FX_Professor

Premium🍎📉 Why Apple Could Be Entering a Structural Correction ⚠️🔍 After scanning major tech names today, one stock stood out— for all the wrong reasons : NASDAQ:AAPL . Technically, Apple has broken below long-standing trendline support , and my chart now assigns a 70% probability(roughly guys...roughly and rounded) of further downside vs only 30% upside . But...

🚀📊 Bitcoin vs S&P 500 – Ratio Signals Strength, Even If Stocks Correct 🔍📈 After posting earlier today about VOO (S&P 500 ETF) and the index itself hitting major resistance, I wanted to shift our focus to what could shine even if stocks pull back: Bitcoin. This chart shows the BTCUSD/SPX ratio – in simple terms, how Bitcoin is performing relative to the S&P...

📚💡 NVIDIA – From Thesis to Profits: How Fundamentals & Technicals Aligned 🚀🧠 This isn’t just a trade —it’s a lesson in how conviction, timing, and structure come together when you truly understand what you're investing in. I’ve been publicly calling NASDAQ:NVDA the “Best Buy of the Decade” since July 2021 when the price was around $18. Why? Because I’m a...

📉⚠️ S&P 500 ETF & Index Hit Resistance – A Technical Warning Shot 🔍🧠 Following up on the video I just posted , I had to share this updated chart of the VOO ETF (Vanguard S&P 500) and US500 Index , now that both are testing key resistance levels. On the left: AMEX:VOO has reached the very top of a multi-year ascending channel—a zone that has historically...

📉📊 S&P 500 ETF & Index at Resistance – Technicals Hint at a Possible Correction 🔍⚠️ Everything here is pure technicals— but sometimes, the market whispers loud and clear if you know how to listen. 🧠📐 The VOO ETF, which tracks the S&P 500 , has now reached the upper boundary of a long-term ascending channel, once again brushing against resistance near...

🤝💥 Ursulization – Bureaucracy Replaces Democracy (a.k.a. The Glasgow Kiss) 🇺🇸🇪🇺 📍Background: The media spun it as a "15% tariff agreement"… But in reality, this wasn’t diplomacy — it was a disguised capitulation. And the stage? None other than Scotland, ancestral ground of Donald J. Trump. So when Ursula von der Leyen came seeking a gentle diplomatic...

First you probably want to watch this video: 📊 ETF News Meets the Charts: ETH, BTC, XRP, and Solana 🔥🚀 The SEC’s new in-kind ETF ruling is a macro-level reset. But as always — we bring it back to the charts 📉🧠 Here's the visual breakdown of what I'm watching and why: 🏛️ ETF Approval = Real BTC/ETH Usage Starts Now ✔️ ETF issuers can now create/redeem...

🚨 ETH - BTC ETF News: What It Means for the Market + China Rumors 💥🌐 July just ended with a crypto bombshell 💣 — and the market is barely reacting. Let’s break it down: 🧠 One part hard news. 🌀 One part geopolitical smoke. 🎯 All parts worth watching if you care about macro market shifts. 🏛️ SEC Approves Real BTC & ETH for ETF Flows (July 29) Say goodbye...

🦄 The Unicorn Breakout – Regression, Madness & Meme Math FX_Professor | July 14, 2025 🎨 Welcome to my world… Some draw straight lines. I draw quadratic regression channels, alien spirals, and unicorns. Because sometimes, the market is not just math — it’s emotion, storytelling, and madness therapy. This chart isn’t just analysis. It’s a prophecy. It’s a...

💰📉 When Gold Believers Flip – Uncle Jimmy, Silver, and the New Safe Havens 🧠🔄 Let me tell you a story that says more than any chart ever could. 📜 Meet Uncle Jimmy (from Canada) . He’s not really my uncle, but out of respect, that’s what I call him. A true OG — early stockbroker, big mustache , 20+ apartments, a life built on commissions, charts, and one...

📊🔥 Silver Breakout, Tech Resistance & TRY Rotation – Structure Meets Reality 🌍📉 Hey traders, FXPROFESSOR here 👨🏫 Today’s charts show how technical structure and real-world capital behavior can tell one powerful story. We’re watching Silver surge, Tech stall, and the Turkish Lira react to local capital flows — all aligning with clean market levels. Let’s break...

📉📊 Mastering XRP Structure with Bitcoin Dominance - (Hedge is Edge) 🧠⚖️ Hey guys, I just posted the video — so you can hear the full breakdown there. 🔊🎥 This time, I'm also sharing the charts here to support the lesson and give you a clear visual on the educational idea. Let’s break it down: 🔍 XRP/BTC – Short Bias We’re at a clean rejection point around...

📉📊 Mastering XRP Structure with Bitcoin Dominance - Educational Breakdown 🧠💡 Hey traders! FXPROFESSOR here 👨🏫 From now on, my TradingView Crypto posts will be 100% educational only . I won’t be sharing target charts or trade setups here anymore. Why? Because even with the best chart, most traders still struggle to execute properly. So instead, I’ll teach you...

🎓📊 Understanding Wedge Patterns - A Real Bitcoin Case Study 🧠📈 Hi everyone, FXPROFESSOR here 👨🏫 From this moment forward, I will no longer be posting targets or trade setups here on TradingView. Instead, I’ll be focusing 100% on education only for here in Tradinfview. Why? Because over time I’ve learned that even when traders receive the right charts, most...

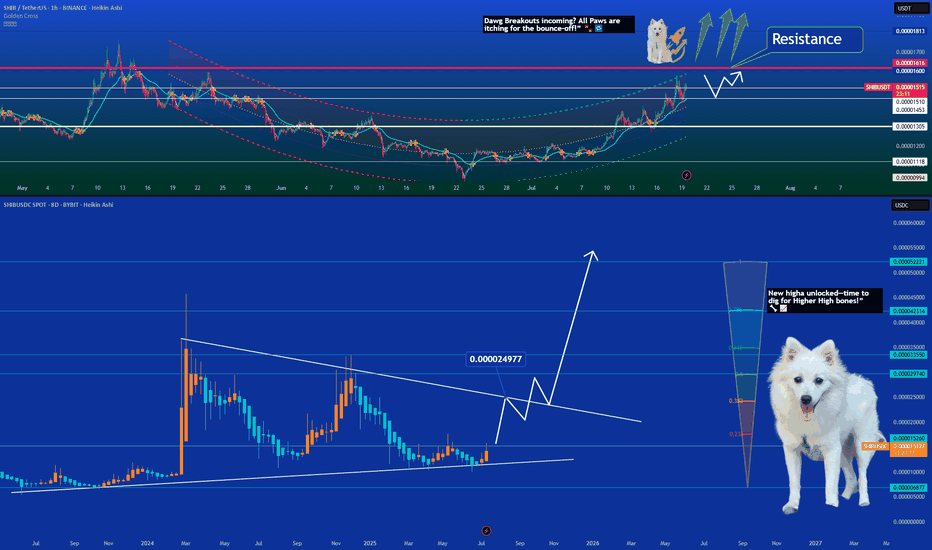

📈 SHIB Breaks Downtrend — Starting a Bullish Climb 🔥🐾 Shiba Inu just pierced its descending resistance line on the 8‑day chart—signaling a trend reversal🔥 On the 1‑hour chart: SHIB has climbed above a key resistance zone (~0.00001510–0.00001550 USDT) Now forming a potential retest → bounce setup Close support lies near 0.00001400, with resistance at...

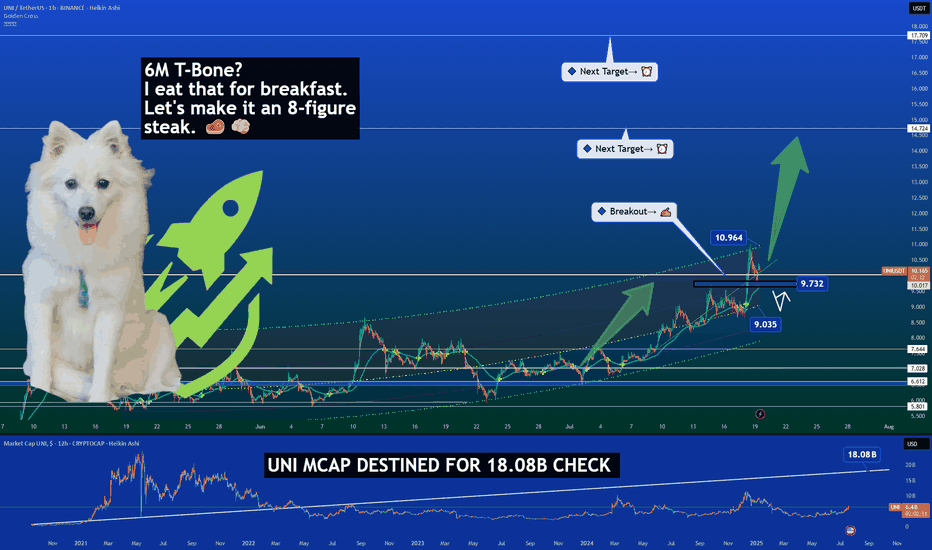

🚀📈 UNI Market Cap Breakout Signals Major Repricing Ahead 💥💹 Forget the December highs. That spike? It came with a bloated market cap and little real growth. T oday, it’s different. UNI has reclaimed the key $10 level, but more importantly, its market cap structure is breaking out after years of compression — and that’s where the real alpha lives. 🔍...

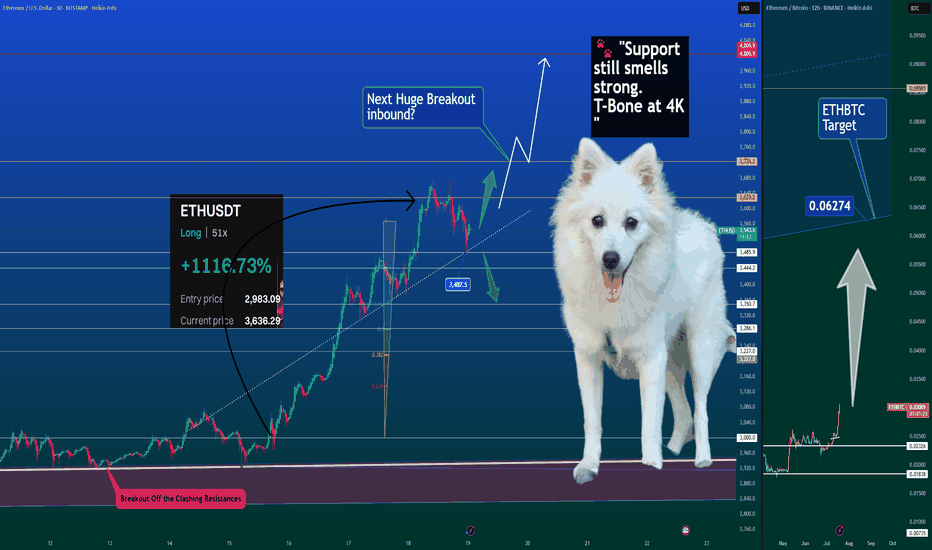

🚀🐾 Ethereum Breaking Out – Is ETH Season Officially Here? 📈💥 Ethereum is showing strength across the board — outperforming Bitcoin, reclaiming trendline support, and eyeing a possible breakout continuation. While macro narratives swirl (crypto legislation, rate cut vibes, political tailwinds), ETH is finally doing what ETH does best — lead. 📊 Chart Breakdown:...

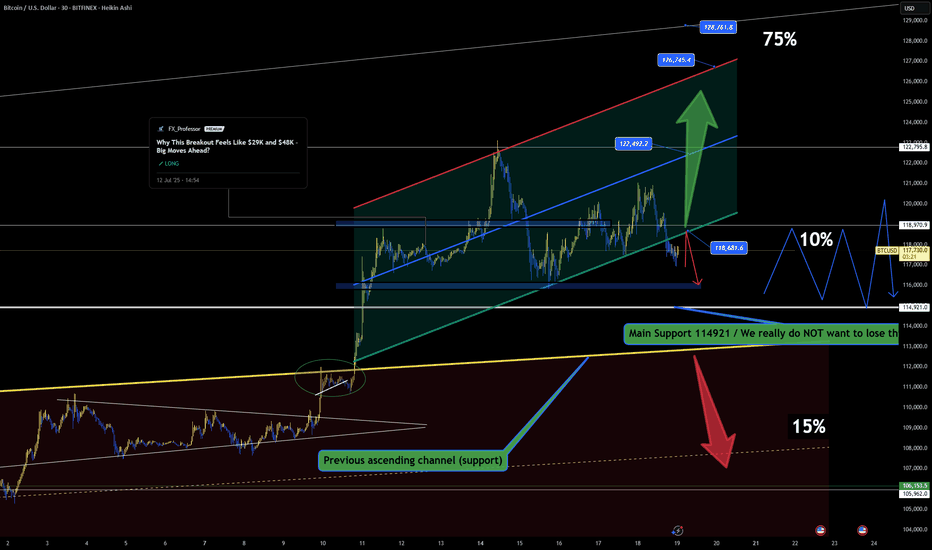

🔥📈 BTC Battles Resistance – Can Bulls Reclaim the Channel? 🧠🚪 Bitcoin is now knocking on the door of the broken channel support — what was once a floor is now acting as resistance. For bulls to regain momentum, price must reclaim and close back inside the channel, ideally above 118.6K. 📍 Key Structural Notes: We've already broken below the internal channel...