Golden_Legend

Market Review On Thursday (April 24), spot gold suddenly soared after two days of adjustment, reaching a high of $3,367/ounce, and then fell slightly to around $3,320/ounce. Although the overall market risk appetite is stable, the Fed's expectations of rate cuts have increased, the US economic data has weakened, and the US dollar has been under pressure, which has...

Expectations of the Federal Reserve's monetary policy: According to the latest data from CME's "Fed Watch", the market's expectations for the Federal Reserve's monetary policy shift are undergoing subtle changes. The probability of maintaining interest rates unchanged at the May interest rate meeting is as high as 91.7%, while the probability of a cumulative...

📌 Market Review: Strong continuation, bulls dominate Yesterday, gold opened high and moved higher, breaking through the 3400 mark. Although it retreated briefly, it quickly stabilized. The US market rose again, reaching above 3430. The daily line closed with a bald big positive line, showing extremely strong buying momentum. 📊 Technical analysis: The bullish...

Gold market analysis and operation suggestions (April 21) - Risk aversion frenzy boosts gold prices, 3400 mark is within reach 📌 Current market dynamics: Affected by the US tariff policy and the continued rise in geopolitical risk aversion, gold continued its unilateral surge this week. Today, it opened higher again, strongly breaking through the historical high...

This week, the gold market showed a trend of rising and falling. Under the influence of the Federal Reserve's interest rate decision, spot gold hit a record high of $3,357 per ounce and then fell back, eventually closing at $3,327, still recording a 2% increase on a weekly basis. The market was closed on Friday due to Good Friday, and trading was relatively...

On Tuesday (April 15) in the Asian session, spot gold rose slightly and is currently trading around $3,220/ounce, only a small gap from the historical high of $3,245.42 set on Monday, showing an overall steady upward trend. Fundamental analysis: The gold market is currently in a rare state of resonance between technical and fundamental aspects. Trade war risks,...

Last week, the gold market experienced an explosive rise, with a weekly increase of up to $290, reaching a record high of $3,245. This extreme market was mainly driven by three factors: the breakout and downward movement of the US dollar index (a weekly decline of 2.3%), the continued rise in geopolitical risk premiums, and the market's strong expectations for the...

On Friday, gold opened at around 3175, quickly climbed to 3191, then fell back to 3183, and then broke out again, breaking through 3200 and continuing to 3219, and finally maintained in the 3220-3200 range. Near the European session, gold briefly fell back to 3187, but soon stabilized and broke through 3200 again, rising to 3237. After the European session, gold...

After the Trump administration recently imposed a large tariff increase, it exempted 90 countries. The policy intention is to divide other countries and put pressure on negotiations. This move may prompt more countries to negotiate with the United States separately, but the tariff game will continue and the market risk aversion sentiment has not disappeared. At...

The gold market is currently in the mid-term adjustment stage of the bullish trend, and the technical side shows three typical characteristics: first, the price has built a standard shock box in the range of US$2955-3055; second, the daily Bollinger Bands continue to narrow to a bandwidth of US$23, a new low in nearly a month, indicating a significant contraction...

Yesterday, the gold market experienced violent fluctuations again. After hitting a high of 3055 during the session, the gold price quickly pulled back to a low of 2956, showing extremely high volatility. Recently, the fluctuation range of gold has been large, with fluctuations of about $100 for three consecutive trading days. Although this volatility is not...

The gold market has recently shown a clear bearish-dominated pattern, with the weekly closing high and long upper shadow negative line, combined with the gap of $50 opened lower this week, the technical bearish signal is strong. Although there was a violent rebound to 3055 during the Asian session, filling part of the gap, it encountered strong suppression near...

The recent plunge in gold does not mean that it has reached its peak, but is affected by the liquidity crisis caused by the global market crash, rather than the top signal of gold itself. A similar situation occurred last year, so this plunge is not surprising. Whenever gold falls, there are always people who speculate that it has reached its peak, but in fact,...

Market Status Analysis The gold market showed a correction trend this week. The continuous decline of the big negative line made the short-term trend bearish, but from the overall pattern, it is still too early to assert that the trend has reversed. The current market is at a critical technical node, and the long and short sides are fighting fiercely near the...

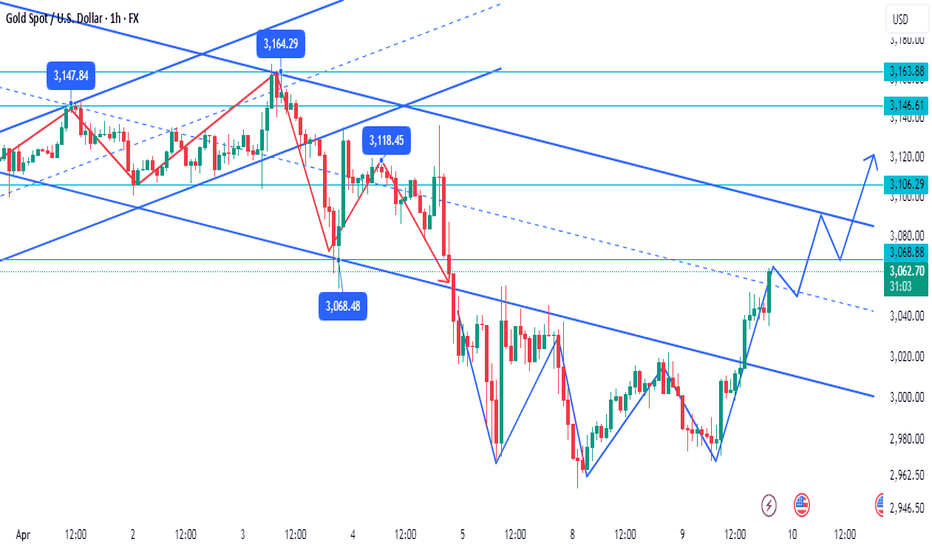

Today, the market focuses on the US non-farm payrolls data for March, including key indicators such as unemployment rate, non-farm payrolls and wage growth. The market generally expects: The unemployment rate remains unchanged at 3.9% The number of farm payrolls may be lower than the previous value of 275,000 The average hourly wage growth rate may slow down From...

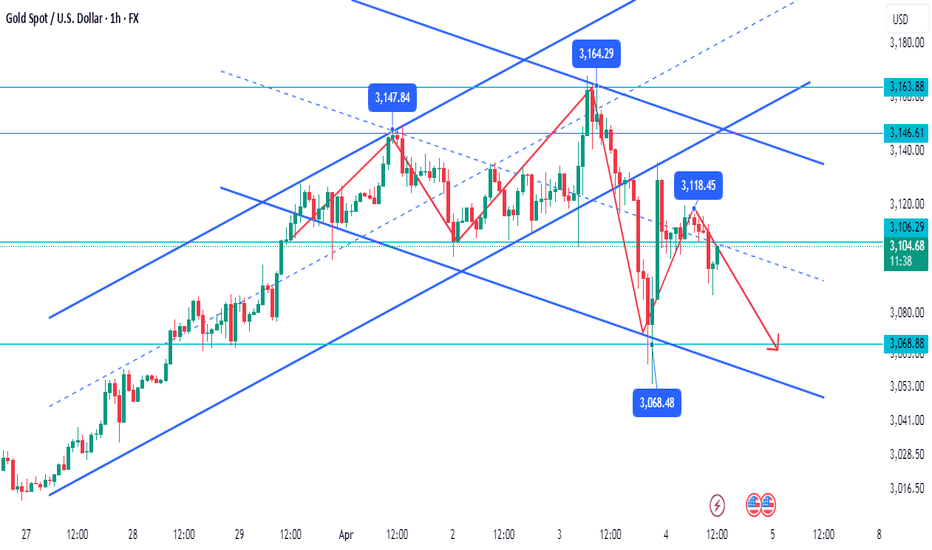

Yesterday, the gold market showed an abnormal trend. The Asian and European sessions broke the routine and showed a clear weak pattern, showing the characteristics of a bear market of "fast decline without rebound". It is particularly noteworthy that despite the positive US manufacturing data released in the evening, gold has abnormally fallen into the dilemma of...

Key technical signals of gold at present: Continuous long positive lines on the hourly line, lower shadow support and long moving average arrangement confirm short-term strength, and the slope accelerates to the target of 3200. The price broke through the previous high of 3127 and closed at 3123.8, showing bullish dominance, but we need to be wary of profit-taking...

The current gold market is in a typical bull carnival market, and prices continue to climb to historical highs. After a small gap-up opening at 3087 in the morning, it quickly rose to the 3097 line, then fell back to repair the gap to around 3076 and rose again. This trend clearly shows that the market is still under the control of strong bulls, but it also...