Analysis: As anticipated, DXY has now swept the major weekly/monthly sell-side liquidity (SSL) at 99.58, tapping deep into a high-probability reversal zone. This aggressive liquidity raid was followed by a sharp bullish reaction—marking the first signs of potential re-accumulation or a relief rally. Currently, price is pushing back toward a bearish order block...

Bias: We’re operating within a clear bullish higher time frame bias, confirmed by previous swing structure and continuous displacement to the upside. Price has consistently made higher highs and higher lows on the 4H and Daily chart. Entry Zone: ✅ 4H Fair Value Gap (FVG) — a clean imbalance from prior bullish displacement. Price has now retraced into this...

CoreWeave is showing classic IPO 'honeymoon phase' price action, with early liquidity swept and bullish structure forming. 🔍 Price swept the daily sell-side liquidity at $35.70 📈 Now pushing higher — next major buyside targets at $55.04 and $65.22 🤖 Backed by NVIDIA, adding serious momentum and credibility 🧠 Expecting strong continuation as institutions begin to...

SDR (SiteMinder) is showing massive potential both technically and fundamentally: - Trading 75.4% below fair value - Forecasted to grow 65.36% YoY - Earnings up 28.2% p.a. over the last 5 years - Analysts expect 91%+ upside On the chart, we’re sitting right on a high-probability monthly FVG + OB zone. If respected, we could see a strong rally back toward the...

Tesla (TSLA) has shown textbook precision by respecting the golden zone after a significant sweep of previous highs. Rather than violating the last HTF low—which would’ve hinted at deeper downside—price instead retraced cleanly into the OTE (Optimal Trade Entry) range and reacted with strong bullish intent. This move indicates a healthy retracement rather than...

🔍Analysis: Following up from a previous breakdown, NVIDIA has now tapped into a high-probability Weekly Order Block (OB) just above the sell-side liquidity zone at $88.97. This level also aligns with a structural area of support, making it a prime zone for a potential bullish reversal. Key signs: Price is showing early signs of displacement from the OB. If this...

Analysis Overview: The chart suggests that SOFI may be setting up for a major bullish reversal, but confirmation is still needed. Let’s break it down: Key Bullish Factors: ✅ Optimal Trade Entry (OTE) Price is currently sitting at an OTE level, a premium zone for long setups often used by smart money. These zones historically mark powerful reversal points. ✅...

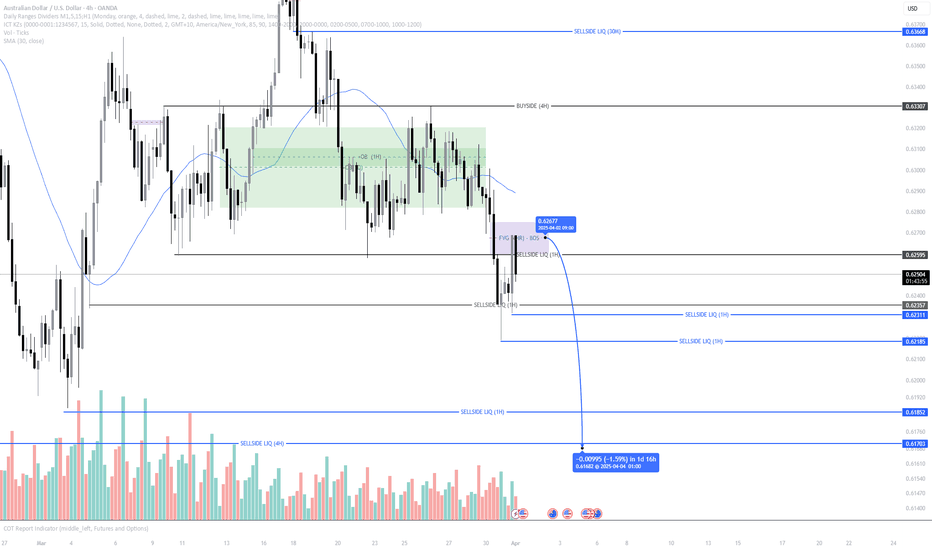

Riding the wave of bearish structure, AUD/USD continues to follow the macro trend with laser precision. After the RBA held rates steady, we’re seeing the typical post-news dump play out—fueled by the market’s disappointment and reduced sentiment. Technically, price respected the 4H Fair Value Gap (FVG) and showed strong displacement to the downside, confirming...

Continuing from the previous Tesla breakdown, we can see price has respected the green zone, aligning with the previously called full-swing projection. As price approaches its high, it’s likely to face some retracement before the next significant move. Key Levels to Watch: - Point of Interest (POI): The Fair Value Gap (FVG) at the $300 zone presents a...

From the higher timeframe perspective, DXY is currently hovering within a key monthly Fair Value Gap (FVG), marked in red. This zone serves as a critical point of interest and could dictate the next directional bias for the dollar. Key Observations: Current FVG Zone: -Price is consolidating within the monthly FVG. A close below this zone would provide stronger...

The AUD/USD pair is showing clear signs of bearish continuation as price respects a higher timeframe Fair Value Gap (FVG), rejecting attempts to push higher. Additionally, high-impact news against the Australian Dollar has accelerated downside momentum, reinforcing the bearish bias. Key Observations: ✅ HTF FVG Respect – Price reacted strongly to the daily FVG,...

Gold continues its overall bullish bias, as evidenced by its respect for the HTF daily FVG, supported by a 1-hour FVG that aligns with the broader structure. The green zone OB presents a potential entry point, reinforcing the upside momentum. Key Observations: -The FVG entry aligns perfectly with the bullish structure, adding confluence to the trade. -Price is...

The GBPAUD chart showcases intriguing price action with a potential bearish setup. Following the raid on higher time frame (HTF) buyside liquidity (weekly), price has displaced lower, signaling a short-term bearish bias. On the daily timeframe, price has formed a high-probability FVG after raiding a short-term low. This FVG becomes a key level to...

Gold is presenting a bullish setup as price retests and respects a higher timeframe Fair Value Gap (FVG). The retracement into the FVG has been met with signs of displacement higher, breaking through highs and confirming a potential move towards key liquidity zones. Key Levels to Watch: -Entry Zone: Around 2,639, aligning with the HTF FVG and short-term liquidity...

Following the HTF bearish bias, silver is presenting a high-probability short setup. Price has respected both LTF and HTF Fair Value Gaps (FVGs), aligning with the overall downtrend. Additionally, the 30 MA has been decisively broken, adding confluence to the bearish narrative. Key Points: - HTF bearish bias confirmed with respect to FVGs on multiple...

Tesla has shown remarkable price action after sweeping the sell-side liquidity on the monthly chart at $152.49. Price tapped into the Golden Zone (OTE) and closed strongly above the sell-side level. This confluence, combined with robust candle closures, signals potential upside momentum. Key Levels to Watch: Immediate Target: Price is aiming for the $460 range,...

This trade is based on a clean 4-hour FVG (Fair Value Gap) setup. The FVG displaced above a short-term high, confirming a bullish structure shift, and subsequently retraced into a high-probability FVG. This type of retracement often offers strong entries with minimal risk while aligning with the higher timeframe directional bias. Key Levels to Watch: - Entry...

Analysis: From the HTF Weekly Chart, NZD/USD highlights critical price action after a long-term sell-side liquidity raid at the equal lows. A recent bullish candle close above the last down candle and the swept lows suggests potential upward momentum, confirming a likely retracement or continuation higher. Key Levels to Watch: Immediate Target: - Buyside...