GoldFxMinds

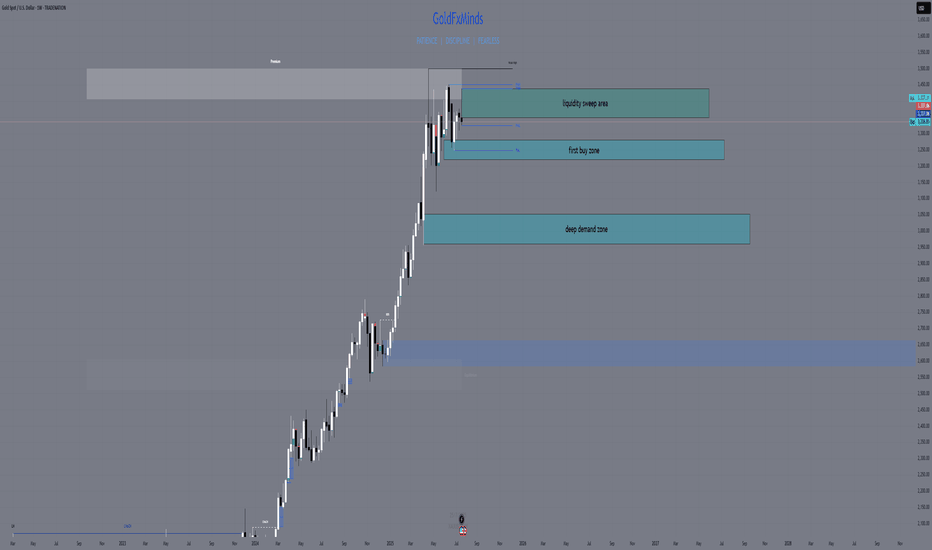

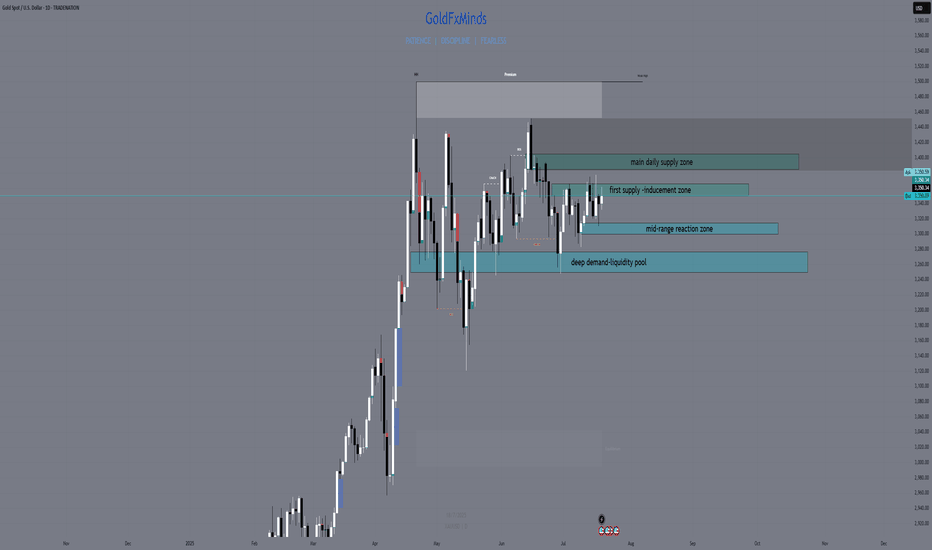

Premium🧠 Macro & Context Gold is surging back toward premium structure after sweeping 3287. With no major news today, flow is dictated by structure, liquidity, and the residual strength from July’s closing push. Bulls have reclaimed internal control, but are now pressing into major resistance zones. This is the perfect battleground for sniper entries. 🔥 Bias: Bullish...

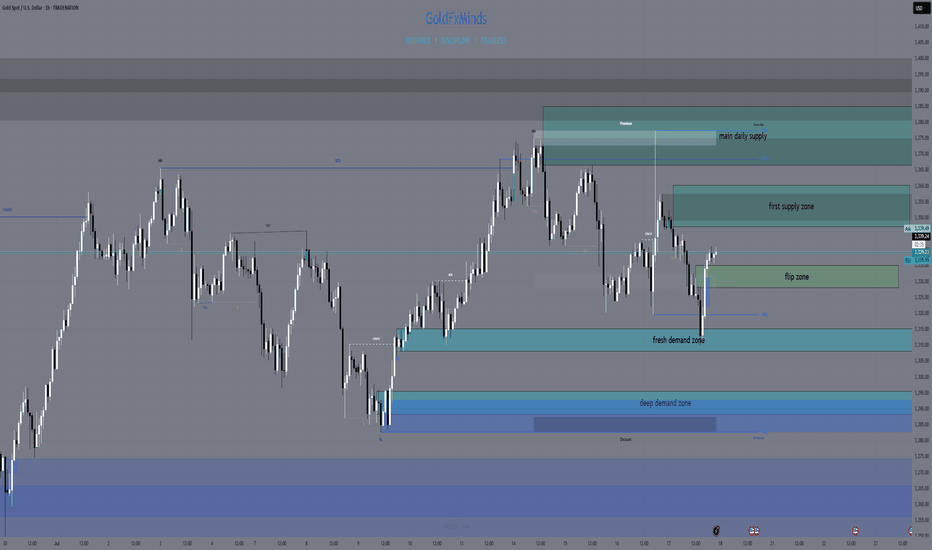

Structure is bullish — but supply is layered. Precision now matters more than bias. — Gold is trading at 3362, sitting right inside the heart of a key structural zone. After a strong breakout from 3285–3260, price reclaimed imbalance, broke internal structure, and powered higher into premium. The trend is bullish — but we’ve just stepped into stacked...

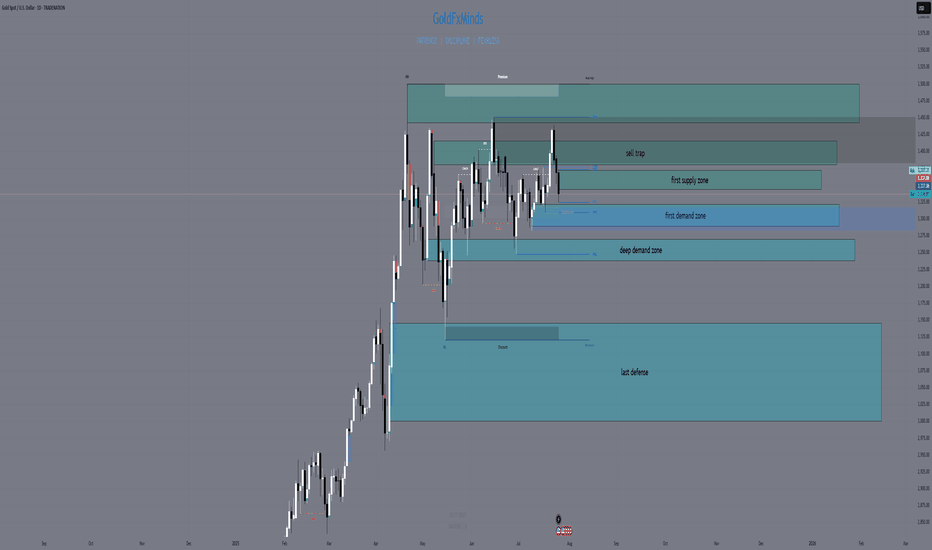

We’re not in breakout. We’re deep in premium — and supply is stacked. — Gold is now trading at 3362, sitting right inside the first valid daily supply zone — the same block between 3355 and 3375 that caused the last rejection. The bullish rally from 3272 was clean: liquidity sweep, CHoCH, imbalance filled, HL confirmed. Bulls did their job. Now they’re walking...

The question isn’t whether gold is strong. The question is — will price expand, or rebalance? 🔸 Macro Overview Gold begins the week consolidating just below its final HTF supply zone (3439), while USD weakens amid mixed macro data and growing speculation of future rate cuts. Markets await fresh catalysts, and gold’s recent impulsive rally is now facing the big...

Welcome to August — and welcome to the top of the macro ladder. Gold is not just rising. It’s rewriting structure. 🔸 Macro & Fundamentals Gold opens August with a fresh impulsive breakout above $3360, fuelled by a weaker USD, rising global risk sentiment, and continued speculative positioning from institutional buyers. The upcoming Jackson Hole meeting and...

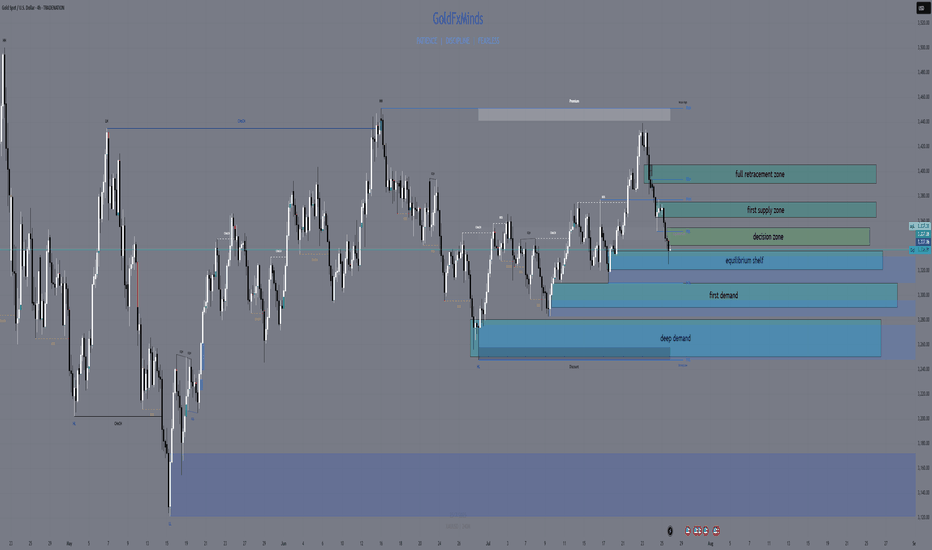

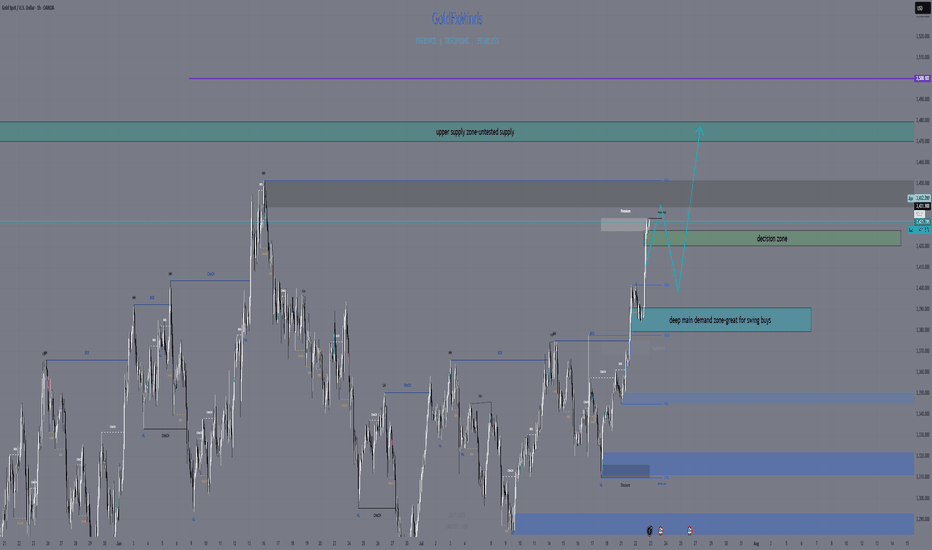

“From deep demand to key supply. The next move is decisive.” 🔸 Sunday Plan Recap Price was falling aggressively into the HTF demand zone (3265–3240). The plan anticipated a bounce only if that deep zone held. Above price, major zones included: 3314 – mid-structure 3330–3345 – supply zone 3368–3380 – final retracement targets 🔸 What Changed? ✅ The deep...

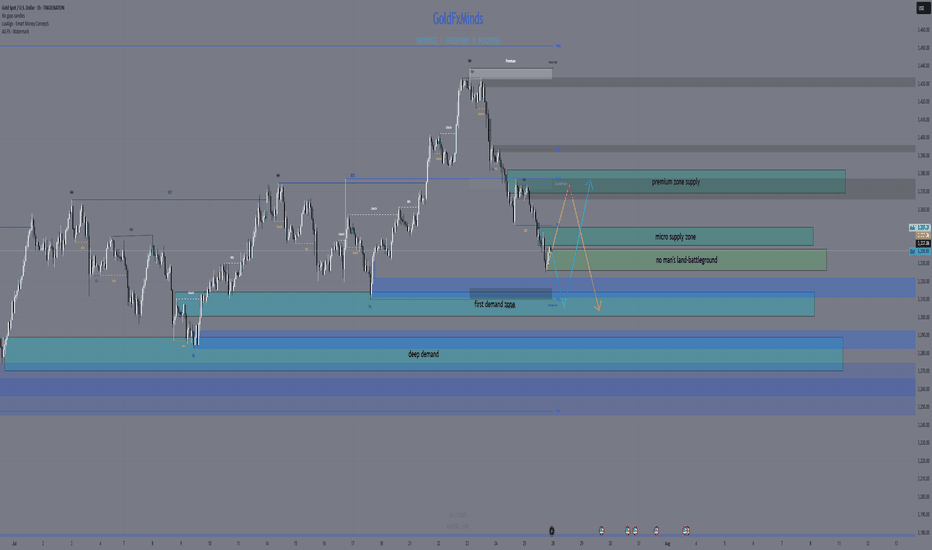

🔸Macro Context Markets are still digesting Powell’s ongoing speech with no clear pivot signals. While FOMC tone remained cautious, no dovish surprise emerged. Trump’s upcoming comments keep geopolitical risks elevated. USD remains firm. Gold is reacting within key HTF demand as intraday volatility cools off. 🔸Bias Overview Weekly Bias: • Bearish rejection from...

🔥 Macro & Sentiment The dollar remains dominant — DXY holding above 105 keeps gold under pressure. No fundamental support for bullish continuation unless major macro shifts. Risk flows are defensive, not aggressive. FOMC and US GDP data remain key drivers for direction this week. BIAS: • Short-term bearish under 3350 • Market still in distribution mode — every...

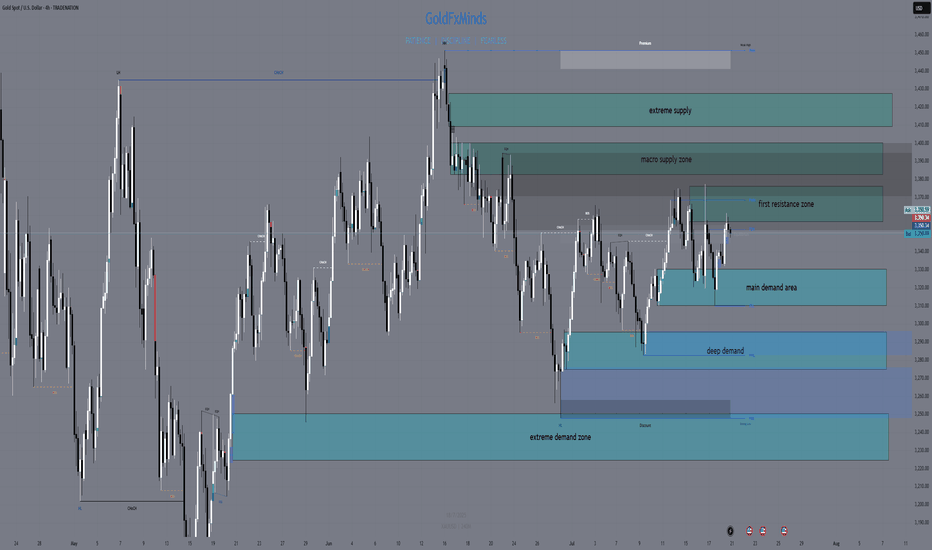

Hello, gold traders! FOMC week is here, the dollar’s flexing, and gold is stuck under a fortress of supply. No fantasy, no overlaps, just your real, actionable H4 map—zones spaced, logic tight, and all fluff deleted. ⬜Bias: Neutral to bearish while price is capped under 3,355 and the EMA cluster. Only flip bullish if price closes and holds above 3,375 with strong...

Hey Gold Hunters! 🌟 Today feels like the calm before a storm—ADP whispers tomorrow, the Fed speaks Wednesday, and gold is inching toward its next big move. Let’s weave the macro pulse into our Smart‑Money map, highlight the five real zones, then plot our sniper‑perfect entries. No fluff—just the human beat of the market. 1️⃣ Macro Pulse & Market Mood US Dollar:...

Hello traders! 🌟 We’re stepping into a pivotal week for gold (XAUUSD), and the weekly chart tells a story of tension, liquidity hunts, and potential big moves. Let’s dive into the three truly critical zones, backed by SMC/ICT logic, Fibonacci, EMAs, RSI, and fair‑value gaps — all in one elegant map. 🎨✨ 🔹 HTF Overview & Macro Pulse Current Price: 3336 Weekly...

Good evening, traders—let’s get this right, no mistakes. Gold hit 3,438, then pulled back and found support exactly in the 3,380–3,390 zone. Here’s your precise update: 🔸 HTF OVERVIEW (H4 → H1) New High & Liquidity Sweep: A clean breakout to 3,438 invalidated every old supply. Primary Demand: Price settled into the 3,380–3,390 H4 order block (untested FVG...

Hey gold lovers! As the NY session wraps up, the chart is a painting of tension: gold boxed tight between major structure — and the real action is only about to start. Bias: At this stage, gold remains in a short-term bullish structure as long as price holds above the 3421–3428 decision area. A break and hold below this zone would shift the bias to neutral or...

Hey, GoldMinds! 🔥 This isn’t just another range day — it’s the type of market that separates disciplined snipers from impulsive chasers. If you want an edge, you need a plan that’s both sharper and more refined than what most see on their charts. After a week full of fake breakouts, confusing swings, and whipsaw price action, gold is giving us the gift of clarity...

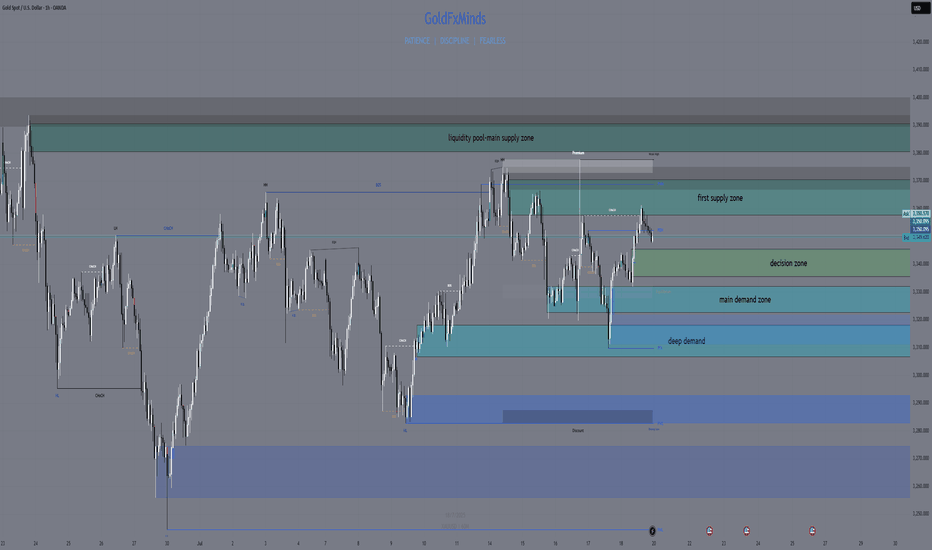

Hello, GoldMinds! 💙 After a volatile week, gold remains caught in a wide H4 range, ping-ponging between structural supply and demand. Let’s break down the current picture so you can navigate the next big moves with confidence. 🌍 Macro & Bias Macro context: Last week’s US CPI print triggered a temporary rally, but gold failed to hold above resistance and quickly...

Hey traders 💙 Gold continues to move inside a high timeframe range, with both bulls and bears defending structure at the edges. Price remains stuck between supply and demand — and only the strongest levels matter now. Here’s how the chart truly looks: 🔸 Key Supply Zones 1. 3380–3405: Main Daily Supply / Liquidity Pool Above This is the top wall of the current...

GoldFxMinds | Structure-Based HTF Plan Hello traders, This week we’re back in key HTF territory. Price is compressing inside a premium structure zone, between clean supply and demand areas. Trend is still bullish, but momentum is weakening — so we focus on structure to guide us. 🟨 Weekly Bias: Neutral | Range Structure in Play We currently have no confirmed...

Hello traders! After yesterday’s high-volatility trap and NY session recovery, we now stand at a major structural junction. Buyers reclaimed 3310–3314 with precision, but price is pressing into multi-timeframe supply. Let’s break it down clearly 🔸 HTF Bias Daily Bias: Bullish correction inside a larger range. Demand at 3310–3305 was swept and respected, but...