the DMA and 21 WMA at 91.025 and 91.070 respectively vs a 91.072 peak thus far. Overall downside projections are relatively...

Hello everyone, if you like the idea, do not forget to support with a like and follow. Holiday-thinned volumes may well be compounding price action, but the Yen is bearing the brunt of the aforementioned Pound continuation and yield/curve retracement, as GBP/JPY breaks the 152.00 level. However, while Japan observes Showa Day, decent option expiries could keep...

Hello everyone, if you like the idea, do not forget to support with a like and follow. Prior Chart: Euro has breached key chart resistance in the form of a descending trendline, but hit another obstacle at 1.2150 before waning amidst a barrage of mostly firmer than expected Eurozone data/surveys that should keep EUR/USD afloat along with 1.1 bn option expiry...

Aussie displayed a degree of resilience for a while on the back of a supportive NAB Q1 business survey before throwing in the towel and retreating towards 0.7700 alongside Aud/Nzd from just under 1.0790 to revisit lows near 1.0750. The Dollar looks set to end a volatile EU session on a firmer footing and/or off lows against all major counterparts, but mainly...

Hello everyone, if you like the idea, do not forget to support with a like and follow. Prior Chart: Usd/Cad printing a marginal new 2021 low circa 1.2300 with extra for the Loonie from Canadian retail sales coming in above forecast in headline and especially ex-auto terms. Further downside momentum coming!

Before: Simple daily Fibonacci sequence with a relatively strong weekly uptrend. Always use the wick ends on the daily to measure the fibs, and they should provide the next level for the pair within the overall trend. Also try to line the Fibonacci extension zones up with other large key level zones to find more confluence. Finally trade within the trends....

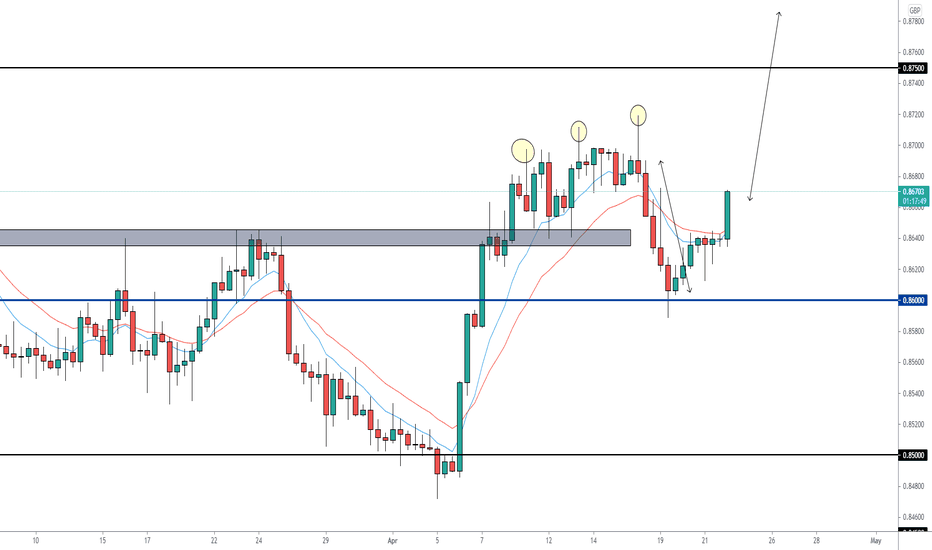

Sterling is still straddling round numbers vs the Buck and Euro at 1.3900 and 0.8700 in the absence of anything Pound specific to trade off, bar less deflationary BRC UK shop prices, while the single currency remains rangebound against the Greenback between broad 1.2100-1.2050 parameters with key declining trendline resistance above the big figure coming in circa...

It has been a minute since we have updated GOLD XAU/USD, but we are excited to finally bring a new bullish bias back. If we maintain above $1,750 this week, we are set for much higher prices to come. Looking later into next year and we are forecasting new highs. We are keeping it clean and we are anticipating a respectful bounce off daily moving averages and...

The Aussie is forming a stronger base firmly around 0.7750 vs its US counterpart and has bounced firmly against the Kiwi in the absence of many NZ participants due to the ANZAC market holiday. Indeed, AUD/USD is back in the high 0.7790 area amidst a sharp rally in copper prices to decade highs on the LME and strength in iron ore alongside other Chinese metals...

Resistance looms at the new USD/CAD 2021 low circa 1.2459 and then 1.2450 may be protected by 1.7 bn expiries extending to 1.2440. However, if the support region gives way later in todays session, we will see a bear run towards highlighted support and finally into new lows within the weekly downtrend. 1.2250 is the significant new downside target upon a clear...

Prior chart: Recent analysis was able to milk 100 pips out of this pair and Sterling is fading as well following a test of 1.3950 vs the Greenback, though should derive more independent impetus from UK retail sales and flash PMIs on Friday if not public finances and the upcoming CBI surveys. If we can hold above 0.8600 here on EUR/GBP we may now look for...

Having survived several rigorous tests of the 1.2000 level, the Euro found 1.2050 vs the Buck almost as impregnable and is now hovering around 1.2055 awaiting the ECB, albeit without much aspiration for anything meaningful in terms of policy insight to trade off. Bullish movements are expected short term. However, the post-meeting press conference and Q&A always...

Somewhat conflicting Canadian CPI data left the Loonie prone to outside influences and an oil-induced decline to sub-1.2650 lows vs its US counterpart, but Usd/Cad reversed sharply when the BoC matched market expectations for a measured QE taper and compounded the hawkish shift by bringing forward rate hike guidance to H2 next year from 2023 previously. This is...