ITSCRYPTO1

US30 broke out of the Asian session consolidation on the LDN open but the structure on intraday is bearish we have a beautiful zone of confluence on US30. 1, 0.618 fib 2. Descending trendline 3rd touch 3. Horizontal supply structure. Looking for confirmations for potential NY reversals.

Multi timeframe price action analysis on GOLD beautiful setups lining up, as always waiting for confirmations in the identified zones.

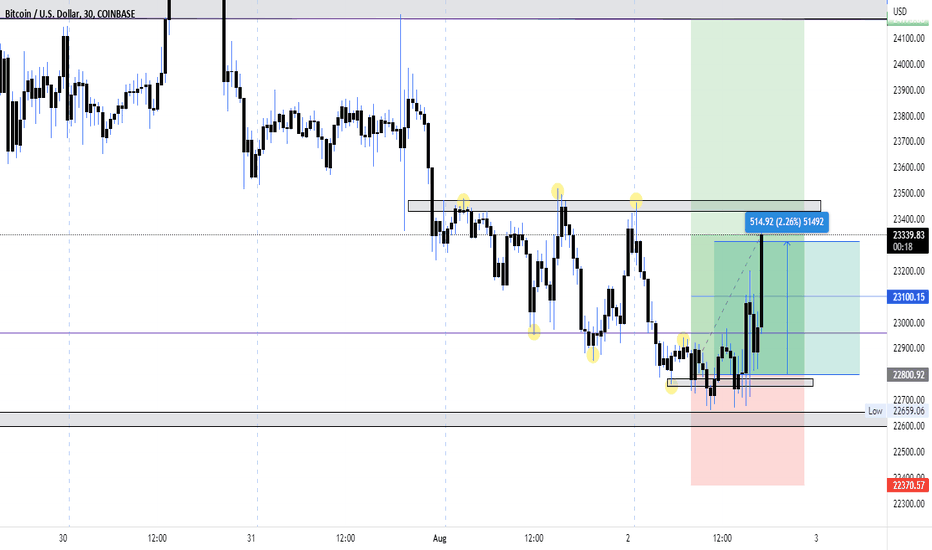

BTC following my projection beautifully - hope all of you managed to capitalise on my idea, i am rolling stops to breakeven and securing some partial profit at +140% using 50x leverage

Hope you enjoyed my top down analysis, please comment below what you would like me to breakdown next, FX or crypto.

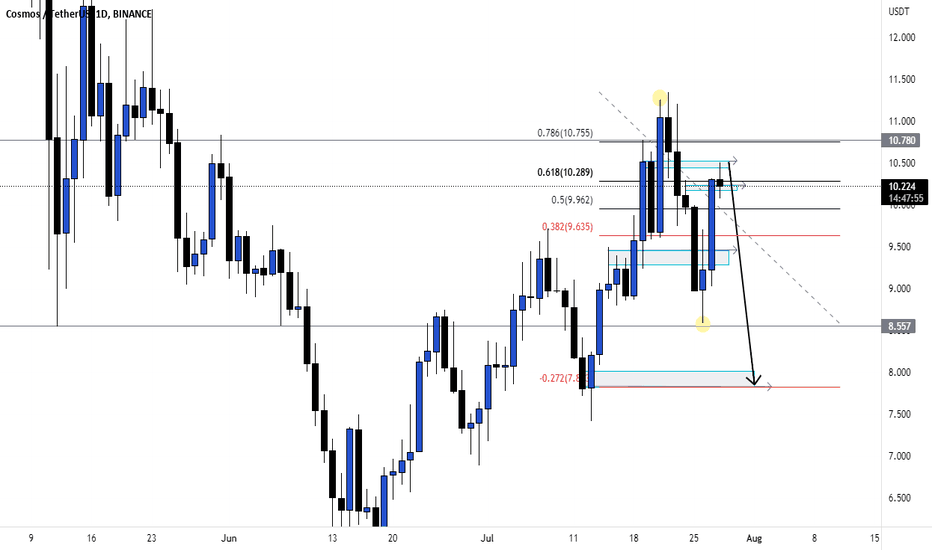

Does this look like a bullish chart to you ?😅 Don't FOMO into positions here guys, this is nothing but a HTF corrective move, zoom out - stay patient, if you didn't capitalise on this relief rally on SPOT positions now is NOT the time to FOMO in, if you did capitalise on this rally great job remember to TAKE PROFITS. This massive bearish flag on the 1D chart will...

ATOM from a daily perspective recently made a small fake breakout above the weekly resistance 10.780 followed by a strong bearish impulse which broke below multiple levels of structure, since the bearish impulse price has made a nice retracement which is currently testing the 0.618 fib in confluence with daily resistance, we can see on the LTF price is already...

Gold cleared the liquidity above all of the highs yesterday on the FOMC - as i mentioned a number of times the news is always a catalyst to collect liquidity, now the market has settled, gold looks ready to rollover price is testing weekly supply at the psychological level of 1745 we can see beautiful structure with a macro micro M formation - inside of the second...

Soooo BTC and ETH made huge moves to the upside exactly as i projected in yesterdays btc update, now price is testing weekly supply after removing huge amount of liquidity from short sellers, the time has come - MASSIVE SHORTS PENDING.

3 possible fundamental scenarios that we can get from the FOMC meeting with my full perspective on the price action we are seeing from BITCOIN - remember extreme volatility is expected trade safely. RISK management is key. Wait for the market to show you direction then react.

Since my previous multi timeframe analysis on US30 everything is still very much valid for the big move to the downside, FOMC tomorrow and i am expecting a 100 BPS hike, which is very bearish for RISK assets and bullish for the USD. From a technical perspective last week price made a very strong rejection on the zone of confluence. 1. 0.618 weekly fib 2....

Since the large bounce from the weekly lows we saw last friday, which we capitalised on, price made a bullish change of character on the intraday timeframes by breaking above the previous swing high and forming a new HH. This indicates a potential change in short term momentum. However on the weekly TF price left a wick to fill to the downside. We can also...

Big week ahead, FOMC on wednesday i hope you all enjoyed my analysis , comment below anything you would like me to breakdown next

GBPUSD followed this mornings projection perfectly, beautiful 138 pips move from the 4H demand zone, i hope some of you managed to capitalise on my previous analysis. Personally i took the GBPAUD buy instead of GU but nice moves across all pound crosses.

GU recently bounced from the psychological level of 1.1800 and broke above the previous daily supply, yesterday PA came back down to retest the zone which is in confluence with the 0.5 fib and saw a very strong reaction from buyers. The daily candle closed in the form of a bullish hammer formation this shows us that the momentum for today is likely going to be...

Get ready guys, the dow jones is setting up for a HUGE move to the downside, manage risk accordingly and wait for confirmations!!

AUDUSD is going to rollover today. DXY is starting to fill the weekly wick as projected all week- RISK is firmly OFF today in the markets. AU reversed from a significant level of weekly supply and made a change of structure by breaking below the previous low and forming a new LL, we are waiting patiently for a retest of the unmitigated supply which caused the BOS,...

So as i said this morning in my SILVER update, commodities were looking beautiful for a rollover - we decided to take the gold setup over silver simply because it provided a better risk reward, i hope some of you capitalised on the previous analysis currently running 3.5R

Close eye's on the commodity market today, after a beautiful corrective move on silver we are looking for sells to capitalise on the next wave down, looking for price to break above the Asian session consolidation and test the daily supply zone identified above, if price follows the projection we will be waiting to see rejections and entry confirmations on the...