House-of-Technicals

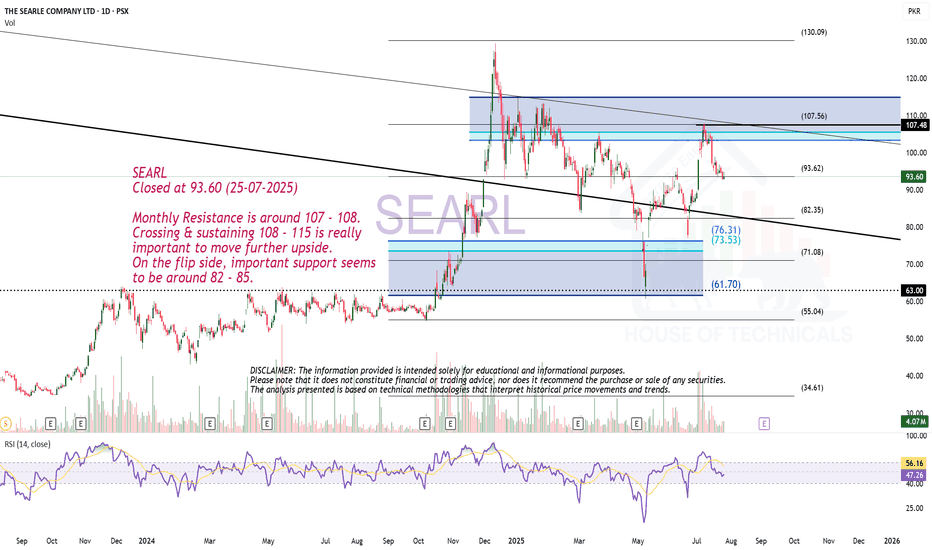

PremiumSEARL Closed at 93.60 (25-07-2025) Monthly Resistance is around 107 - 108. Crossing & sustaining 108 - 115 is really important to move further upside. On the flip side, important support seems to be around 82 - 85.

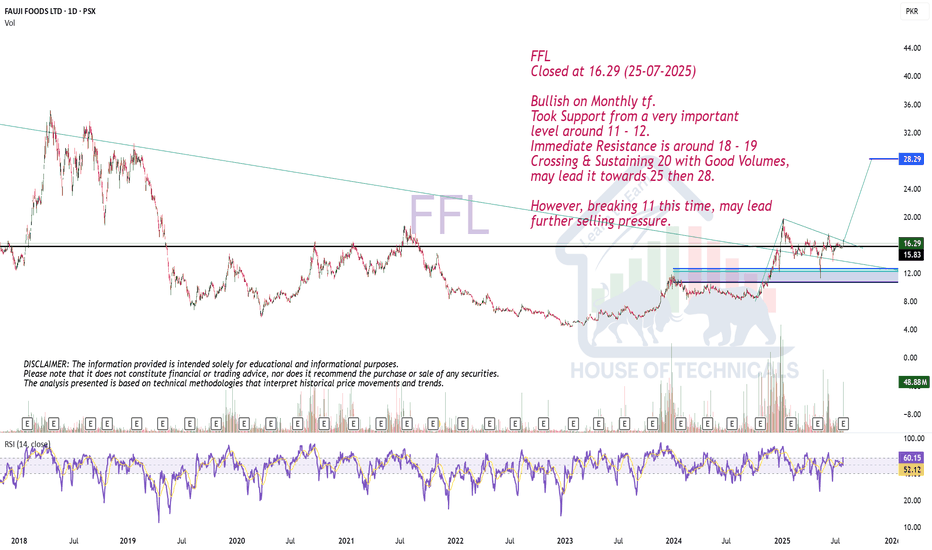

FFL Closed at 16.29 (25-07-2025) Bullish on Monthly tf. Took Support from a very important level around 11 - 12. Immediate Resistance is around 18 - 19 Crossing & Sustaining 20 with Good Volumes, may lead it towards 25 then 28. However, breaking 11 this time, may lead further selling pressure.

BNWM Closed at 81.13 (25-07-2025) S1 seems to be around 76 - 76.50 & S2 around 68 - 69 Though Bullish on Bigger tf but may re-test the mentioned Support levels. Upside it may reach 90 , 99 & then 110- 112

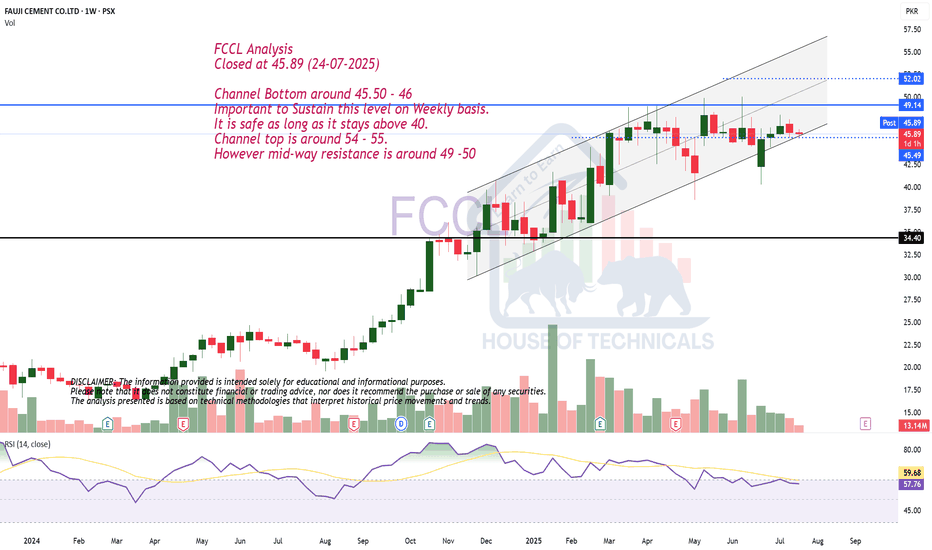

FCCL Analysis Closed at 45.89 (24-07-2025) Channel Bottom around 45.50 - 46 Important to Sustain this level on Weekly basis. It is safe as long as it stays above 40. Channel top is around 54 - 55. However mid-way resistance is around 49 -50

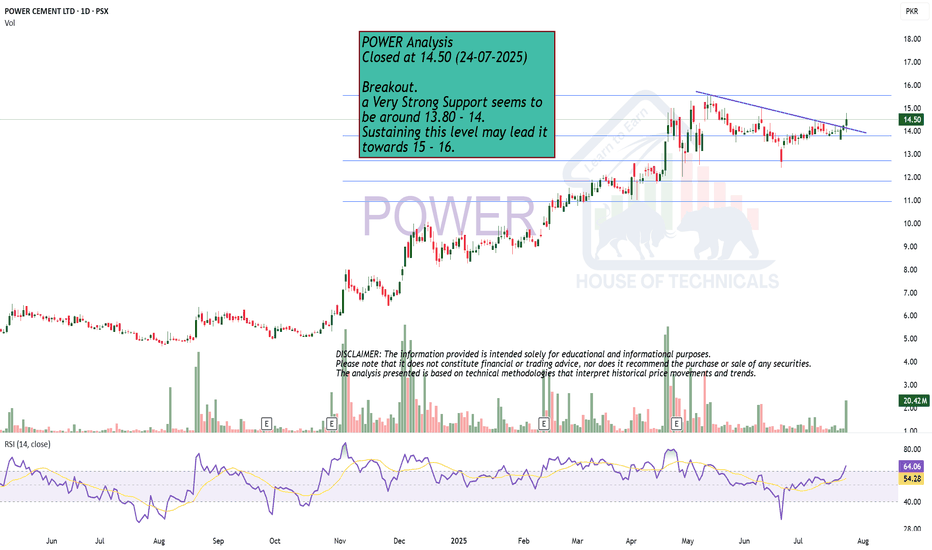

POWER Analysis Closed at 14.50 (24-07-2025) Breakout. a Very Strong Support seems to be around 13.80 - 14. Sustaining this level may lead it towards 15 - 16.

2082 - ACWA POWER Closed at 229.60 (23-07-2025) Continuously in Down Trend but, bullish divergence appearing. It may bounce from the current level (around 225 - 230); however it needs to Cross & Sustain 274 - 275 to start its Uptrend. If 275 is Sustained, we may witness 300 - 305. On the flip side, breaking 220 - 222, may bring more selling pressure & it may...

860 - KSBP CMP 222 (10-07-2025 09:31am) Buy1 @ 212 - 216 Buy2 around 201 - 203 TP1 around 237 - 240 TP2 around 263 - 265 Stoploss 200 (Closing basis)

Monthly Closing above 290 -292 is a positive sign. If this level is sustained, it may hit 335 - 348 easily. On the flip side, Important Support levels are 280 - 283 and then around 250

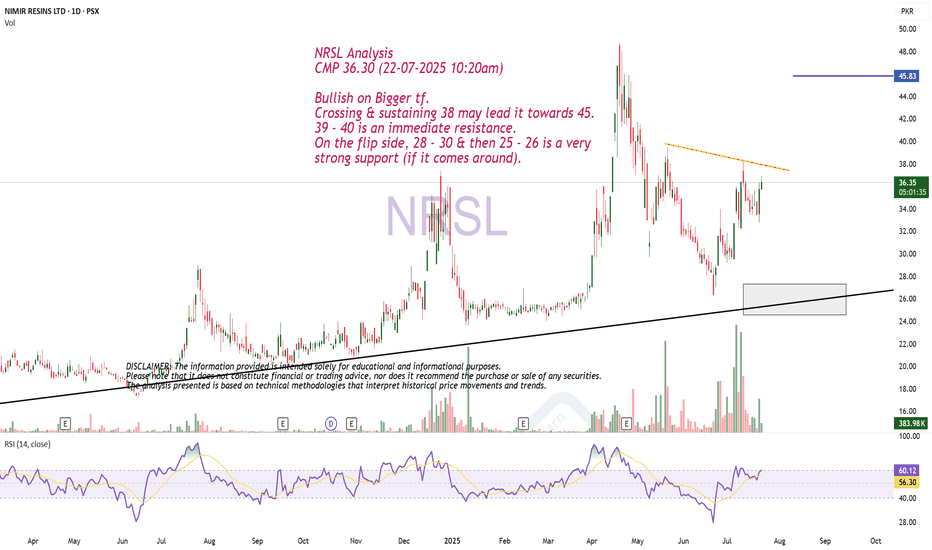

NRSL Analysis CMP 36.30 (22-07-2025 10:20am) Bullish on Bigger tf. Crossing & sustaining 38 may lead it towards 45. 39 - 40 is an immediate resistance. On the flip side, 28 - 30 & then 25 - 26 is a very strong support (if it comes around).

GAL Closed at 478.26 (18-07-2025) Somewhat in consolidation. It should cross 508 atleast to continue its uptrend. If 472 is broken, we may witness more selling pressure. Then Important Support would be around 433 - 435.

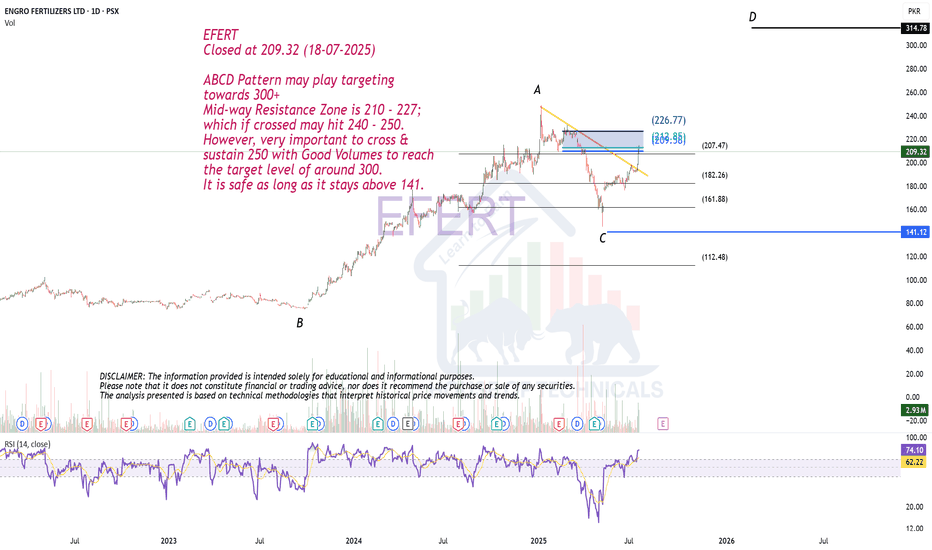

EFERT Closed at 209.32 (18-07-2025) ABCD Pattern may play targeting towards 300+ Mid-way Resistance Zone is 210 - 227; which if crossed may hit 240 - 250. However, very important to cross & sustain 250 with Good Volumes to reach the target level of around 300. It is safe as long as it stays above 141.

NETSOL Closed at 145.06 (18-07-2025) Though in Uptrend but Important Support seems to be around 133 - 134 which is also a Channel bottom; Next Support will be around 120 - 122. Channel top is around 185 - 190. However, in case of Extreme Selling Pressure, 103 - 105 is a Very Strong Trendline Support.

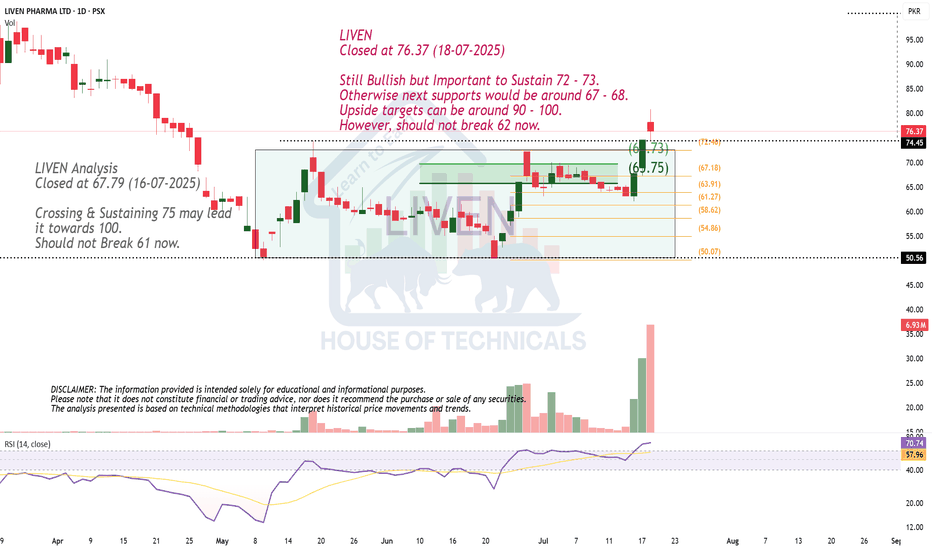

LIVEN Closed at 76.37 (18-07-2025) Still Bullish but Important to Sustain 72 - 73. Otherwise next supports would be around 67 - 68. Upside targets can be around 90 - 100. However, should not break 62 now.

ISL Closed at 97.96 (18-07-2025) Important Resistance is around 98 - 104. Once crossed with Good Volumes, we may witness upside move towards 130 & then around 150. On the flip side, 94 - 96 & then around 80 - 83 are the Important Support Levels.

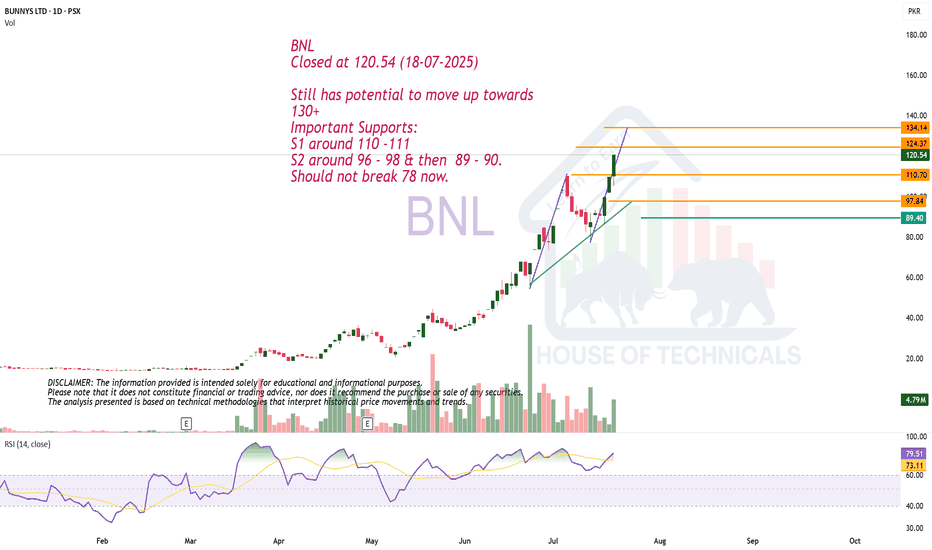

BNL Closed at 120.54 (18-07-2025) Still has potential to move up towards 130+ Important Supports: S1 around 110 -111 S2 around 96 - 98 & then 89 - 90. Should not break 78 now.

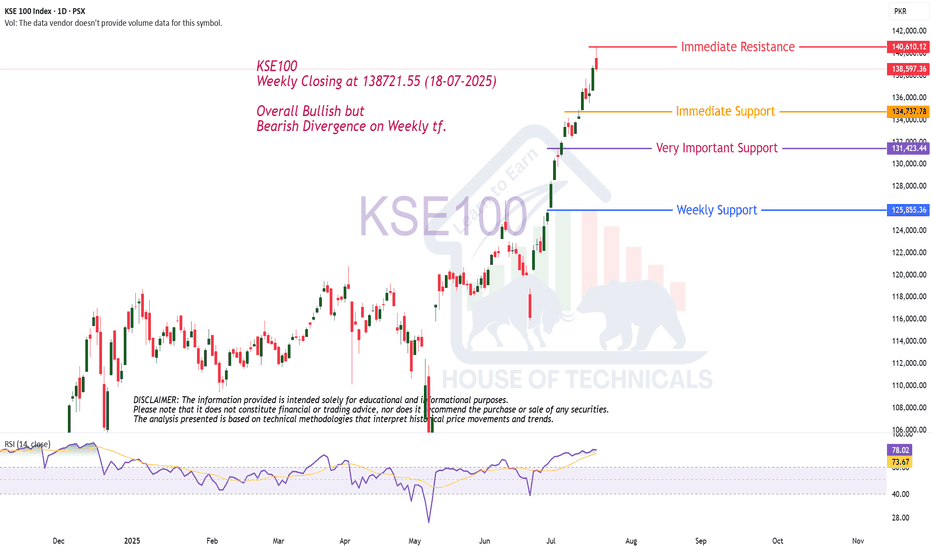

KSE100 Weekly Closing at 138721.55 (18-07-2025) Overall Bullish but Bearish Divergence on Weekly tf.

SYS Analysis Closed at 121.80 (17-07-2025) Immediate Resistance is around 128 - 130 Crossing & Sustaining this level may lead it towards 150 - 152. Breaking 115 may bring more selling pressure\ towards 100 - 107.

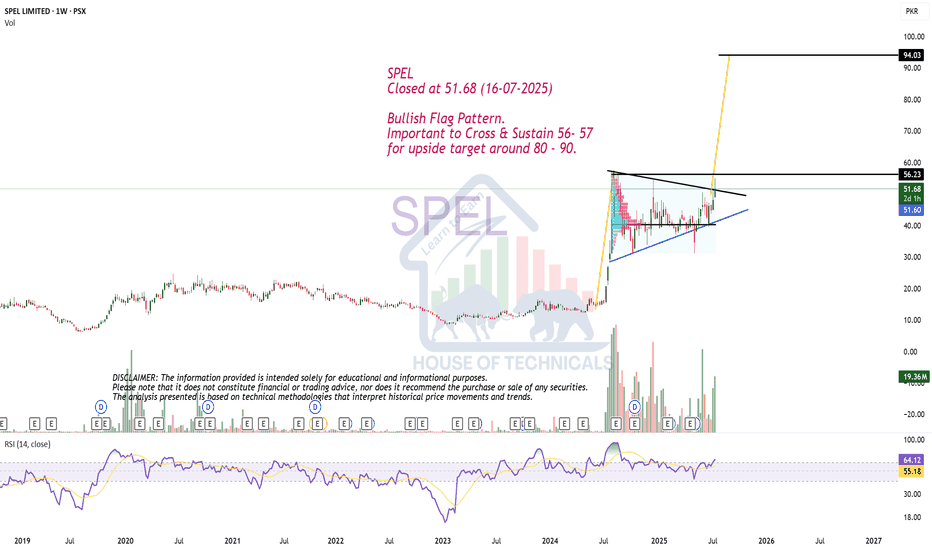

SPEL Closed at 51.68 (16-07-2025) Bullish Flag Pattern. Important to Cross & Sustain 56- 57 for upside target around 80 - 90.