FX_Scrubbs

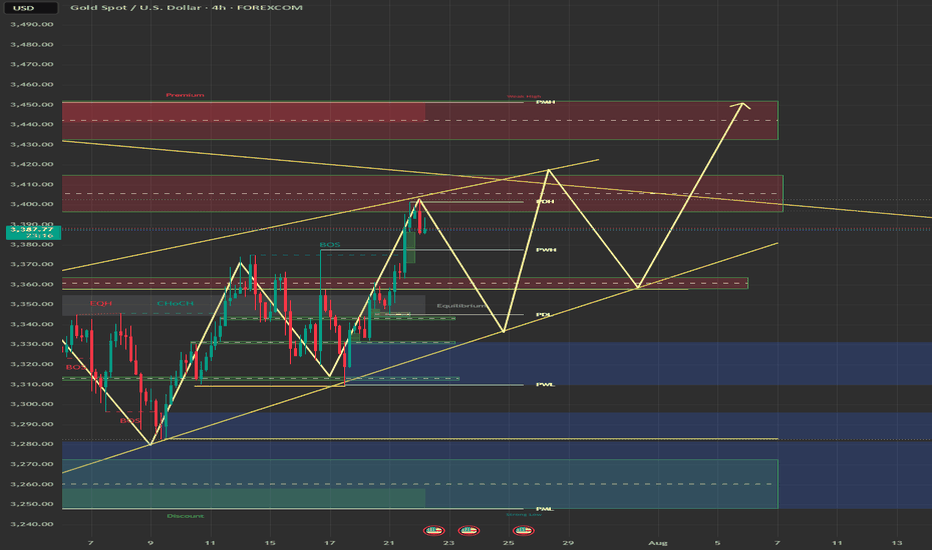

EssentialGold Enters a High-Stakes Week This week sets the stage for major moves in gold. The charts are signalling liquidity grabs, premium compression, and volatility driven by upcoming macro catalysts. Key events ahead: Tuesday: ADP Employment Data Wednesday: The Fed Gold is currently consolidating beneath a critical supply zone, suggesting potential for a breakout...

Welcome to a new trading week. Price is compressing within a premium structure, boxed between clean supply and demand zones. While the overall trend remains bullish, momentum is clearly fading — so structure takes priority this week. 🟨 Weekly Bias: Neutral | Range-Bound Conditions There’s no clear directional conviction on the weekly timeframe — we’re in a...

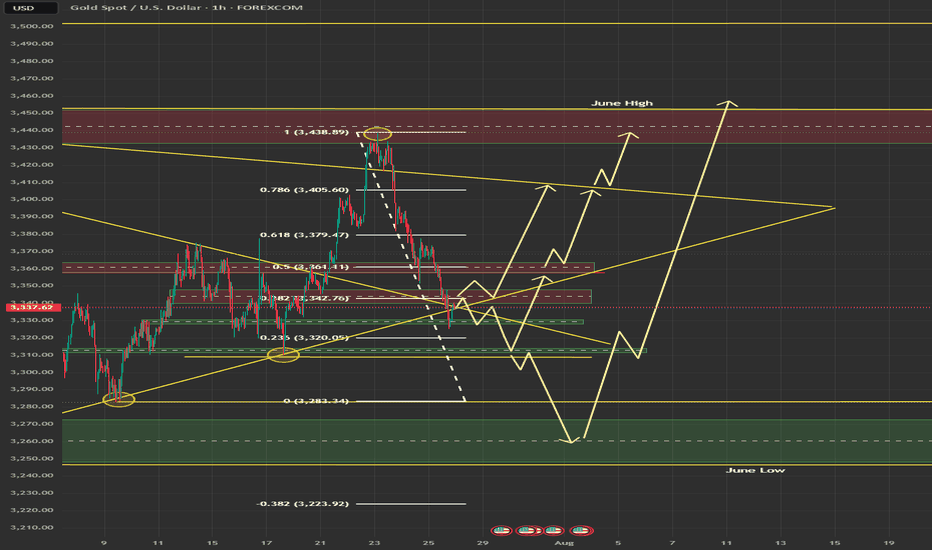

🟡 Gold Update: High Volatility Pullback Nearing Resolution Gold has recently exited a high-volatility phase. After plunging sharply from the 3438 high, price aggressively dropped to 3380, tapping deep liquidity within a high-confluence discount zone. 📉 GOLD MARKET UPDATE – JULY 24 Gold pulled back hard from 3438 → tapped deep liquidity at 3380. Volatility...

Market Outlook Update Following up on Sunday evening’s analysis — honestly, I didn’t expect the move to unfold this quickly. We’ve still got questions on the table: will the market call Trump’s bluff, or just shrug it off? The Euro certainly didn’t ignore the developments, as we saw with that strong bullish London session yesterday. Will we see one or two more...

🟡 Gold Weekly Outlook – Bullish Momentum Tested at Key Support Welcome to a new trading week! Gold remains in a broader uptrend, though recent price action is testing a critical support zone that could define the next directional move. 🔹 Key Zone in Focus: $3,308 Gold is currently testing the $3,308 level, a major support area from previous consolidation. How...

🔸 WEEKLY BIAS The broader trend remains bullish to neutral, though momentum is softening within a premium rejection zone. In May–June, price broke structure to the upside, printing a new weekly higher high (HH) above 3380. However, it failed to sustain above the volume imbalance (3430–3480), signaling exhaustion in that premium range. Currently, price is...