HispanicHedge

NYSE:XOM currently piques my interest, particularly with oil prices potentially stabilizing or rising further. Recent geopolitical developments and policy shifts under Trump’s administration—such as rolling back Biden-era energy regulations, reducing methane fees, and easing LNG export permits—could significantly influence the energy landscape. My intuition...

Context & Market Overview I'm extremely bullish on JPMorgan Chase ( NYSE:JPM ) right now—lots of bullish catalysts are aligning: - Major deregulation is underway: - Consumer Financial Protection Bureau dismantled ✅ - Trump's regulatory pivot pre-earnings ✅ - FDIC Acting Chair set to push further deregulation ✅ - Potential Powell pivot (interest rates) in...

Continuing from my last update, market volatility remains high due to Trump's unpredictable policy decisions. After initially folding and offering economic relief, Trump pivoted sharply with a sudden 145% tariff announcement. Today, China countered strongly with a 125% tariff. These escalating tariff exchanges continue to create significant uncertainty and market...

This week, we've witnessed a dramatic shift as equities and U.S. government bonds cratered simultaneously. Trump, facing intense market backlash, notably reversed his aggressive tariff stance—forced by China's strategic response and market realities. At the start of the week, the yield on 10-year U.S. Treasuries stood at 4.00%, skyrocketing to 4.51% in just a...

Last Friday, the market pressure was intense, and my bullish call option, targeting $537.64 on SPY, seemed overly ambitious as tariffs and political uncertainties peaked. I stated, " AMEX:SPY Trump went all in thinking he had the cards. We were getting sent back to the McKinley era," wondering when or if Trump would fold under international pressure and market...

Recent price action in TLT has raised questions about whether the recent sell-off reflects foreign selling pressure, potentially driven by liquidity shifts into equities, or simply represents healthy profit-taking. Key economic data from Japan may provide context to this move, as Japan's current account surplus hit a record high at JPY 4,060.7 billion in February...

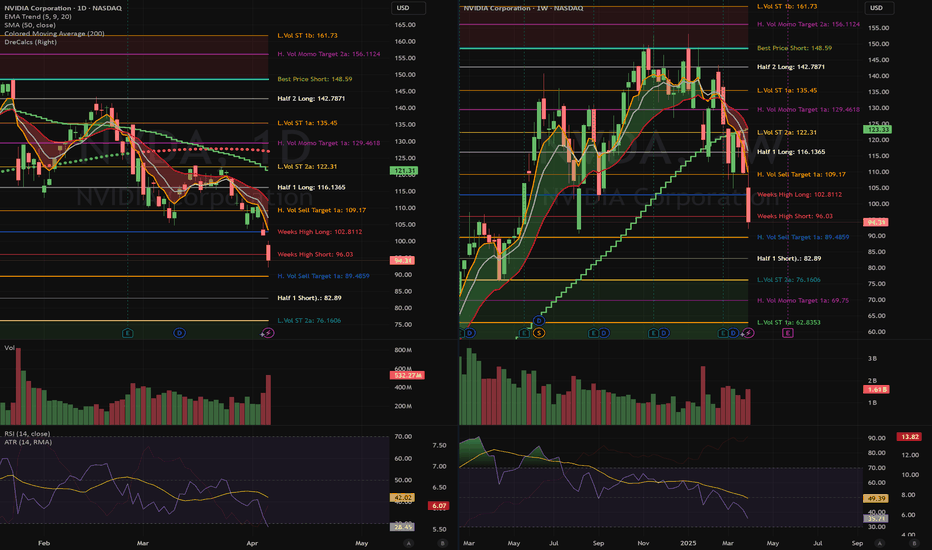

Overview & Market Context NVIDIA just saw a major sell-off, dropping around 7% in a single session and slicing below key support levels. This abrupt move has raised questions: Is NVDA oversold enough for a bounce, or are we at the onset of a broader bearish trend? High trading volume suggests significant institutional distribution, so caution is warranted for...

After a strong downward momentum observed on the daily timeframe, SPY has shown signs of a potential reversal on the lower timeframe (65-minute chart). Here's the breakdown: SPY has seen a significant bearish move recently, breaking through key support levels and establishing a new recent low around the critical Half 2 Short target at $486.41. This sharp...

1. Big-Picture Narrative There’s increasing talk of a “104% China Tariff,” bringing back memories of Donald J. Trump’s 1988 loss in a piano auction to a Japanese buyer—an event some speculate influenced his later calls for high import taxes. Fast-forward to today, and concerns about renewed tariff escalation add extra pressure on the markets. The user’s view:...

Liberation Day has turned into a dramatic "blow the markets back out" day for the SPY , with a significant daily drop of nearly 6%, slicing decisively below the critical 200-day moving average at $574.46. Historically, breaking below the 200-day MA is a strong bearish signal, indicating potential further downside momentum. The previously identified key bearish...

Federal regulators deepen probe into Trump's social media deal - Reuters

Oracle shares rise on better-than-expected earnings report - CNBC My thought process on this idea is the following: 1) 10yr yield @ 3.33 2) Strong dollar 3) Fed potentially raising .75 basis points, according to J.P. Morgan. Risk/Reward and environment is to the downside. If NASDAQ catches a bid and dollar/yields cool off, this may be a nice long. As of right...

$122 can take to 52 highs and above. The 10yr yield spiked to 3.36 and was not able to take this lower. China, limited supply and potential diesel shortages. Not a great setup.

It was a nice run, but the ponzi scheme is over. Back below $20k she goes.

Infamous Jaime Dimon economic hurricane for the real estate market. Inflation, recession, stagflation. You name it, houses are unaffordable for the average American.

Strong dollar is market negative. what are your thoughts?

The trade has become too obvious and needs a pullback. We would need a serious macro event to get us above $129. Consumers need some breathing room.

Fed reserve credibility not looking too good. They have made a serious policy booboo and are now stuck between a rock and a hard place.