FaithdrivenTrades

Price tapped into the Reversal Block and is now dancing under trendline resistance—setting up for a potential breakdown. If momentum holds, we may see price gravitate toward the retest zone near 3,320 or even the gap magnet at 3,289. However, if buyers defend the YL zone, we could get a sharp bounce and retest the previous value areas. ⚔️ Battle lines are drawn....

Current market structure is testing the Order Block (OB) support right at POC/Trendline confluence. A bullish bounce is in play targeting yesterday’s high (YH) and value area high (VAH) if this zone holds. 🔹 Price respected YL zone and OB 🔹 Confluence: Trendline + POC + Order Block 🔹 Bullish bias as long as above 3345 📌 Bias: Short-Term Bullish 🎯 TP: 3387–3392...

We anticipated the gap fill and price did revisit the marked imbalance. A clean breakout from wedge and structure led to a +60 pip move. Currently, price is respecting the 0.5 - 0.618 Fib retracement zone after failing to break above the 0.382 (3058). 💡Key Observations: Rejection at retest zone (3347–3358) 0.618 level holding intraday structure Breakeven hit...

XAUUSD 15Min Analysis – June 2 Price broke out of the descending channel and tapped into a potential reversal zone. Still respecting the gap zone below, which may act as a magnet for price. Key levels ahead: Watch for reaction at the 3316–3331 resistance Clean breakout = bullish continuation Rejection = short opportunity back to gap zone 📌 Bias: Short-term...

🚨 XAUUSD 15M – Compression Before Expansion? Gold is forming a bullish wedge near the PDL (Previous Day Low) and has tapped into the 0.5–0.618 Fib retracement zone, aligning with a recent demand area and volume support. Price is coiling, suggesting a potential breakout move. 🔎 Key Technical Confluences: Retested Recent Broken Resistance Zone near 3280–3285 (now...

Gold is attempting a recovery after sweeping recent lows, now trading near the Value Area Low (VAL) and rebounding off a Recent Broken Resistance zone. The structure still favors the bears unless key zones are flipped. 🔎 Scenario Map: Bull Trap Possibility: Price may rally into the POC/Value Area High (VAH) around 3295–3314, tagging PDH. Sell Setup Ideal Zone:...

Gold is currently sitting at a critical decision zone, testing the trendline and potential breaker structure after failing to break the Previous Day High (PDH) and reacting from Order Point (OP). 🔍 Key Observations: Price rejected from PDH + OP zone with a clean bearish reaction. Now sitting on a key ascending trendline and the Previous Day Low...

Gold is currently sitting at a critical decision zone, testing the trendline and potential breaker structure after failing to break the Previous Day High (PDH) and reacting from Order Point (OP). 🔍 Key Observations: Price rejected from PDH + OP zone with a clean bearish reaction. Now sitting on a key ascending trendline and the Previous Day Low...

Gold showed strong rejection at the upper channel in the Daily TF, tapping into the Rejection Zone near 3398. 📊 Current Scenarios: Bullish Breakout above PDH/AVL → Expect rejection again at the 3398 zone if momentum weakens. Bearish Breakdown → Possible Cup & Handle formation, with a bounce or continuation from: 🔹 Recent Broken Resistance 🔹 FVG + Mitigation...

🔥 Current Bias: Bullish (Short-term decision point incoming) 📍 Still holding a bullish bias overall as the higher timeframe downward channel target remains unmet. Price is currently hovering around the accumulation zone—a key decision area. 📈 Long Scenario: If accumulation zone is broken upwards, expecting price to rally into the FVG and potentially towards the...

📌 Key Market Structure: 🔹 Daily Downward Channel still intact — price remains under pressure 🔹 PDH (Previous Day High) rejected, confirming bearish strength 🔹 Price Reopened Near PDL (Previous Day Low), showing indecision 🔹 Volume Imbalance at POC (3,310) – potential magnet for price retrace 🔹 Support Zone holding around 3,275 - 3,280 🔹 Pullback Zone marked near...

Today’s market was a textbook example of volatility and technical precision on XAUUSD across both sell and buy setups. 🔻 Sell Trade (3334 to 3208) – Strategy 1 Execution Price initially reacted to a key resistance zone within a daily downward channel. After forming a short-term high at 3334, price reversed sharply with momentum and clean structure...

📍 Possible Reversal Zone: 3228 - 3230 📍 Buy Zone: 3175 - 3179 (Asian Session) 📍 Current Bid/Ask Levels: 3203.620 / 3204.450 🔍 Price has formed a rising wedge structure approaching a potential reversal zone at 3228 - 3230. Watch for rejection signals in this area for potential sell opportunities. 📈 Alternatively, a pullback to the identified Buy Zone at 3175 -...

Technical Insight: EUR/GBP is once again rejecting a major higher timeframe resistance zone, showing clear signs of bearish pressure. Price action has decisively broken below the ascending trendline that held since April 2, confirming a market structure shift. The break adds to confluence as momentum turns in favor of sellers. Fundamental Backdrop: This week’s...

📉 Technical Analysis: EUR/GBP just broke out of a clear rising channel on the 1H chart with a strong bearish engulfing candle, signaling an early reversal. Price failed to maintain momentum above 0.8662 (previous high/resistance) Massive rejection at the top of the channel, followed by a sharp sell-off Entry at ~0.8583, SL above highs at ~0.8670, TP targeting...

This chart exemplifies classic ICT methodology and Smart Money Concepts (SMC) in motion. Here's a breakdown of the zones and logic: Current Market Structure Market swept a prior low (liquidity grab) near $3,015, indicating Smart Money accumulation in the breaker block. Bullish reaction occurred precisely at the breaker + demand zone, suggesting accumulation...

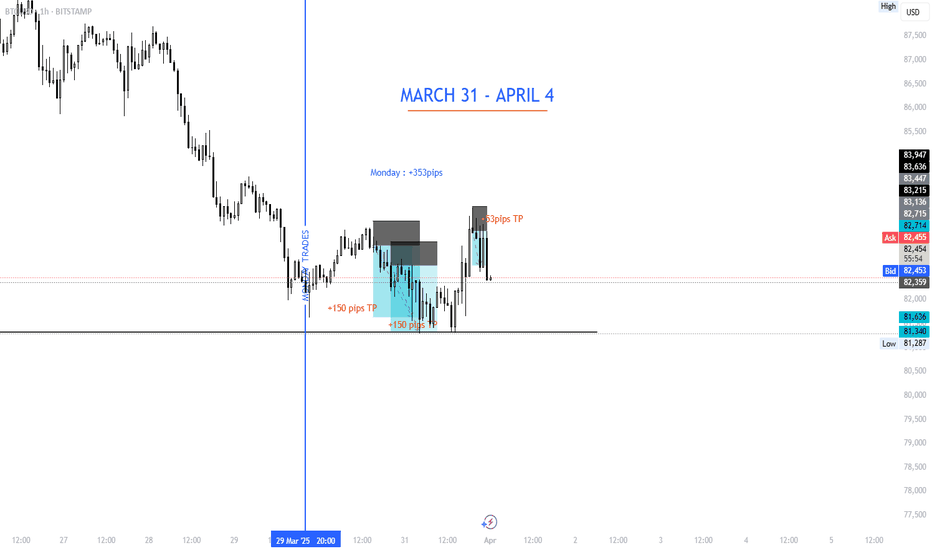

Monday opened with strong recovery moves on BTCUSD after last week's selloff, creating multiple tradable pullbacks within a clean intraday structure. 🔹 Trade Summary – Monday Price rejected a key support zone, offering an early entry and delivering +150 pips TP on the first move. A continuation entry allowed for another +150 pips, with price reaching into a...

Gold began the new trading week with moderate volatility and clean technical structure, offering both breakout and support-based opportunities. 🔹 Monday Recap Price initially faked a breakout above a key intraday resistance, triggering a stop-loss of -80 pips on the first attempt. A second setup from a rising trendline support aligned with bullish market...