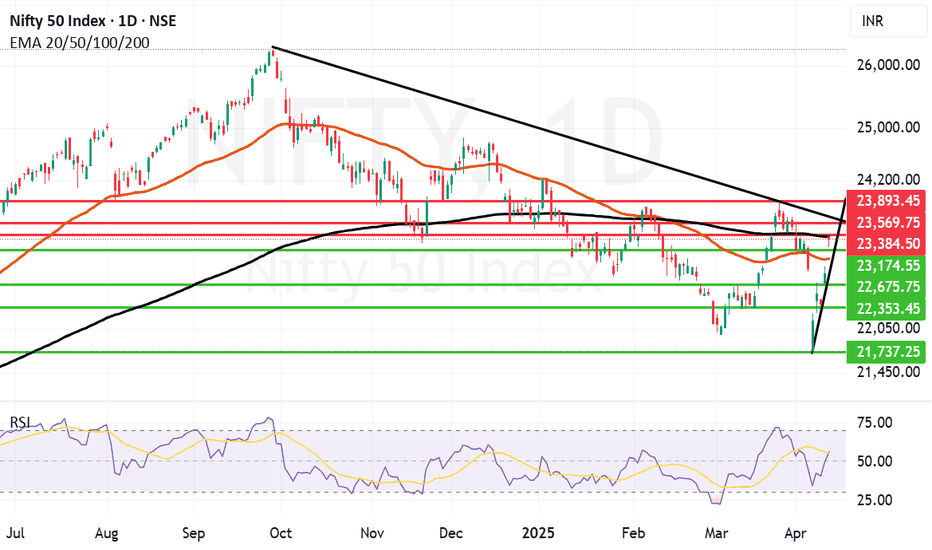

Nifty has cleared the 200 days EMA or the Father line on Daily chart. But in the hourly chart depicted here has hit a resistance zone which happens to be a trend line resistance. RSI of Nifty is currently above 73 and the scope for upside is there but limited. With a shortened week tomorrow we will have a weekly closing. So a positive closing tomorrow can place...

Nifty is rallying for the last few days along with global markets due to relief provided by US President Donald Trump due to Tariff pause but we are approaching a zone where the maniac rise might halt or it might take some time to relax and catch a breath or two. The zone of concern starts from Father line of daily chart which is near 23360. Once we get a...

IDBI Bank Ltd. engages in the provision of commercial banking services to retail and corporate customers. It operates through the following segments: Corporate and Wholesale Banking; Retail Banking; Treasury; and Other Banking and Group Operations. The Corporate and Wholesale Banking segment includes corporate relationship covering deposit and credit activities...

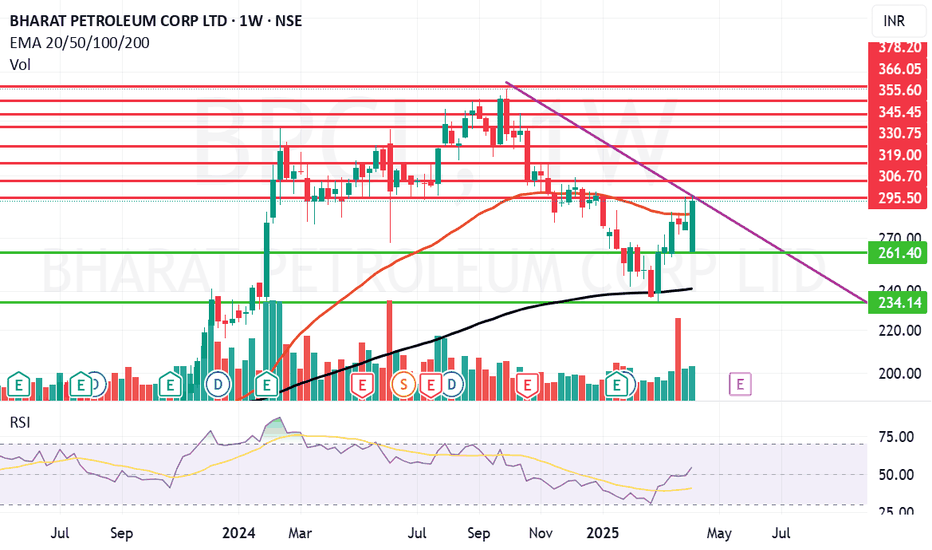

Bharat Petroleum Corp. Ltd. is a holding company, which engages in the business of refining of crude oil and marketing of petroleum products. It operates through the Downstream Petroleum and Exploration & Production (E&P) segment. The Downstream Petroleum segment includes the refining and marketing of petroleum products. The E&P segment focuses on hydrocarbons....

After the drastic Trump Tariff war shock Nifty is trying to recover it's lost territory closing at 22828. Right now the Nifty is trapped between Mother and Father lines of its Hourly chart. The supports for Nifty remain at 22761 (Mother Line Support), 22675, 22353 and 21859. Below 21859 Nifty becomes very week again. The resistance for Nifty on the upper side...

Nifty has given a strong closing amidst global uncertainty. The uncertainty and heavy volatility will remain in the market so traders are requested to be very cautious especially with regards to Futures and Options. Any positive news can trigger a huge upside at the same time any negative news can trigger a huge downside as well. India is silently staying...

Indian markets staged a recovery along with it's global peers. Although the market moved 374 points upwards. After making a high of 22697 the market closed at 22535 which is 162 points down. Which means it has formed a Bullish Doji. Now Doji candle irrespective of the colour means uncertainty, until we clear the Doji top further upside will not be possible. The...

Nifty as expected suffered heavy losses due to Trump Tariff Tornado which has engulfed the global markets. The good thing which is the silver lining in the cloud was that it recovered from the lows of the day by a lot. The lowest point of today or perhaps the year 2025 so far was 21743 and we closed the day at 22161. Which is about 418 points. However we are not...

Trump Tariff announcements has sent the global markets into free fall. The reaction has sent global markets into knee jerk reaction. Global trade will axis will realign because of these actions of US. As per the analysis of many experts the disadvantages to India are limited. There are opportunities galore in sectors like Pharma and Textile etc. The support levels...

After reaching a weekly high of 23869 Nifty decided to fall back in search of its support zone. Currently it is holding above the Father line in the daily chart which is at 23406. Below the Father line there is Mother line waiting to support Nifty at 23114 in case the weakness seen on Friday persists. We will be in trouble again in case we get a daily or weekly...

The index that is trying to break out and one needs to watch the next week seems to be the FMCG Index. The FMCG index is currently facing the Mother line resistance. If the index can overcome the Mother line resistance which is at 53619 there is a chance that this index in the near future can go on to its net resistance levels which are at 54203, 55259 or even...

Nifty has today found a good support just above Mother line of the hourly chart and Mid-channel support zone as it bounced from lows of the day near 23412 to close at 23591. Tomorrow being the weekly closing, monthly closing and financial yearly closing it become very important or one of the most important days for investment enthusiasts. A positive closing...

After a proper breakout and a rally which stretched above 1900 points from the March 4 lows, Nifty was clearly overbought on the hourly chart. It might be coming down for one or more of the following reasons: 1) Retesting support from where it can launch fresh move. 2) Correcting the RSI which had gone into the overbought zone. 3) Pressure due to upcoming...

Nifty has given a good break out above Father line (200 Days EMA) at 23399 and Long term trend line. This shows that Bulls have made a comeback and are out of Coma. However Bears can try to disrupt things later in the week. Important resistance zone of Nifty now is between 23708 and 23830. Crossing and closing above 23830 has potential for the rally to inch...

The index that did very well this week and which has potential to carry forward the momentum into the next week seems to be the CNX Pharma Index. The pharma index looks strongly placed above Mother Line of 50 Weeks EMA line. The resistances it faces or can face if it moves upwards can be near 21667. If this trend line resistance is crossed, there is a...

Nifty made a solid comeback gaining 4.26% this week. One major hurdle remaining which is 23403. If Nifty can close above this level the next resistances will be at 23809, 24030, 24215, 24443, 24667 and 24873 before Nifty can regain 25K levels. The supports for Nifty on the lower side if it is not able to cross the major hurdle at 23403 will be 23109, 22789, 22334...

Nifty saw 3 good days of recovery. Now the real test begins as we are approaching the 3 big daddy resistances. 1) R1 Mother line Resistance (50 days EMA) 22988. 2) R2 Long Term Trend line Resistance 23237. 3) R3 Father Line Resistance 23399. If these 3 are crossed the Nifty has potential to hit 23809 in the medium to short term. If Nifty rally does not have...

Today the Nifty had a good leap after a lot of consolidation. The key question is will the momentum continue or FIIs will again take this opportunity to book profit. Today FII is on the net buying side after a long time. If the buying continues or even if FII remains neutral there is a good chance that we can see upside from here. Key resistances for Nifty...