💱 Is it time for the Euro? 💱 For some time now I have been watching the Eur/jpy pair which is, in my opinion, beginning its journey towards breaking out and landing finally at the 150 levels. 💱 Looking at the key indicators. We see bullish signals everywhere. Given today's upward candle and the formation of increasingly higher lows, it is hard not to hold a...

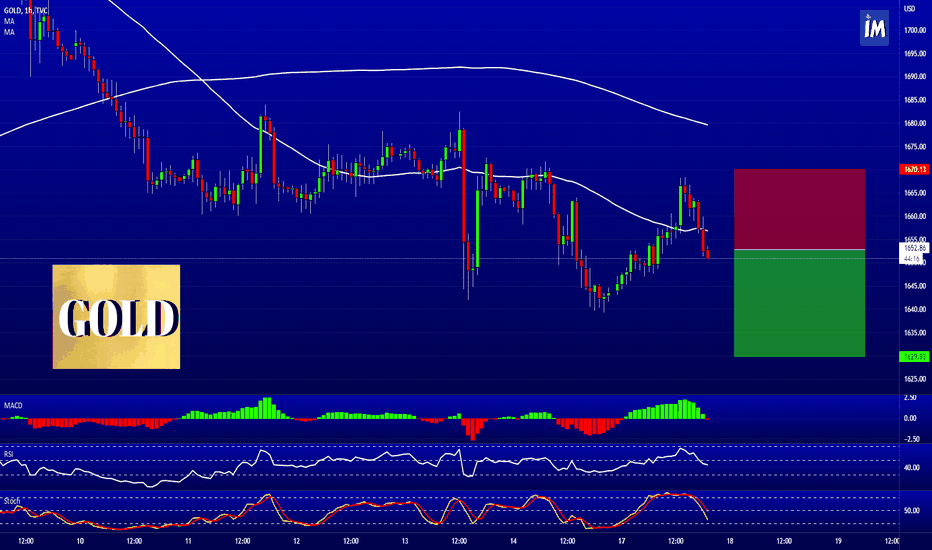

🪙 Gold ready to fall, quick analysis 🪙 In today's analysis, we will again look at gold this time on the 1H interval which, for me, has performed many confirmations of weakness. 🪙 Starting with indicators which all generate downward signals, ending with the fact that we are under key moving averages. 🪙 I encourage you to read the previous post on gold and...

⬇️ AUD/CAD prepare for a decline? ⬇️ Since the start of the sideways trend that took place on October 10, it has been rather dull on this pair, a few breakout attempts and nothing more. ⬇️ But today's week has a lot of important events in store for both of these pairs. ⬇️ Starting at 1:30 a.m. on Tuesday English time, we will have the Minutes meeting where...

📉 Will the S&P500 Fall into the 3210-3110 zone? Is the market discounting recessions. 📉 In today's post we will look at the S&P500 index, which, in my opinion, after the end of last week and the formation of the candlestick formation of the falling star, informs us of the possibility of a drop into the levels of 3210-3110, which are determined by 2...

In the current analysis, we look at the king of cryptocurrencies Bitcoin. On Chart 1D, we can see that it has been moving in accumulation since mid-June. On September 21, the double bottom was compacted. In the last few days, you can see that bitcoin is about to break. The most appropriate level will be 0.382 of the last downward impulse, it will be around...

In the current analysis, we look at eth/usdt. We see a cumulative trend since June 14, with the biggest rise to $ 2,000 per eth. Then we dropped to level 61.8 of the biggest implus. We've been accumulating on this level for several days and eth won't go any further. After applying the next two fibo levels, at the level of $2532, we created a cluster. 0.618 of...

📈USD/CAD📈 📈 A quick analysis based on support and resistance. Regarding the detailed analysis, I refer you to the previous post on this pair: 👇 👇 📈 If you like the analysis. Leave a like and follow <3 📈

The S&P 500 has been in a downward trend since the beginning of 2022 This week we broke the resistance from June. Which is a clear signal of bearish dominance in the equity market We cannot expect any sudden changes in the FED policy in the coming months Market consensus is that the peak of interest rate hikes will fall in March at 4.5%.

₿ Referring to my previous post on Bitcoin in which I wrote that there is a high probability of a breakout from the double bottom (post pinned at the bottom) ₿ We can see that Monday and Tuesday trading session gave a new light of hope for a bump for this cryptocurrency. ₿ The level of 37k was seen from the fact that I measured the last 2 largest corrections...

💸 In today's analysis we look at an interesting opportunity on the aud/cad pair. 💸 Since the beginning of today's session, we can see the strength of the Austarlisian dollar against the Canadian dollar. 💸 Most of the technical analysis indicators signal the possibility of a breakout and divergence from the previous moment when we were at the same price level....

NZD/JPY Are we flying to test 0.618? Quick analysis of NZD/JPY After a massive downward wave and a few days of correction, are we ready to continue the downward trend? Due to the recent weakness of the nzd and the gradually increasing strength of the jpy I encourage you to observe this pair in the coming days. Risk-reward ratio around 1 (correct)

USD / CAD, Continuation of the uptrend, price accumulation before the move. In the current analysis, we look at USD / CAD. We are currently at key levels, the price area around 1.36 1.38 is a moment of accumulation for this pair, which has been going on since September 26. Today the level of 1.364 was defended, which gave us the confirmation of the Head and...

💶 EUR/USD Volitality in pips per hour 💵 Useful? follow profile!