Gold (XAU/USD) Daily Chart Analysis – April 4, 2025 1. Trend & Structure Overall Trend: Gold has been in a strong uptrend, forming higher highs and higher lows within an ascending channel. Current Position: Price is currently near the upper boundary of the channel, suggesting potential resistance and a possible pullback. 2. Key Support & Resistance...

Gold (XAU/USD) 1H Analysis – April 2, 2025 Pattern Identified: Head and Shoulders Formation detected, indicating a potential bearish reversal. The neckline has been drawn as a support trendline, which, if broken, could confirm further downside movement. Key Levels: Current Price: $3,123.55 Neckline Support: Around $3,120 Target Area: $3,070 - $3,060 (Marked in...

Bitcoin (BTC/USD) Daily Chart Analysis – April 2, 2025 Market Structure & Pattern: Bitcoin is currently trading around $84,346, experiencing a slight decline of -0.97% for the day. The chart shows a falling wedge pattern, a potential bullish reversal structure. A breakout above the upper trendline could signal upward momentum. Key support at $74,400, marked by a...

AUD/USD Analysis - April 1, 2025 (1H Timeframe) Trend Overview The pair is currently in a descending channel, forming lower highs and lower lows—indicating a downtrend. Price has reached a strong demand zone (purple box) around 0.6240 - 0.6260, which has previously acted as support. Key Levels to Watch Support Zone (0.6240 - 0.6260) If price holds and forms...

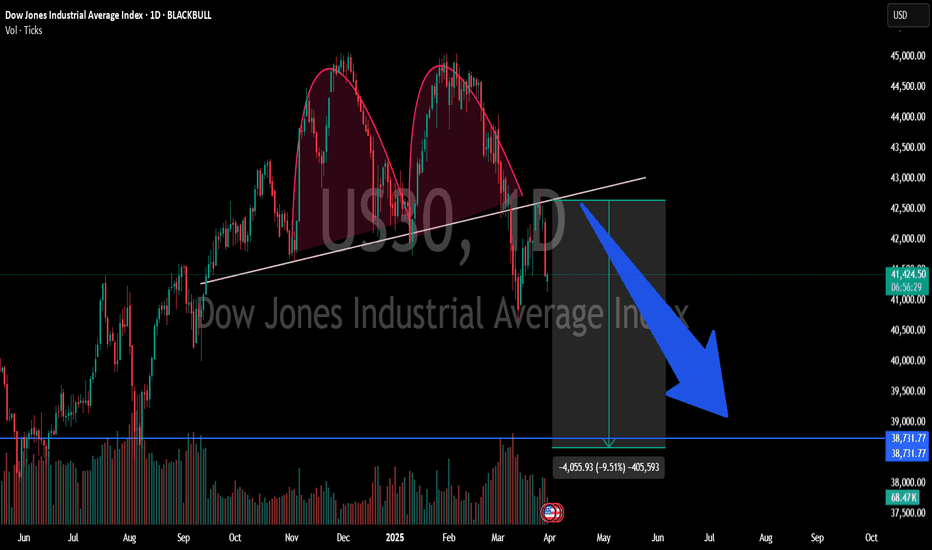

Dow Jones Industrial Average (US30) Analysis - March 31, 2025 Chart Structure & Pattern Head & Shoulders Pattern: The chart shows a clear double head & shoulders formation, which is a strong bearish reversal signal. Neckline Break: Price has already broken below the neckline of the pattern, confirming a potential downward move. Retest in Progress: The price is...

NASDAQ 100 (US100) Analysis - March 31, 2025 Trend & Structure The chart shows a strong bearish breakdown from a rising wedge pattern, which is typically a bearish reversal formation. After a sharp decline from all-time highs, price is breaking below key support at 19,921. The next major support zone is highlighted in purple, around 18,000 - 17,600, which served...

US30 (Dow Jones) Daily Chart Analysis – Bearish Breakdown Ahead? Market Structure & Trend Analysis: The chart shows a Head and Shoulders (H&S) pattern, which is a bearish reversal formation. Neckline break confirmed, suggesting further downside movement. The large blue arrow points to the next key support area near 38,731, representing a potential drop of about...

NZD/USD 4H Analysis – Bullish Channel Holding Support Market Structure & Trend Analysis: The price is moving within a well-defined ascending channel, with multiple touches on both support and resistance. Recent bounce from the lower trendline suggests the bullish structure is still valid. The blue arrow indicates a potential upside move toward the channel’s...

NASDAQ (US Tech 100) 4H Analysis – Bullish Recovery in Progress Market Structure & Trend Analysis: The chart shows a strong downtrend, with price breaking below a rising channel earlier this month. However, a bullish breakout from the falling wedge is now in play, indicating a potential trend reversal or retracement. The price is approaching the 20,250 - 20,532...

XAUUSD (Gold) 1H Analysis – Head and Shoulders Breakdown Chart Pattern Analysis: The chart displays a Head and Shoulders pattern, a classic bearish reversal structure. The left shoulder, head, and right shoulder are clearly labeled, confirming the formation. Price has broken below the neckline, signaling potential further downside movement. Support and Resistance...

Analysis of CAD/JPY (1H Chart) Trend Reversal & Breakout: The price previously moved within a descending channel but has since broken out to the upside. This breakout indicates a shift in market structure from bearish to bullish. Key Resistance at 106.203: The chart suggests a bullish target around the 106.203 resistance level. If price reaches this level, we...

Gold (XAU/USD) - 4H Analysis Technical Overview: Price is moving within a well-defined ascending channel. It is currently testing the upper boundary of the channel, which has acted as resistance multiple times (highlighted in orange circles). Historically, each time price touches this upper boundary, a pullback follows. Key Levels to Watch: Resistance: $3,000 -...

Germany 40 (DE40) - 4H Analysis Technical Overview: The price broke below an ascending trendline, signaling a potential trend reversal or deeper correction. Currently, it's retesting the broken trendline, which could act as resistance. A drop towards the 21,709 support level is possible if sellers maintain control. Key Levels to Watch: Resistance: 22,719 (Current...

NASDAQ (US Tech 100) - 4H Analysis Technical Overview: The price has been in a strong downtrend, trading inside a descending channel. Recently, it reached a potential support level around 19,375 - 19,500 and is showing early signs of reversal. A breakout above the channel resistance could confirm a short-term bullish move. Key Levels to Watch: Support Zone: 19,375...

USD/JPY – Daily Chart Analysis (March 12, 2025) Market Structure & Key Levels: Current Price: 148.358 The pair is in a downtrend, forming lower highs and lower lows after breaking a key ascending trendline. Key Resistance: 149.252 (previous support, now acting as resistance). Key Support: 140.000 – 142.000 zone (highlighted in purple, strong demand area). Possible...

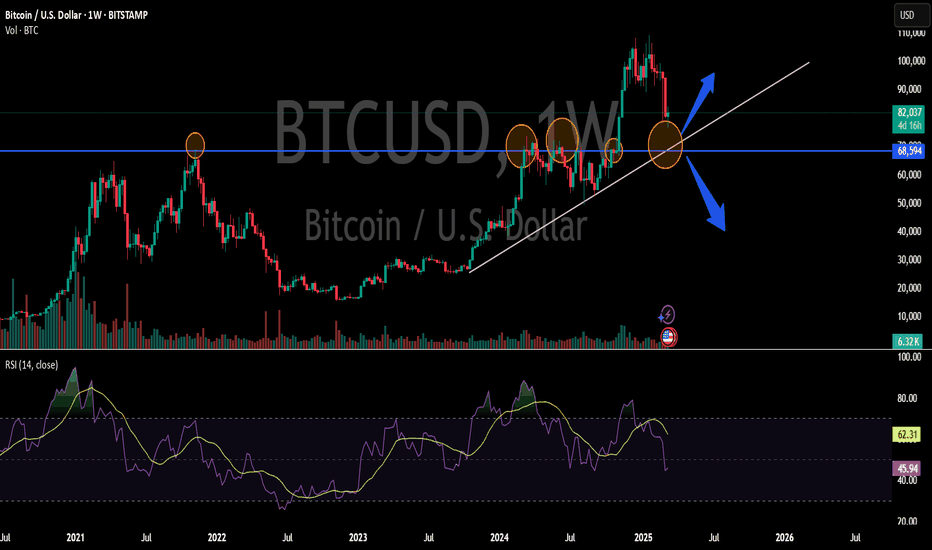

Bitcoin (BTC/USD) – Weekly Chart Analysis (March 12, 2025) Market Structure & Key Levels: Price: $82,451 Bitcoin recently pulled back after reaching a new high above $100,000, correcting toward a major support area around $68,594. The previous all-time high (ATH) from 2021 (~$68,000) has turned into a key support level. The ascending trendline is also aligning...

NASDAQ 100 (1W) Technical Analysis – March 12, 2025 Market Structure & Breakdown: The NASDAQ 100 has broken down from a rising wedge pattern, a bearish signal. This breakdown led to a sharp sell-off, pushing the price to 19,423. The next key support zone is highlighted around 18,000 – 17,500 (purple box), where buyers might step in. Volume & RSI Analysis: The...

XAU/USD (1H) Technical Analysis – March 11, 2025 Market Structure & Trendlines: Gold has been in an uptrend, consistently making higher highs and higher lows. The previous trendline was broken, leading to a temporary pullback. A new trendline has formed, acting as a dynamic support level for potential further upside movement. Price Action & Key Levels: Gold is...