NOTION Trend: Bullish Rst: 1.00/ 1.06 Spp: 0.96/ 0.93 Broke above resistance at 0.96, momentum shows no sign of slowing down. Widening BB will continue to drive the stock further. Maintain my view, trading opportunity valid, you can consider to grab if there's any chance retrace to 50% of today bull candle - around 0.935

WCEHB Trend: Bearish, technical rebound Rst: 0.40/ 0.435 Spp: 0.36 Technical rebound in play in tandem with recovering RSI & MACD, but must take note long term still in downtrend. Quick trading opportunity valid, see money take money.

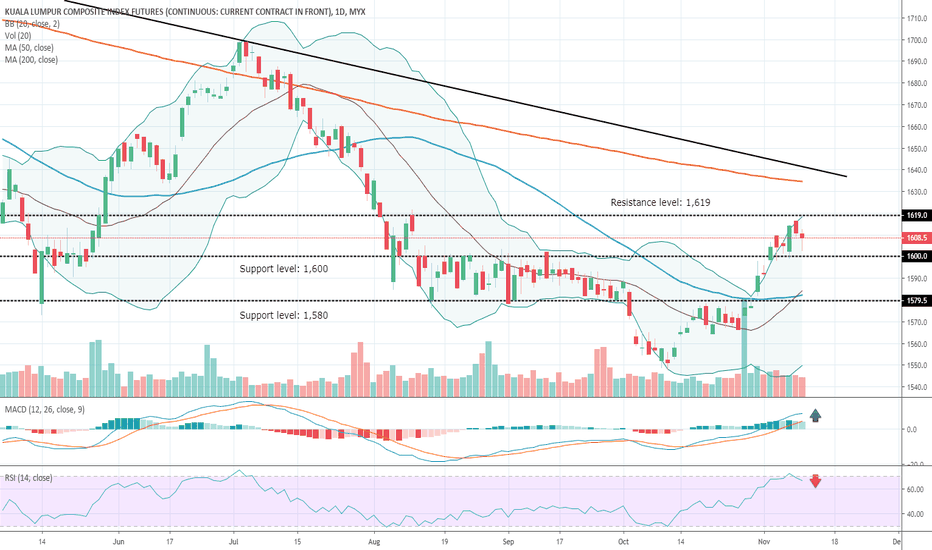

FKLI - Attempt to recover above 1,600 hit challenge, pushing the formation of shooting star/ bearish candle, MACD on the verge casting bearish crossover. Downside risk remains.

FKLI - 4H breaks down from Head & Shoulder formation, has latest candle close below lower BB, and well below crucial support at 1,600. Further downside likely to unfold towards 1,586.

ECONBHD - Attempt to depart from 0.755 hit strong resistance, but luckily indicators still remain strong, Stochastic continue to head north. It must successfully push towards upper BB to allow further upside to kick in.

FKLI - Strong support observable above 1,600 and 4-hours chart has morning doji formation which is bullish. MACD remains bullish. Chance to reach 1,619 intact.

ECONBHD - Bullish breakout & is now slowly confirmed with latest candles continue to stake alongside MA50. Support is good at 0.73, resistance at 0.78 to 0.825

FKLI - Bullish engulfing candle pushed above upper BB, MACD & RSI continue to stay bullish. Upward momentum persists. Resistance at 1,619

Recap our earlier message for those who want to contra, MYEG has hit forecasted resistance at 1.23 today, good to consider exit. Indicators are turning bullish following these few days price recovery, but careful stock in bearish trend will easy to deteriorate recovering indicators.

FKLI - Congrats those longing the index, hit forecasted resistance at 1,600, with widening BB & surging MACD, we expect further bullishness will continue to unleash. Next resistance observable at 1,619

MRCB - Waiting to breakout from channel formation, bullish bar pushed above upper BB with stronger buying interest is positive sign. RSI & MACD head higher. Resistance at 0.78 must be broke to inch higher towards 0.84

MUDAJYA - Bullish breakout from MA200, the magnitude of spike from RSI & MACD suggest further upside is there. Next resistance observable at 0.36/ 0.38/ 0.40 respectively. Support at 0.29

FKLI - 4 hours chart just experienced bullish breakout and MACD bullish crossover and rising RSI. Immediate resistance at 1,580 if break shall lead the index higher towards 1,600

DESTINI - Bearish stock but just staged for bullish breakout from falling trendline. Widening BB and the rising magnitude of RSI & MACD suggest further upside possible. Support good around 0.21 to 0.22, resistance at 0.25

OCR - Tweezer bottom formation with healthy volume, indicators are heading northward, Stochastic bullish crossover. Support good at MA200/ 0.275 Source: t.me

MASTER - Bullish engulfing candle pushing the stock above upper BB, with stronger buying volume. Indicators continue to surge. More upside towards 1.74

FKLI - 4 hours chart has RSI & MACD continue to soften, but the index is trying to forge support new above MA50/ level close to 1,565. If the formation successful, shall lead the index to retest strong resistance level at 1,580

KAREX - Bearish engulfing candle formed upon touching MA50, signalling strong resistance at this level, immediate support at 0.43. The stock is still in big bearish trend, volume is thin, rebounding indicators may have hard time pushing above since trend is bearish. So good to avoid.