FadeMeIfYouCan

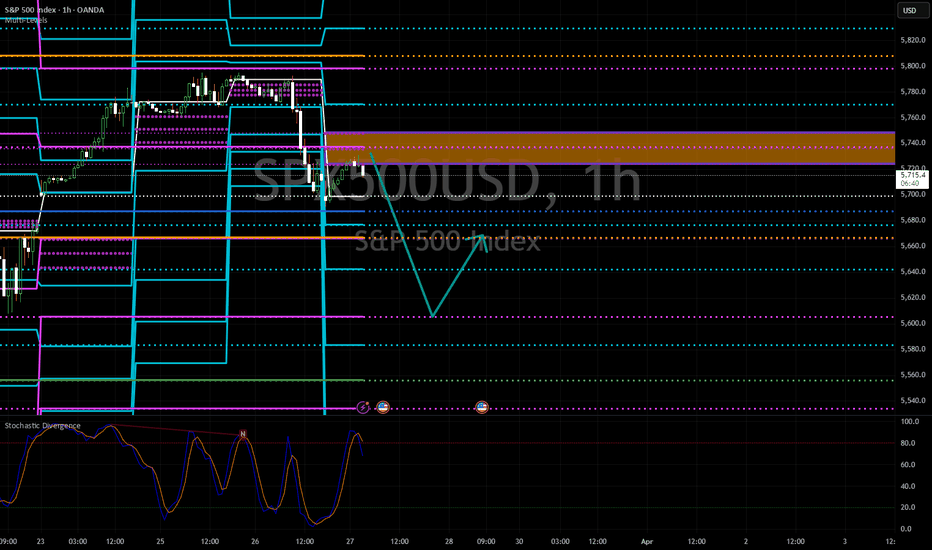

Premium#SPX pulled back nicely to PZ yesterday before rallying 70 points, going back to resistance zone. Overall, price action looks toppish. Could see a move down to 5525/55 but will be looking for a turn at that level for a long. If level does not hold, next strong support below is at 5400. Today is Tariff day. Trade safe.

Was wrong on the move on Friday, as market trended down. Need a bullish daily candle to negate this down move. Pullback to 5638/68 is a possible short for a move lower.

Similar to SPX, NDX flushed down to make a new lows. However, if this holds, look for a move back to yesterday's high.

I was bearish SPX yesterday and the PZ held the rallies and price just sold down to new lows. Overall, price is still in consolidation and the flush to new lows could see another move back to the highs of yesterday. Looking for an up from here.

I was wrong on the move for SPX yesterday as market sold down strongly. Bearish price action and so much that I think market is still bullish above 5600, based on daily price action, IMO we will further downside as long as 5750 holds.

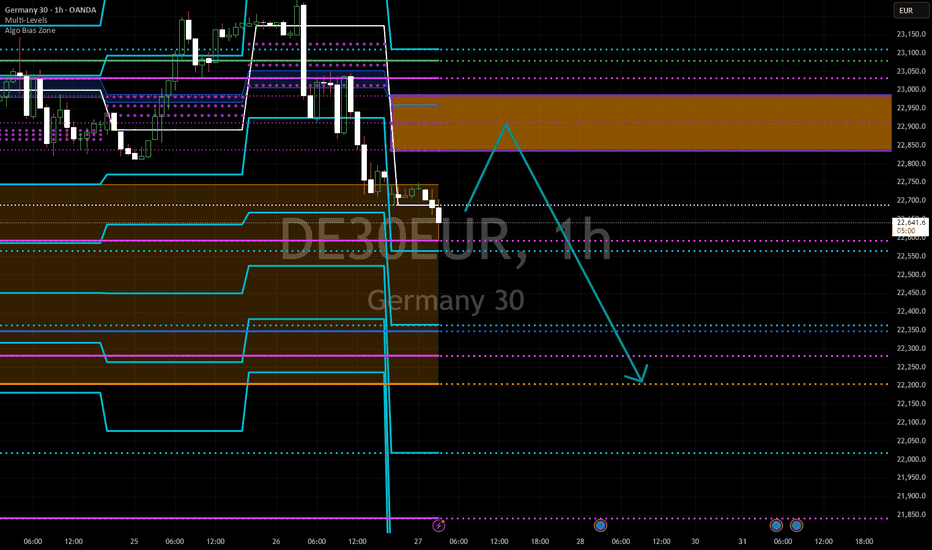

Similar to SPX, DAX looks even more bearish based on price action. IMO, as long as PZ holds, expect further downside.

I called a good bottom yesterday and an almost 400 points up move. Price is pulling back now. Looking at 23010-30 to hold for a move higher.

SPX made a nice bottom off PZ yesterday and moved up. Today, I am looking for a possible move down to 5750, make a new low but find buyers to move higher to 5860.

DAX moved up but sold down strongly while US indices held up. Is it really so bearish? IMO, as long as Friday's low hold, could see another move higher. Looking for a move higher from here.

Huge run up in #SPX after a gap up. Strongly bullish for further upside. Any dips is a buying opportunity. Looking at PZ to hold for another leg higher, or if it breaks, look at 5700 for a long up to 5880 then 6000.

SPX made a pin bar on Friday. Path of least resistance is to the upside. 5690 if traded today, is a low risk level to go long to target 5810 and 5860.

Volatile day for #SPX yesterday, market rallied on PPI but failed and came down to our 5815 level to perfection and rallied to 5865 for a good 50 pts as shared in our group. Price action on daily is still bullish, looking for further upside. Price is holding PZ now. Bullish, with assumption that CPI could well follow PPI, for a move higher, 5900 5960 as next...

I did not provide the plan for Friday, though EURUSD did make a nice dip to PZ before continuing higher to first level and then pulling back. Momentum has slowed down and TBH, I am not sure of the next move. IMO, I would want to wait for a pullback and bullish momentum for a long and a move higher from here, while shorts could work below PZ, but I would prefer...

I was looking for a move higher on Tuesday on a dip. EURUSD came down to clear Monday's low, about where the buy level is and closed 20 pips higher. I would say that there is no bullish reaction on Tuesday, though overall bullish thesis is still intact. If price does not hold at current PZ, which I think it would not, could see a move down to 1.0370 in which I...

I was looking for a dip to go long off for EURUSD yesterday. And after an initial move higher, EURUSD moved down to our buy level at 1.0396 and bounced off for 20pips before pulling back now. I am still cautiously bullish for a move higher but EURSD might pull back to 1.0378, which give a good level to go long off, for a move higher, with 1.0514 as a good near...

I was bullish EURUSD on Friday and it worked out as plan; a fake test of lows then a move up to our buy target. I would say that price hit a resistance zone thus the next move will be tricky. But overall, the thesis of a lower high for a move higher. Will look for longs on a re-test of PZ, or in the worst case scenario, from 1.0366.

After Wednesday's sell down, price action near term price action showed a recovery and I said to short from higher up. Indeed, we saw a move up of over 50pips before an ability to move higher, and it just closed back near the lows. However the lows still hold. Not exactly bearish though IMO, but could be early to say lows is in in terms of daily candle. For lows...

I was somewhat wrong on the direction yesterday but intraday levels worked great. TBH, I was not sure about the direction of move yesterday. I said that it does look bearish and if it goes up first, could see the sell down lower. And it nicely hit 1.0513, sold down to 1.0468 level for 45pips, which I said could be a bounce point and well it did bounce back to OP...