The Pound has been from pillar to post Yen-wise either side of 149.00 following soft UK CPI metrics and then the upside PMI surprises, though on an even keel with the single currency as the vaccine export impasses rumbles on. The Yen is feeling the adverse effects of the latest downturn in USTs, and again rather unfortunately as it is largely left in limbo waiting...

PMI beats have helped the Euro retain hold of the 1.1800 handle against the Buck. Possible movements down into 1.17090 are now likely,. The Dollar remains upwardly mobile amidst deteriorating risk sentiment on latest waves of the coronavirus that are forcing many countries to roll-back reopening plans and some to re-enter lockdown or tighten restrictions. However,...

Aud/Nzd soaring towards 1.0940 from around 1.0818 respectively at the other ends of the spectrum, and the catalyst came overnight in the form of a AUD 3.8 bn Government fund designed to put a ceiling on house prices via extra short to medium term supply. Finance Minister Robertson warned that the recent increase in property valuations is not only having an adverse...

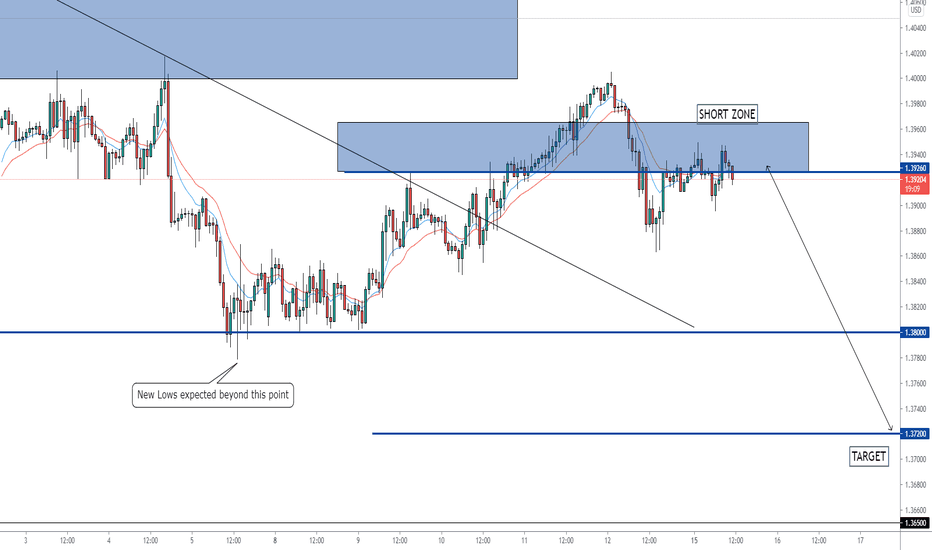

Before: Sterling has lost more momentum approaching 1.3900 and pulled back through the DMA at 1.3830 before losing 1.3800+ status altogether and is now looking even more prone around the 1.3760 pivot point that prefaced Cable’s rally. The dollar index gathered more momentum and bullish technical impetus once 92.000 was breached as counterparts lost...

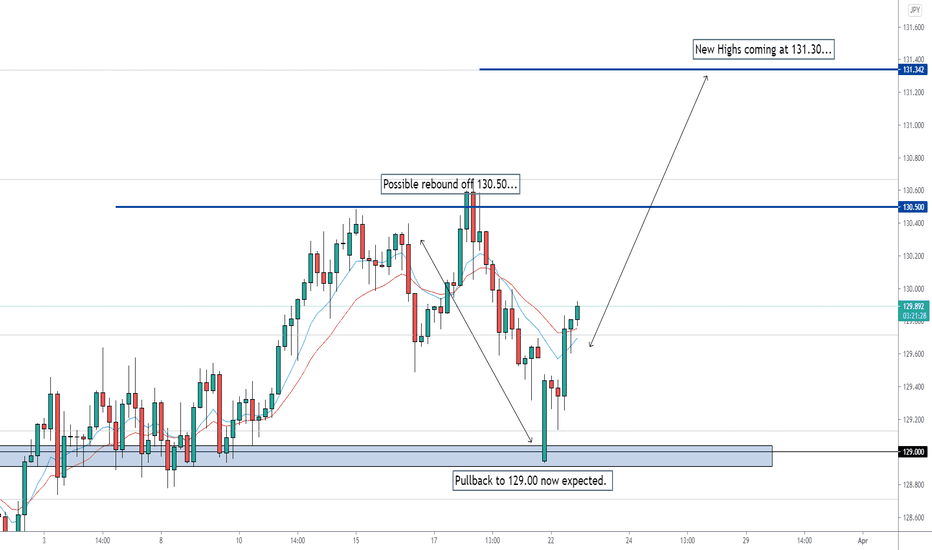

Prior Chart: The Yen has been gyrating around the middle of a 129.80 corridor where decent option expiry interest rolled off at the NY cut (1.1 bn at the 129.75 strike), but looks supported into month, quarter and financial year end if not seeing safe-haven demand to the same extent as the Franc.

The currency markets are relatively sedate and orderly as evidenced by the index hugging a tight line either side of 92.000 amidst relative calm in bond land after recent antics and last Thursday’s particularly aggressive bear-steepening that propelled benchmark yields to and through psychological levels. Indeed, the DXY is meandering between 92.155-91.872 and...

Pound looks ripe for another attempt post fresh 2021 lows against the Euro towards 0.8500 on bearish technical impulses, contrasting COVID-19 factors and comparatively divergent BoE/ECB policy stances. Aside from the negative impact of Eur/Gbp cross selling, the Euro is also struggling to sustain any real thrust vs the Buck through 1.1900 as the Bund/T-note spread...

The FOMC’s SEP dot plots did not leave a lasting affect on the Greenback or provide sustained relief for US Treasuries as the global debt sell-off resumed and intensified to the extent that even the short end of the curves retreated sharply. Accordingly, initial post-Fed losses on dovish takeaways were erased and almost reversed in certain cases as the index...

Prior GBP/AUD analysis: UK standpoint could lie in the hands of the BoE at midday where more heavy news is due to impact. Aussie is a G10 outperformer following a pretty resounding labour report in terms of the key metrics that smashed consensus forecasts. From a technical standpoint without going to much into details, there is possible further lower price to...

The Aussie is faring even worse following another dovish RBA speech that has left Aud/Usd clinging to the 0.7700 handle on the eve of jobs data and the latest RBA bulletin. It remains to be seen whether the final bouts of pre-FOMC positioning push the Buck back down and into negative territory, but for now the Dollar is holding broad gains with the index pivoting...

Not the weakest G10 link by any means, but under pressure again and top heavy vs the Dollar above 1.1900 where 1.7 bn option expiries reside ahead of the Fed. However, the single currency has lurched some distance away from 1.2 bn at the 0.8600 strike against Sterling after stops at 0.8550 were finally tripped to push the cross down to test 2021 lows circa 0.8540...

Prior analysis: Loonie extends its recovery from circa 1.2500 to crest 1.2450 in advance of Canadian CPI tomorrow. The dollar index has bounced firmly from worst levels and is probing 92.000 without extra leverage from Treasury yields in the run up to 20 year supply, with knock on adverse effects for basket components like Sterling that is being capped below...

Prior Analysis: All rangebound vs their US rival, with the Euro contained between small parameters and not really gleaning any momentum from moderately better than expected ZEW economic sentiment or current conditions. Meanwhile, the Yen is even more confined from 109.29-10 awaiting Japanese trade data and the BoJ. EUR/JPY has recently come into the 130.50 zone...

The Dollar has been meandering for the most part against G10 peers, though mainly elevated and grinding higher with some outside assistance from a downturn in oil prices. However, upside progress has been hampered by a less supportive yield backdrop as US Treasuries recoup some of Friday’s heavy losses and the curve re-flattens ahead of the Fed on Wednesday....

Sterling has survived the potential loss of a round number, at 1.3900 briefly with some assistance from quite unexpected remarks from BoE Governor Bailey just days before Thursday’s MPC event. Data coming out this evening at 8:30pm GMT. Cable is now circa 1.3930, but the Pound more perky vs the Euro eyeing stops on a break of 0.8550 again vs a high of 0.8589 at one stage.

USD It looks like the Dollar may fall short of completing a full round trip from lows to highs, and in DXY terms 92.000 could be a step too far within the 92.506-91.364 range, but a reversion to bear-steepening in USTs has helped the Buck arrest a slide that picked up pace after benign CPI data on Wednesday. Moreover, most major rivals have reversed from best...

The Aussie is flagging against its US peer having touched 0.7800 before waning to sub-0.7750. At this stage, more decent option expiry interest in the cross at the 1.0730 strike (1.3 bn) looks safe, but Aud/Usd is currently at the lower end of 0.7745-60 expiries (1.2 bn) and not too far from similar size sitting between 0.7725-20 (1.1 bn). Possible short idea...

If there was any uncertainty about the capability of yields in terms of an overarching force, the abrupt turnaround in direction for the Greenback and broad risk sentiment should remove all uncertainty. However, the catalyst for the latest reversion to bear-steepening in US Treasuries and other global bonds is less clear-cut, as the 30 year auction was not a flop...