ICHIMOKUontheNILE

PremiumWhy Did I Lose XAUUSD During NFP Time 😢 While I Was Waiting for a Miracle 😉… and Everyone Else Cashed In? 🤑 Alright, champ. Let’s break down why you lost your short trade around $3,348 per ounce, while the whole world seemed to be printing money. This one’s for the smartest and slickest trader on Egyptian soil—but explained like someone who actually...

This is a stealth bullish accumulation day. Market maker completed a fake drop and now prepping breakout. Play long bias from control zone with stop-hunt fade backup. Schabacker would call this a false breakdown spring + congestion base rally. XAUUSD (Gold Spot) ANALYSIS | AUG 01, 2025 | CAIRO TIME GMT+3 🔍 Multi-Timeframe Technical Breakdown (Daily → 5m) ...

🔥 I. MACRO CONTEXT & NEWS FLOW IMPACT — "WHY THE HELL IT MOVED" Yesterday’s move was a classic institutional fakeout followed by controlled accumulation. Today is retest day. Watch VWAP and order flow like a hawk. Don’t chase, wait for reversion and load at value. 📅 Date: July 30, 2025 📰 Event: US Employment Cost Index: Lower than expected Core PCE: Cooled...

Inside the Trap: Schabacker Congestion, VWAP Warfare & The Silent Distribution on XAU/USD 1. The Congestion Area – Schabacker Style 🔍 What We Saw: Price action rotated in a tight range: 3,324.5 - 3,329.5. This is not random. This is Schabacker’s classic Congestion Zone: Duration: 12+ hours Width: ~5 points Volume: tapering near edges Failed breakouts on both...

🟡 Is Gold Preparing for a Breakout — or a Trap? Let’s break down the latest market data 👇 ⸻ 🟥 1. U.S. Inflation News (PPI & Core PPI) Report Previous Forecast Actual Monthly PPI 0.1% 0.2% 0.0% Core PPI 0.1% 0.2% 0.0% 📉 Result: Very bearish for the U.S. dollar → Inflation is cooling → Fed may pause rate hikes → Interest rates could stabilize or drop → And gold...

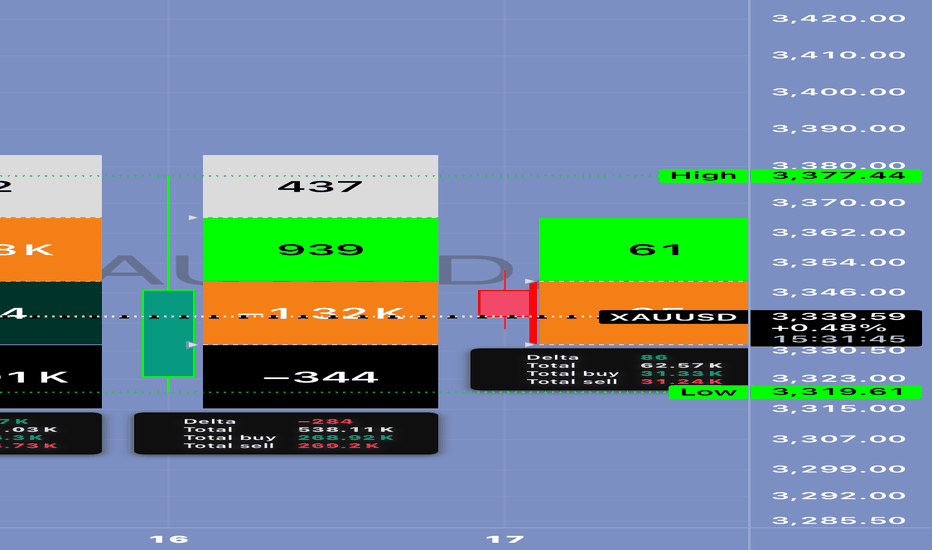

💥🔥 Let’s Crush the Market – Updated Zones for Thursday & Friday, July 17–18, 2025 Based on the latest explosive move to 3,377.25 followed by a sharp rejection. 🔥 Current Market Status – XAUUSD Gold made a violent breakout to the upside, reaching 3,377.25 and triggering a massive wave of stop orders above. Then it snapped back quickly, confirming this was...

🚨 XAUMO Golden Report – Institutional Strategy Plan (July 15, 2025, Cairo Time) Directional Bias: ✅ Bullish with retracement traps Market Structure: Classic Schabacker Congestion to Continuation Phase: Distribution > Trap Liquidity > Breakout Pullback 📊 KEY TECHNICAL LEVELS (All Cairo Time) Level Type Price 🔺High of Day 3,374.88 🟢Key Resistance 3,366.36 -...

📊 XAUUSD Institutional Market Recap & Forward Guidance | July 14–15, 2025 🕒 Execution Focus: Cairo Time 🗓 14 July Recap – Liquidity Engineering Phase Gold executed a precision liquidity trap below VAL 3341 during Asia–London overlap. Price swept weak long positions, engineered a false breakdown, and rebalanced above VWAP Median / POC (3349). The buy-side...

🧠 I. Market Overview & Directional Bias: 📌 Bias: Bullish-Intraday With Potential Trap Today’s price action formed a V-reversal spike low at 3353.75, clearing out stop clusters below FVG and VWAP. Followed by aggressive absorption just under 3358.5 major resistance. Volume divergence shows declining sell pressure with rising absorption on the footprint charts. 📚...

🟡 Gold Market Analysis (XAU/USD) – 6 Weeks of Anticipation 🧠 Imagine This… The gold market (XAU/USD) over the past 6 weeks has been like an aging football team. They were legends once—scoring goals (sharp rallies), but now? The stamina has dropped, and the effort is limited. The market tries to attack (break above 3500), but every time it reaches that peak, the...

A Simple Lesson: How to Identify Congestion Zones in the Market — Schabacker’s Approach and the Head and Shoulders Pattern ⸻ 👤 Who Was Schabacker? 🔹 Richard Schabacker was one of the pioneers who authored seminal works on technical analysis. 🔹 He lived over 90 years ago and served as Editor-in-Chief of Financial World magazine. 🔹 His most notable book...

📘 EDUCATIONAL POST: Can Gold Really Drop 10% in a Day? Let’s Break It Down Alright, traders—before you start thinking the sky is falling, let’s look this chart straight in the face and get real. ⸻ 🔍 The Setup Right Now Here’s what’s showing up: ✅ A bullish pennant forming up top (potential continuation higher). ✅ A big head and shoulders pattern in the middle...

Market Recap & Forecast – Egyptian Edition Yalla ya shabab—before you run off to Sahel or your cousin’s mashwi, let’s break down the market moves. Bring your tea—we’re about to see how they played us like a baladi tabla. 🗓️ 3-Day Recap (June 30 – July 2) ✅ Monday (June 30) Market woke up strong—“Ana mesh hayemny!” like Adel Emam in El Irhab Wel...

🎓 XAUUSD Traders – The ONLY Timeframes That Matter If you want to stop being a liquidity snack for the big players, you must know which timeframes actually reveal what the market makers are doing. Here’s your complete educational guide for XAUUSD: ⸻ 🔍 1️⃣ The 4-Hour (4H) – The Market Maker Blueprint ✅ Why Watch It? This is where the real accumulation and...

🎓 XAUUSD Market Maker Playbook – Learn How the Game Is Rigged Traders—if you think this market is some pure, fair supply/demand mechanism, you’re getting played. Market makers run sophisticated pump and dump cycles designed to trap you. Today, I’m going to break down exactly how they do it, so you can start trading like a sniper, not a sheep. 🔍 Understanding...

🎓 Mastering Delta–Volume Divergence: How to Read Institutional Absorption and Trap Setups ⸻ 1️⃣ What Is Delta? Delta measures the net aggression between buyers and sellers: • Market Buys: traders lifting the ask • minus • Market Sells: traders hitting the bid ✅ Positive Delta indicates stronger buying pressure. ✅ Negative Delta indicates stronger selling...

⚔️ XAUUSD Daily Institutional Analysis Monday, June 30, 2025 ⸻ 1️⃣ Price Structure & Context Current Market Snapshot: • Daily Close (June 28): 3,273.40 • Key Technical Breaks: • Closed decisively below the 0.5 Fibonacci Retracement (3,288) • Breached and retested the Value Area Low (VAL) at 3,285.91 • Clear rejection of the 0.618 retracement...

Period: Monday June 30 – Friday July 5 Focus: US Independence Day (July 4), NY Market Closure Impact 🟢1. Price Action Context Last Week (ending June 28): Weekly bearish engulfing closed near the lows (~3,250 area). Series of failed rallies above 3,330. Price compressed in a tight lower range—distribution, not accumulation. Monday June 30 – Friday July...