Gamblers-Fallacy

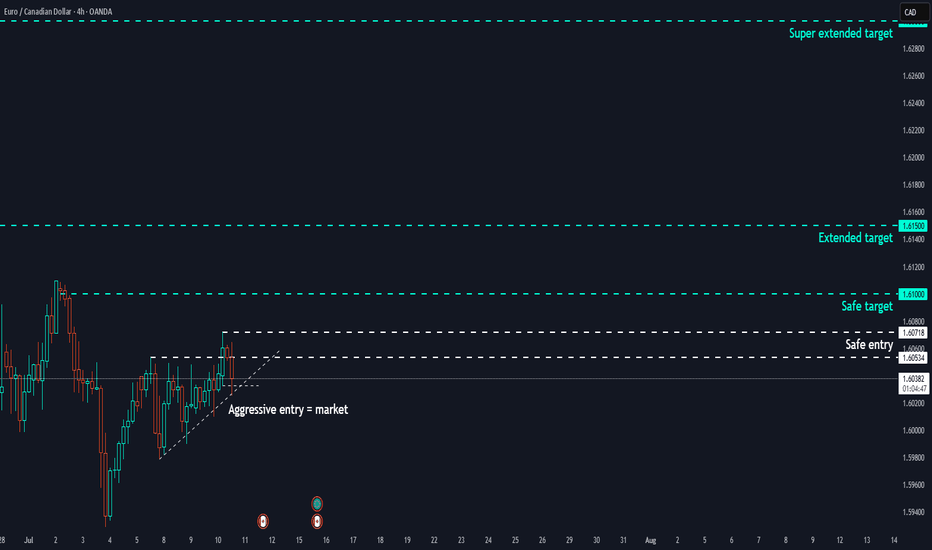

PremiumThe main reasons this seems like a very good opportunity to me are : Trend : EURCAD is in a strong uptrend at the moment Retail : Majority have a BEARISH sentiment on this pair Institutions : More holdings in EUR than CAD Structures : Equal highs up above that MAY act as a magnet Price action : Recent breakout of a consolidation and resistance shelf Targets :...

The main reasons this seems like a very good opportunity to me are : Trend : EURCAD is in a strong uptrend at the moment Retail : Majority have a BEARISH sentiment on this pair Institutions : More holdings in EUR than CAD Structures : Equal highs up above that MAY act as a magnet Price action : Recent breakout of a consolidation and resistance shelf Targets :...

For AUD/CAD at 0.8811 here, I’d estimate roughly: Rally above 0.9130 first ~35% Drop below 0.8492 first ~65% Why the skew toward the downside? Recent rejection at 0.9130 – price failed there in late Feb/Mar and again in June, showing that ceiling still holds. Lower‐high bias – since topping at 0.9130, each bounce has come in lower (now around 0.887 → 0.899 →...

For USD/JPY at 144.11, weighing the daily range (139.58–148.65) and recent price action, I’d estimate roughly: Slide below 139.58 first ~60% Rally above 148.65 first ~40% Reasoning Range position: We’re in the upper half of a well-defined 139.58–148.65 band—mean regression favors a move back toward the lower boundary. Failed rallies: Price has tried three...

For NZD/USD at 0.6017 here, I’d put the odds roughly at: Rally above 0.6379 first ~60% Drop below 0.5656 first ~40% Why the slight tilt to the upside? Higher‐low pattern: Since last autumn’s peak near 0.638, the lows have stepped up (≈0.550 → 0.565 → 0.582 → now 0.601), showing buyers pulling in earlier on each pullback. Mid‐range flip: The 0.5656 zone held as...

On the NQ around 21,638, I’d estimate roughly: Rally up through 22,248 first ~60% Slide down through 21,024 first ~40% Why? Up-trend bias: Since the April low (≈16,000), the market has been in a strong rally, clearing multiple interim highs. Resistance vs. support: 22,248 has capped rallies twice (Jan & Feb), so a break would be bullish but not guaranteed....

For AUD/USD here (0.6487) I’d peg the odds roughly at: Rally above 0.6943 first ~60% Drop below 0.6031 first ~40% Why a tilt to the upside? Higher-low structure: Since last year’s low near 0.594, price has formed progressively higher retracements (0.620 → 0.635 → 0.648). Momentum: Daily candles have been predominantly bullish with shallow pullbacks, and...

On AUD/JPY from here (93.50), the odds favor a slide back toward 86.05 over a rally to 100.94: Down‐trend bias After topping near 108 last summer, price has carved a lower high (~96) and is struggling under 94–95. Range dynamics You’re in the bottom half of the 86.05–100.94 band; mean‐reversions tend to gravitate back toward the “midpoint” or beyond, and this...

Higher‐lows structure Since March, EUR/JPY has carved a series of higher lows (~156 → 160 → 162 → 164), signaling buyers stepping in sooner each pullback. Recent breakout The pair just cleared the prior swing high around 166.0 with follow-through buying—classic mid-range bullish bias. Momentum & RSI Daily RSI is trending upward without overbought exhaustion yet,...

Here’s how I see GBP/JPY in this well-defined range: Key levels Resistance: 199.81 (multiple rejections since late 2023) Support: 191.43 (holds going back to mid-2024) Range dynamics Price has spent the last 18 months oscillating between these two lines—no sustained trend outside the band. We’re currently stuck just below the midpoint (~195.6) with failure...

For this long off 1.1193 targeting 1.1909 vs. a retrace back under 1.1193, I’d peg the probabilities roughly as: Outcome Probability Rally above 1.1909 first ~75% Drop below 1.1193 first ~25% Rationale Bullish breakout: EUR/USD has convincingly flipped 1.115–1.120 into support and cleared the 1.15–1.16 ceiling with follow‐through. Momentum: Daily candles show...

Given the daily down-trend and your clear break below the 1.3729 pivot, the path of least resistance is down toward 1.3420 rather than back up to 1.3729: Trend USD/CAD has been in a multi-month down-trend from the 1.4800 highs, carving lower highs and lower lows. Broken support → resistance That 1.3729 level failed as support in late May and should now act as...

Higher timeframe trend = down Retail traders = long JPY = Strong, AUD = Weak Therefore bias = down NOTE : Not in yet - Entry order set below the structure that is forming currently. A decent level of structure was broken to the left (marked with red horizontal ray) so I believe more downside is incoming (potentially all the way to the white horizontal ray which...

Higher timeframe trend = down Retail traders = long Therefore bias = down NOTE : Not in yet - Entry order set below the structure that is forming currently. We are at a resistance turned support zone (marked with white rectangle) and have seen a reaction which may entice buyers to get involved - at which point we can get involved if their stops get taken...

Higher Timeframe trend = Sell Retail trader bias = Buy Institutional bias = Sell Short term target = retail trader stoploss zone I would like to clarify that I dont trade with extended targets like the secondary and tertiary ones marked. This might be handy for people who leave runners on their trades. Also keep in mind that I am only providing my own...

Higher Timeframe trend = Buy Retail trader bias = Sell Institutional bias = Buy Short term target = retail trader stoploss zone I would like to clarify that I dont trade with extended targets like the secondary and tertiary ones marked. This might be handy for people who leave runners on their trades. Also keep in mind that I am only providing my own SUBJECTIVE...

Higher Timeframe trend = Sell Retail trader bias = Buy Institutional bias = Sell Short term target = retail trader stoploss zone I would like to clarify that I dont trade with extended targets like the secondary and tertiary ones marked. This might be handy for people who leave runners on their trades. Also keep in mind that I am only providing my own...

Higher Timeframe trend = Buy Retail trader bias = Sell Institutional bias = Buy Short term target = retail trader stoploss zone I would like to clarify that I dont trade with extended targets like the secondary and tertiary ones marked. This might be handy for people who leave runners on their trades. Also keep in mind that I am only providing my own SUBJECTIVE...