A possible sell off on the GBPUSD pair. expecting a break of the trendline for a move downside to the 1hour target.

A short term possible correction for USDJPY, and we can look for another entry later.

Gold moving higher in the long term, but a quick short term move is in view, with relatively good entry.

USDJPY 1H bullish. buy now you ca benefit from this move

A quick wave 2 correction for GBPNZD. Will also be looking for a buy entry after the correction

Sell idea for GBPUSD, as we anticipate the strengthening of the USD in the coming weeks. We will continue to witness the sell off of other currencies paired with the USD.

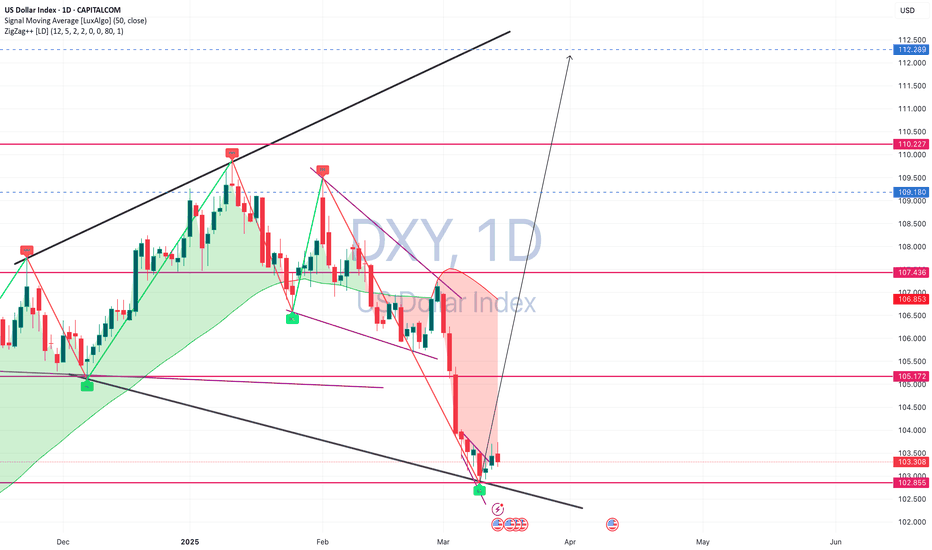

Hello traders, hope we all had an eventful week. In the coming weeks we will be seeing a bullish move in DXY, which will also create a bullish momentum for all USD pairs. Trade safe!

BTCUSD, is currently completing a wave 4 correction. It is still strongly bullish and will be seeing more upside momentum in the coming weeks.

Hello traders, Gold will be having a bearish correction on the 4Hour timeframe. Once, completed we should see the buyers coming back in. Observation: We are currently in a ranging market. Therefore, the movement will be slower as there isn't much liquidity in the market at the moment.

Happy New year traders. A new opportunity to achieve your dream life awaits. This session i will be looking for the pullback in XAUUSD to enter long. We are currently, completing a wave E in the expanding triangle, after which we will continue with the bearish trend. Observation: the wave E can also fall short and not breakout of the triangle. Trade safe everyone.

USDJPY, has taken quite a bit of time to retrace downwards. As JXY gains momentum , USDJPY is now ready to drop. Observations: as long as, the key trendline is not broken we should see a correction to around 153

Looking at XAUUSD 4hour. I will only continue with this trade as long as the green key trendline holds. As we currently have a breakout, from the uptrend trendline in the expanding triangle. I am very much bullish for now.

The bearish trend continues on USDJPY, after a 1hour time frame correction. The pair is ready for another sell-off.

As predicted last week all analysis played out accordingly. This week i will continue to hold some of my positions for the longterm. This coming week will continue with the bearish trend on DXY, and we will keep shorting USD. USDJPY will see more downside, as JXY gains more bullish momentum.

BTCUSD will most likely fall in the coming weeks. In view of, most safe haven assets rising in the following weeks due to Dollar weakness. BTCUSD may take a tumble to our first target of 91,374, before falling lower to around 69,000. Note: Do not rush into trading any asset without first getting a clear confirmation.

Next week will continue with the correction on XAUUSD. Which will also present some great opportunities for long trade entry and great swing trade potential. Also, anticipating the fall of DXY which will allow all XXXUSD pairs to rise. Entry point: 2,616 for best entry Note: Employ patience when entering the market and look for confirmations before taking trade.

The coming week will bring an interesting turn of events for market. The USD will play a great role, as the market fundamentals point towards the Dollar $ falling. EURAUD will witness an increase, in the strength of AUD, thereby causing the EURO to fall. Entry point : for best entry looking at 1.6527 Recommended to take profit at different stages, as the market...