Gold_Entry_Point

PremiumCore Logic Bullish Factors Strong safe-haven demand: Global trade tensions (Trump tariffs, Indian/Brazilian retaliation) and geopolitical uncertainty (expected US-Russia meeting) support gold prices. Expectations of a Fed rate cut: Weak US employment data (worst-than-expected initial jobless claims) strengthens the possibility of a September rate cut, and the...

Latest Gold Market Trend Analysis and Trading Strategies (August 12, 2025) News Analysis Geopolitical Risks Ease US President Trump will meet with Russian President Vladimir Putin on August 15 to discuss possible solutions to the Russia-Ukraine conflict. Market expectations for a thaw in geopolitical tensions have increased, weakening gold's safe-haven...

Core Logic Bullish Factors Strong safe-haven demand: Global trade tensions (Trump tariffs, Indian/Brazilian retaliation) and geopolitical uncertainty (expected US-Russia meeting) support gold prices. Expectations of a Fed rate cut: Weak US employment data (worst-than-expected initial jobless claims) strengthens the possibility of a September rate cut, and the...

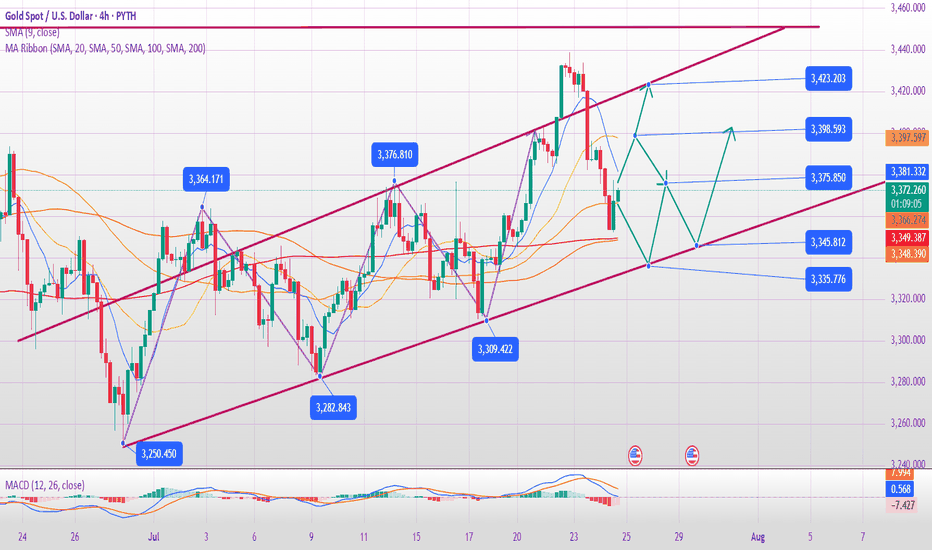

I. Daily Analysis Overall Trend: Gold remains at the end of a converging triangle, with upper resistance at 3406 and lower support at 3360, awaiting guidance on the direction of a breakout. Key Moving Average: The 5-day moving average at 3372 remains a short-term bullish-bearish watershed. If it holds above this level, the market will likely remain volatile and...

📌 Core Logic: High-level fluctuations, be wary of a pullback risk News support for gold prices Expectations of a Fed rate cut: Weak US economic data (employment, services) reinforce expectations of a rate cut, putting pressure on the US dollar (around 98.7), benefiting gold. Safe-haven demand: Trump’s policy uncertainty (tariffs, personnel changes) has increased...

I. Gold Fundamentals Analysis Expectations of a Fed Rate Cut Strengthen: Weak US economic data (such as employment and manufacturing) has heightened market expectations of a September Fed rate cut, putting pressure on the US dollar and benefiting gold. Changes in Federal Reserve officials and policy uncertainty have exacerbated market volatility and increased...

1. Key News Drivers ✅ Expectations of a Fed Rate Cut Strengthen (Core Logic) Weak non-farm payroll data (the probability of a September rate cut soars to 90%) leads the market to anticipate two rate cuts this year, with the first likely in September. The US dollar weakens: expectations of interest rate cuts suppress the US dollar, and the attractiveness of gold...

I. Gold's Current Core Contradiction Bull Support Factors Weak non-farm payroll data reinforces expectations of a Fed rate cut, with the market betting on an over 80% probability of a September rate cut. Risk Aversion: Although the tariff extension has not yet been finalized, the market remains concerned about escalating trade frictions, and gold is in high...

I. Gold's Current Core Contradiction Bull Support Factors Weak non-farm payroll data reinforces expectations of a Fed rate cut, with the market betting on an over 80% probability of a September rate cut. Risk Aversion: Although the tariff extension has not yet been finalized, the market remains concerned about escalating trade frictions, and gold is in high...

Core Logic Analysis Negative factors dominate The Federal Reserve's hawkish stance: keeping interest rates unchanged and Powell suppressing expectations of a rate cut have weakened gold's safe-haven appeal. Strong economic data: ADP employment data exceeded expectations, and coupled with the upcoming PCE and non-farm payroll data, market expectations of an early...

1. Key News Drivers Federal Reserve Policy Expectations: The market generally expects the Fed to maintain a hawkish stance. If economic data (such as ADP, GDP, and PCE) show strong performance, the expected rate cut may be further postponed, which is bearish for gold. Geopolitics and Risk Aversion: Uncertainty in the US-China trade negotiations and the situation...

Key Influencing Factors Negative Factors: A stronger US dollar: A rebound in the US dollar index is suppressing gold prices. Recovering risk appetite: Market demand for safe-haven assets is weakening. Rising real interest rates: Expectations of Fed policy are impacting the cost of holding gold. US-EU trade agreement: Easing geopolitical tensions will weaken...

Comprehensive analysis of the gold market and trading strategy recommendations News analysis Short-term support factors Weakened US dollar: The market is in a wait-and-see mood before the Fed's interest rate meeting, and the US dollar bulls are temporarily suspended, providing support for interest-free assets such as gold. Safe-haven demand: Policy uncertainty...

Core influencing factors Risk aversion cools down: Despite frequent geopolitical risk events, market panic has not significantly increased, weakening gold safe-haven buying. US dollar strengthens: US economic data supports the continuous rise of the US dollar, and funds flow back to US dollar assets, suppressing the attractiveness of gold. ETF holdings outflow:...

Core influencing factors Risk aversion cools down: Despite frequent geopolitical risk events, market panic has not significantly increased, weakening gold safe-haven buying. US dollar strengthens: US economic data supports the continuous rise of the US dollar, and funds flow back to US dollar assets, suppressing the attractiveness of gold. ETF holdings outflow:...

1. Brief analysis of gold fundamentals The current gold price is fluctuating downward, and the core driving factors are: Risk aversion has cooled down: The United States and Japan reached an agreement on automobile tariffs and promoted an agreement with the European Union, easing previous global trade tensions; The overall risk appetite of the market has...

The storm after the gold safe-haven carnival, the long and short battles at the 3380 life and death line Fundamentals: The safe-haven feast was suddenly hit by a "black swan", and gold collapsed by $60 from a high! Today (July 23), the gold market suffered a dramatic reversal-spot gold crashed from a high of $3439, plummeting $60 in a single day to $3379,...

1. Gold fundamentals analysis: On Tuesday (July 22), spot gold rose strongly for the second consecutive day, and once again broke through the psychological barrier of $3,400/ounce, attracting market attention. This rise mainly benefited from the continued fermentation of geopolitical tensions in the Middle East, the market's risk aversion sentiment heated up,...