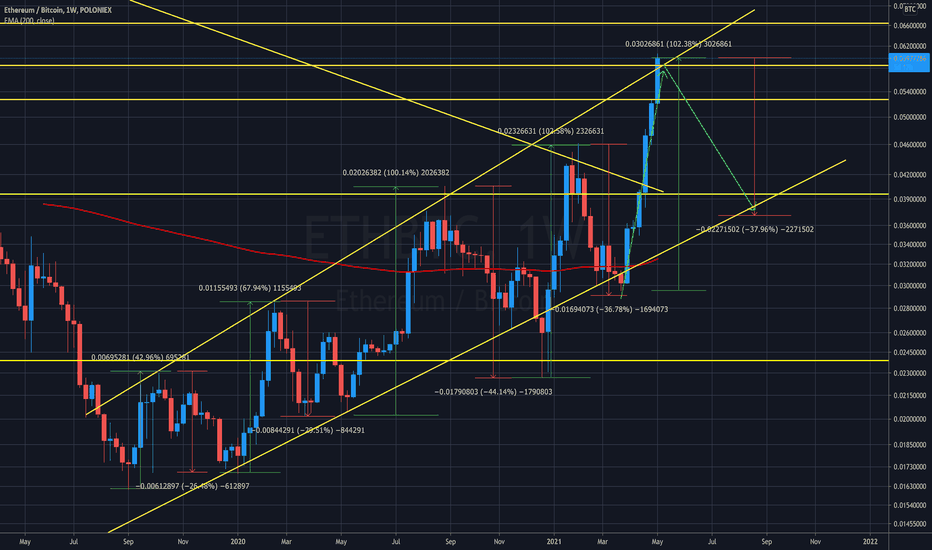

I don't know exactly what the fundamental rationale will be, but if we break to the upside there will be a huge spike in the ETH/BTC ratio. Perhaps we will see BTC rise sharply first, and then ETH catch up. I would expect something like ~30,000 USD/ETH and ~200,000 USD/BTC. Uncropped chart:

I would expect a cool down in the ETHBTC ratio, back to the lower bound of the chanel. But because I don't know 100% what will haben, I am positioned 50:50 ETH/BTC.

NIMIQ needed some time to shake out every weak hand. After the price explosion in May, it corrected very deep and bottomed before the latest break out. The pattern of the last days is very clear and we have seen this pattern in NIMIQ always before it pumped. We could see another very strong really.

I have been following this project for some time now and I think Nimiq has a lot of upside potential. Nimiq is a usability focused crypto-currency.

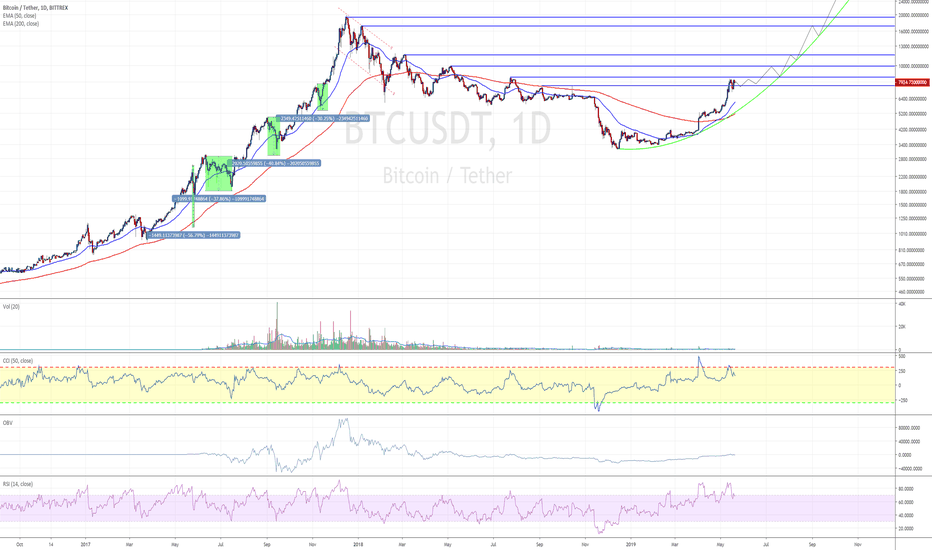

The structure is very clear, in my opinion. We won't see new lows and the corrections will be of a very short nature. This triggers new FOMO waves until the bulls of the last bubble jump up again.

The ugly correction should be over soon.

This support line should hold, otherwise we will see another hard drop.

9900 USD could be the next target, if we don't see a larger degree correction.

This could be a possible turning point. We have a strong support line from 2013 and the down trend line from 2011 and the 38.2% fib line.

This is one of my first Elliott Wave counts, critique is welcome.

I am new to Elliott Wave theory and this is my first count. If you have any critique, please don't hold it back.

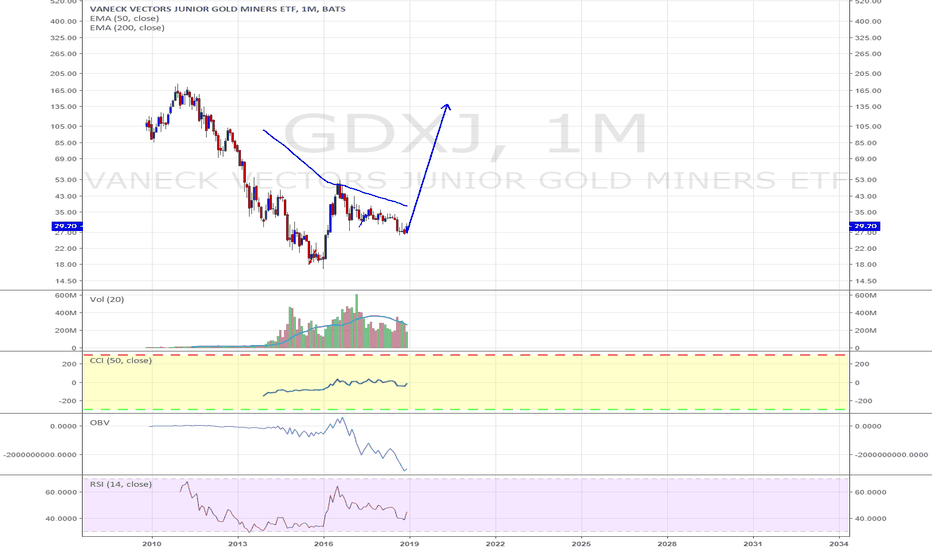

I'm not an expert, but this is the first time since 2013, that the XAU/SPX ratio exceeds the 200 day moving average line.