Genesiv

Looking at the H4 chart, Price has reversed from the resistance level at 0.9161 along with the 23.6% Fibo, if price were to reverse from here, it could drop to our take profit at 0.9063 which is a recent swing low Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is"...

Looking at the H4 chart, Price has reversed from the resistance level of 135.186 along with a 50% Fibonacci retracement. A reverse from here, the price could drop to 132.67 which is overlap support. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as...

Looking at the H4 chart, there is overlap resistance which lines up with the 38.2% Fibonacci retracement. our sell entry will at 1862, stop loss will be at 1890 and take profit will be 1807 Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market...

Looking at the H4 chart, we are waiting to sell at 100.70 which is an overlap resistance, take profit will be at 97.76 which is an overlap support and stop loss will be at 101.95 Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary,...

Looking at the H4 chart, we are seeing price is pushing up to our sell entry at 14546 which is resistance level where price had multiple rejections in the past. Our stop loss will be at 146.72 and take profit level is 143.66 which lines up with the 50% Fibonacci retracement Any opinions, news, research, analyses, prices, other information, or links to...

Looking at the H4 chart, Price is approaching to our buy entry at 0.8836 which is an overlap support. Stop loss will at 0.8766 and take profit will be at 0.8924 which is next resistance level. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general...

Looking at the H4 chart, we are looking for buy entry at 0.6549 which is an overlap support, take profit will be at 0.6644 and stop loss will be at 0.6487 Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute...

Price is testing our resistance which we are looking for a sell entry at 1.3851, if price were to reverse from this level, we could see price drop to 1.3698 which is overlap support and stop loss will be at 1.3898 Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is"...

Title: Soybean Futures ( ZS1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 1535.00 Pivot: 1514.00 Support: 1490.75 Preferred case: Looking at the H4 chart, my overall bias for ZS1! is bearish due to the current price being under the Ichimoku cloud, indicating a bearish market. If this bearish momentum continues, expect price to possibly drop...

Title: Copper Futures ( HG1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 4.1130 Pivot: 4.0145 Support: 3.8945 Preferred case: Looking at the H4 chart, my overall bias for HG1! is bearish due to the current price being below the Ichimoku cloud , indicating a bearish market. Expecting price to drop from the pivot at 4.0145 where the overlap...

Title: NATURAL GAS Futures (NG1!), H4 Potential for Bullish Rise Type: Bullish Rise Resistance: 3.520 Pivot: 2.623 Support: 1.968 Preferred Case: Looking at the H4 chart, my overall bias for NG1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. To add confluence to this bias, price has also broken above the...

Title: Cocoa Futures ( CC1! ), H4 Potential for Bullish Continuation Type: Bullish Continuation Resistance: 2838 Pivot: 2660 Support: 2565 Preferred case: Looking at the H4 chart, my overall bias for CC1! is bullish due to the current price above the Ichimoku cloud, indicating a bullish market structure. If this bullish momentum continues, expect price to retest...

Title: Gold Futures ( GC1! ), H4 Potential for Bearish Continuation Type: Bearish Continuation Resistance: 1854.9 Pivot: 1827.7 Support: 1791.8 Preferred Case: Looking at the H4 chart, my overall bias for GC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. To add confluence to this bias, price is also along a...

Title: BTCUSD Futures ( BTCUSD ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 25270.00 Pivot: 23815.00 Support: 21376.00 Preferred case: Looking at the H4 chart, my overall bias for BTCUSD is bearish due to the current price crossing below the Ichimoku cloud, indicating a possible shift to bearish market structure. If this bearish momentum...

Title: Coffee C Futures ( KC1! ), H4 Potential for Bullish Continuation Type: Bullish Continuation Resistance: 214.05 Pivot: 182.95 Support: 172.60 Preferred case: Looking at the H4 chart, my overall bias for KC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. To add confluence to this bias, price is also along an...

Title: LINKUSD Futures ( LINKUSDH ), H4 Potential for Bullish Rise Type: Bullish Rise Resistance: 9.559 Pivot: 8.061 Support: 7.570 Preferred case: Looking at the H4 chart, my overall bias for LINKUSD is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Expecting price to rise from the pivot at 8.061, and head towards...

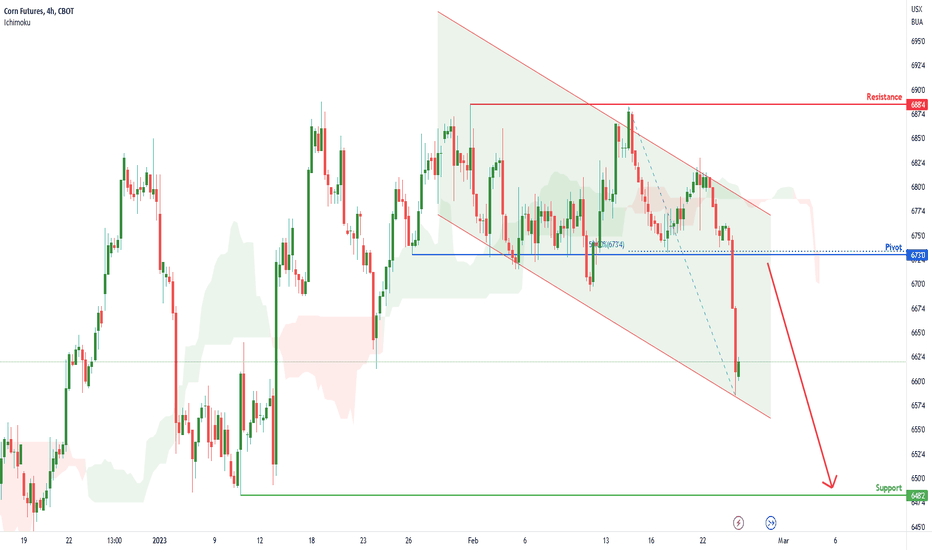

Title: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop Type: Bearish Drop Resistance: 688.50 Pivot: 673.00 Support: 648.25 Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. To add confluence to this bias, price is also within a descending...

Title: Gold Futures ( GC1! ), H4 Potential for Bearish Continuation Type: Bearish Continuation Resistance: 1854.9 Pivot: 1827.7 Support: 1787.2 Preferred Case: Looking at the H4 chart, my overall bias for GC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. Expecting price to possibly drop from the pivot at...