Topside Target 5.75%, clear the FVG+ and reject off of monthly ATH downside gann.

BTC / USD Notes: Expecting a drop back down to the trendline followed by strength to the upside following U.S midterm elections. > Support Target ~$19,800 - $20,000 >> Upside Target ~ $22,500

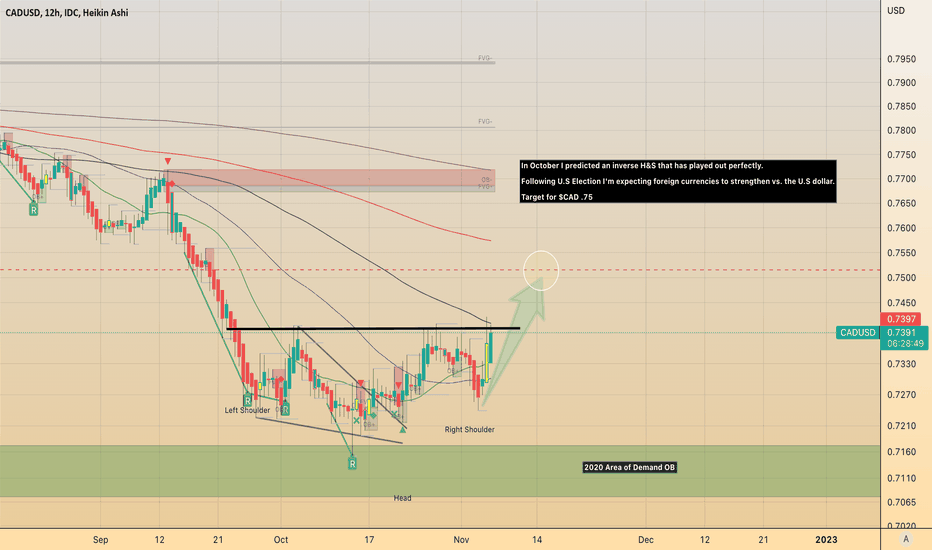

In October I predicted an inverse H&S that has played out perfectly. Following U.S Election I'm expecting foreign currencies to strengthen vs. the U.S dollar. (charts predicting a republican victory) Target for $CAD .75

XRP | USD Following the hard re-test back into the triangle I'm expecting a reversal and exit of the range as an upside breakout. Target .55c

What we know: - FOMC meeting will be volatile paired with earnings releases this week. - Markets fully expecting 75bps. - If FOMC tone is neutral and rates do not exceed 75bps, expecting a bullish market sentiment and continuation up to 23.5k after a re-test of wedge breakout. - If FOMC flips hawkish, a breakdown into the wedge could serve at the last bullet to...

- Expecting a volatile week in the markets due to FOMC - Hedging that markets react bullish on the expected .75 bps hike. - Early week sell-off may cause a sharp drop on XRP to .39-.40 before a bullish reversal.

What we know: - The DXY is in a corrective structure from the highs in September. - The 1974 High's were tested as Support with a weak bounce. - Next Support would be the multi-decade median ~108.00 *The DXY may continue it's strength to 117-120 with any unexpected rate hikes or political catalyst. *Otherwise, should hikes be .75bps expecting markets to react...

Possible IH&S Forming. All eyes on 11.2 FOMC for volatility, but expecting a bullish follow-through on most currencies as Q4 unravels.

It's possible that TOTAL2 touches the weekly 400MA, however indicators are oversold and likely a deviation for liquidity is a higher probability.

Indicators showing strength of the range bottom, potential setup for a whipsaw beneath the range (likely due to fundamental news driven event) otherwise my bias is a bullish return to the median of the range.

Short Term deviation back to the mean expected ~ 11.02 FOMC meeting. Target .75

Textbook Bullflag, front running retail while fear is high at these lows. Confirmed by horizontal trading range, indicators on HTF bullish.

On a HTF (WK or MO) it's evident that XRP is entering into a mega WAVE 3 since inception. Assuming the rise in 2018 was a primary W1 followed by a multi year accumulation zone we can assume that the 2020 lows formed the end of the correction and that the impulse out of 08/2020 began the new trend. The confusing part for me is which wave did we complete, did we...

![$XRP | USD [LONG] XRPUSDT: $XRP | USD [LONG]](https://s3.tradingview.com/u/Uhj3KuWM_mid.png)