Ian_Carsen

EssentialI believe this can fill in the next day or 2, RR depends on the lvl taken, Sui is currently in a very bullish move so it makes sense to take the higher red lvl for lower RR IMHO.

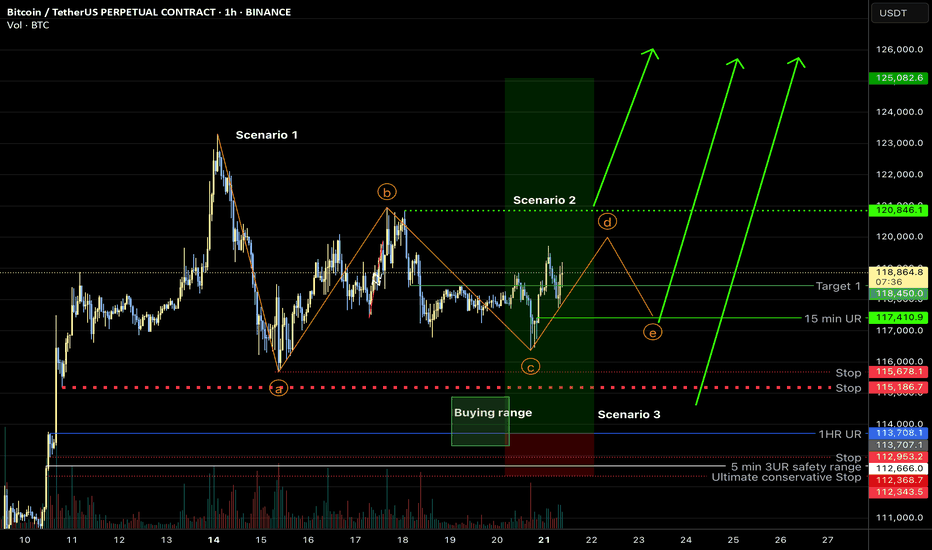

My previous hypothesis of a sharp correction (scenario 3) looks to be incorrect. I believe the most likely corrective structure is a contracting triangle at this point (scenario 1), and the last leg should be bought for new ATH, however, it is also possible we had the last major low for this correction and new ATH are imminent (scenario 2)—which will be on the...

Currently looking for something like the following, Take out the stops, and hold the the range below Before new all-time high

I believe bitcoin is eventually making a new local lower low, however, that it will likely bounce off the indicated range first, moving up in a three wave move before continuing lower. Well, the target may need to be adjusted, the indicated trade is attempting to take advantage of this Analysis.

Bitcoin most likely to continue higher from one of the indicated ranges. It may be best to split a trade 1/2 entry on one and 1/2 entry on other with stop below the second, or 2 trades with 1/2 normal risk.

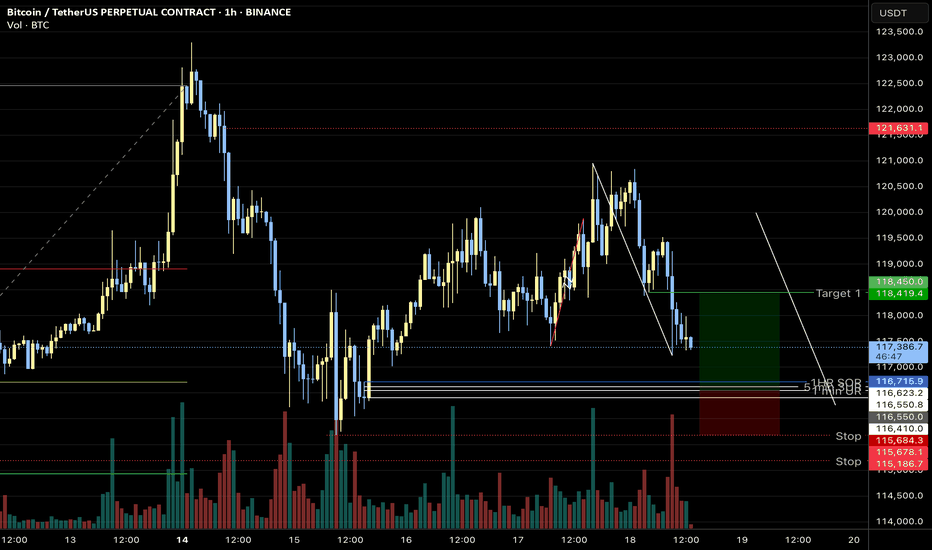

Bitcoin has risen significantly, if it retraces some it will likely stop at the indicated range. Target will need to be selected after the entry based on the development of the chart.

Possible Elliott wave triangle suggests a new local high in the near future giving a trade opportunity at the untested range. Target may be adjusted--that provided is conservative.

I expect a short move up followed by a bigger retracement. While I’d try a long at the lower indicated range, a move further, below it, is certainly possible.

I think bitcoin will likely find resistance at the current range, or slightly higher, and move down in a stepwise fashion to the indicated supports in the near future.

Wif seems to be going up to a longer-term target. A trade could be taken as so

While I believe it is still possible to target the more global support zone below, a sequence of events like that shown (another smaller push higher before a larger drop) would suggest BTC is on its way to new ATH again. Conversely, a larger drop from current resistance levels would suggest we still have one more larger leg down to me.

Indicated are some of the major support and resistance levels I'm looking at. I'd expect price to break out of the current consolidation to the upside before moving lower.

Should be a fairly safe trade, and a minimum first target. Could possibly hold for a bit more, or less depending on how the chart develops

Anime seems to continue to be upward bound toward the indicated eventual target, a safe exit is shown for the 1.%7 RR, although one could potentially hold it higher for almost a 5 RR--or something in-between.

While I believe BTC is heading higher (not ATH highs yet) after ending at least pt 1 of a larger corrective phase, if it breaks the current near-term trend but falling below the indicated wick, I think there's a good chance of reaching the first indicated support. Upon which there should be a long to the short region indicated.

Doge has not hit its larger target, therefore I think this would be a decent short-term long

It's likely that BTC will find a short off of the indicated range and move lower to one of the indicated ranges, at which point the correction will have ended and another move to new ATH can begin.

Dot is in an uptrend, the idea would be to catch the next move up. The higher RR is likely to miss the entry--and if entry is filled not reach the indicated target but something more local. The lower RR entry (higher price) is not as rewarding however. Of course you may use local breakout etc entry techniques.