Sorry for sharing this trade late, just connected to my TradingView account. NZD/USD broke a good congestion level, but I preferred to wait before opening a long position. I was waiting for the breakout of a second important level, formed by the previous important swing high. After the breakout, very easy trade to catch. Let's hope for the best :)

GBPCHF seems to have the necessary strength to get out of a 5-week congestion phase. that is quite unusual for such a volatile currency pair. Buyers seem to push the price higher, already attempting once to break the resistance formed by the sideways trend. Bad news is that the price is currently also forming lower highs, showing a very tight pennant on the...

USDCAD is on a support formed by a very important swing high that we had before. In addition, right on the same level, there are the red and the orange moving averages that could work as dynamic key-levels. Normally, we wait for a sign of rejection, but we can get an extraordinary risk-to-reward ratio structuring our trade like this, so I'm going to reduce a...

USDJPY broke through the Ichimoku cloud and also passed an important resistance that we were monitoring. It seems to have good momentum, so I entered the trade with a risk to reward that is lower than 1:2, but with a concrete chance to move the stop loss very soon since the cloud is moving up due to the very strong bullish momentum.

GBPJPY recently has shown good action by buyers. I'm waiting to see if this action continues and is strong enough to take GBPJPY out of a sideways trend that seems to be very solid in the last period. I place my buy stop entry order out of the congestion phase to confirm the breakout and the strength by buyers. Risk to reward is great for this trade :)

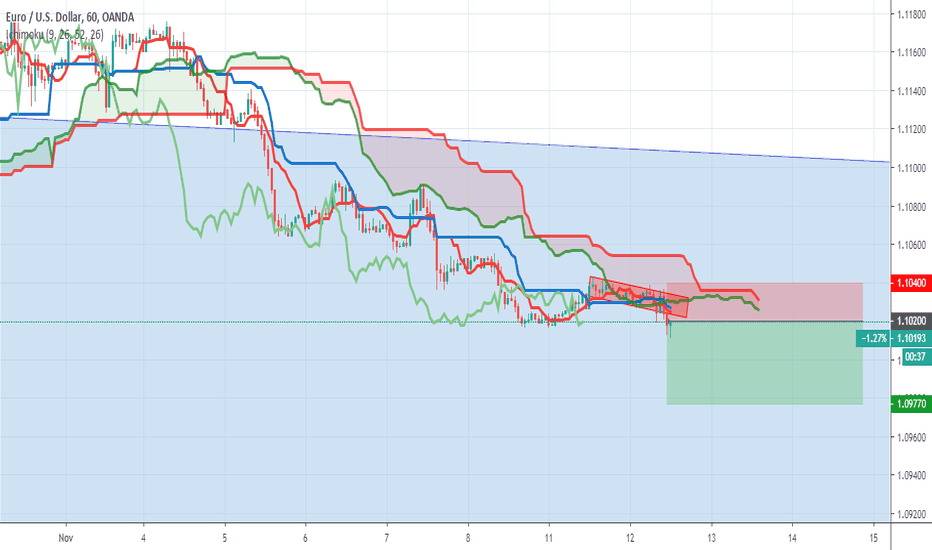

EURUSD is a currency pair that we were already monitoring in our daily analysis on YouTube. As I mentioned yesterday, I wanted to wait for a better signal because the blue line of the Ichimoku Indicator was heading up for the first time in a while, so not a good sign for a possible short position. We finally had a good rejection on the cloud, with some strength by...

After the favorable interest rate for the NZD, the currency pair had a very strong up-movement, testing, once again, a strong long-term resistance. NZD has been weak for months, with speculators joining and waiting for the interest rate to go down, as announced by the Reserve Bank of New Zealand. Everyone, including me, was expecting a rate at 0.75%, while the...

GBPUSD has been quite slow recently. Volatility in November can't certainly be compared to the one we had in October. The price is currently approaching two down-trend lines: the first one is a long-term one, going through the whole month of November; the second one is a recent one and also forms the upper part of a pennant. Last candle was quite strong, giving a...

I know, I know. You are not very happy about the 1:1.9 risk to reward ratio :) I want to start the analysis from there. The risk to reward ratio is not very appealing and we usually trade with a ratio that is at least 1:2. The reason I still like this trade is that the down-channel is very steep, this offers the possibility to easily adjust the stop loss and the...

EURCHF is breaking through the up-channel and the Ichimoku cloud. As mentioned yesterday in the YouTube video, I was waiting for this kind of situation to open a short position. I couldn't get a great risk to reward ratio because I want to place the stop loss above the cloud and the take profit based on the measured move. Still a good opportunity.

EURGBP is attempting to break a very strong downtrend, with the price trying to go above last important swing high and above the Ichimoku cloud. We have talked about this potential trade on my YouTube channel, I hope you had the chance to follow the idea and structure your own trade.

EURUSD is at the top of a descending channel, so we can try to find any action by sellers, confirming that this is a good level to get in with a short position. At the moment, on the H4, we have a good upper shadow hitting the upper part of the channel, but I would like to wait for a stronger action, so I place a sell stop entry order at 1.1110, so we can verify...

USDCAD is forming a new bearish setup while the price is in a tight sideways channel. The bottom part of this congestion phase also matches with a previous important support, so a breakout of this key-level might push the price below 1.31. This is a stop entry order, we are not going to enter at the market price.

EURAUD is following a rising wedge and the setup of the moving averages also show that there is an uptrend. So why am I planning a short position? The rising wedge is still quite large and this gives the opportunity to try to find a rejection at the top of it, with a great risk to reward ratio. Also, the moving averages are quite close to each other, so with a...

NZDUSD is testing again a short term support that we have had for the past 3 days. We are waiting for the right attempt by sellers, so we place our sell stop entry order right below the level, waiting for a breakout.

As I mentioned in my video on YouTube channel (Federico Sellitti), I was going to look for a trading opportunity on this chart. We have a second hammer right on the upper part of the ascending channel, so I'm opening my long position on it.

AUDCHF just formed a bearish engulfing pattern, creating an opportunity to enter with a short position in this down-channel. The price is slightly retracing, this gives us the opportunity to get a very good risk to reward ratio, while still placing a good stop loss, above a mid-range downtrend line, and a good take profit at the bottom of the descending channel.

EURCHF is testing for the third time a support that already proved to work in the past even as a resistance. Since we can play this trade with a great risk to reward ratio, placing the stop loss right below the support and the take profit around the green area, I suggest to sacrifice a portion of your potential profit and choose an entry that is higher than the...