HutsonBay

GBP fundamentally is very weak and given the opportunity that lies ahead with the BOE interest update on the 10th May, GBPCAD presents a great trade. Market has broken a decent bullish run and is now sitting on 38.2% retracment support. I am looking for a move lower on the hourly chart before entering this short.

Fundamentally, BT group is under enormous pressure and the stock has been in a steady decline. Given the downgrading issued by BarCap yesterday, and the increase in competition, this stock has great bearish potential. Targets could move to 70p / 100p

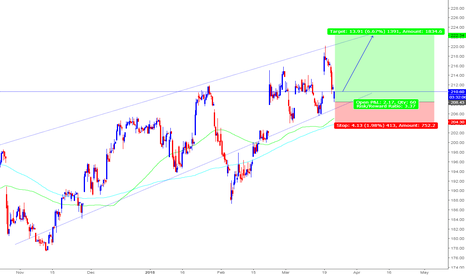

Barclays has presented a nice long opportunity. Bullish candles appearing on the 4hr trend line and decent support from the previous runs higher. BOE Interest Rate announcement today will impact bank sentiment, but not expecting any significant moves lower.

Broken to the downside through a key S&D zone Retest acting as a period of profit taking and looking for a continuation lower

Unfortunately my GBPJPY long position was stopped out during Labour's speech, coupled with comments from Barnier around UK progress on key areas like citizen's rights. On the daily time frame we have a perfect break, retest, followed by more bearish candles. Theresa May is speaking today and she will be doing her best to cement her position as a stable leader and...

Looking to take advantage of the USDCAD break above its daily resistance trend line. 400 pips on the table!

USDJPY has now reached its daily resistance line were we have seen extensive selling This setup presents a great risk/reward Let's see where this pair ends up

The Labour party have delivered their plan on Brexit and the Fed have signaled 3 rate hikes in 2018. We have no broken to the downside and have a target level on the weekly chart which has acted as a great buy zone since the Brexit Vote June 2016

Series of daily and weekly long trendlines acting as support GBP sentiment is fairly positive at the moment which has seen a lot of bidders. Great RR

Key support level broken - bears piling in

USDCAD has an establish sell off trend line. Looking for a push lower - tight stop loss If we see a push above and get a retest, this pair could turn into a great long position

EURUSD has fallen away from the highs of 1.25 with a loose double top There are two key take profit areas - one on the support trendline and the other at a supply zone. Once the market has reached this area, the sentiment could be become bullish again, looking at the weekly chart, this could be a great place to load in long term buys.

2nd Trade of the week Risk 182 pips, Reward 286 pips Looking for a bullish break to the 50% retracement level David Davies is speaking on Thursday in Vienna so can expect some background chop in £ sentiment

First Trade of the week and nothing particularly clever about this trade. Market seems comfortable with sell offs, followed by profit taking. Several structured resistance levels which are using as protection for the stop loss Happy Monday ...

We have the beginnings of another reverse head and shoulders forming, with a clear neckline. Fib support was perfectly formed and given the recent shifts in USD weakness, this trade has great potential.

Buyers have been found on the supporting trendline. 100 MA scooping up buyers today Looking for completion of this rally to the top of the wedge

This is a fairly brave position to take, given the USD weakness. The Japanese Central bank will be watching these low levels and formulating a plan on how to combat We are buying at support level with targets at 50% retracement which was a previous supply/demand zone where support turned resistance.

0.9 has demonstrating a lovely area for buyers to load order. On the daily time frame, we have raced ahead of the MA 100 / 200 I am late to enter this trade, but feel the long term sentiment and momentum is good. I may scale out of my position at the next supply zone - £ symbol Any significant break of the channel / trend and I will be closing the position