Judging by the fact that a solid ascending channel has been formed, the middle to long-term sentiment of the pair is expected to remain bullish. At the moment, the price is ranging within the borders of the consolidation box identified on the chart. The previous DAILY candlestick has closed impulsively bearish, which means there is still a bit of room for the...

As it can be inferred from the DAILY (D) timeframe chart, the price is approaching the upper boundary of the descending channel that is illustrated on the graph. As we know, before an impulsive move happens, the price should go through a consolidation phase. This can be clearly observed taking a look at the historical price action. Thus, we are keeping a close...

As it can be noticed from the graph, the price has nicely broken below the 0.985 area of previous support now turned into resistance and re-tested the broken structure by printing a wick candle. We are pretty positive that the price will keep declining till the 0.97 zone of support is reached.

The price of EURUSD has been declining for a while now. The massive downtrending channel illustrated on the graph is still in play and the price is trading within the borders of it. At the moment, the price is sitting on the lower barrier of the channel. Although our general bias remains bearish both from technical and fundamental perspectives, we believe that a...

Taking a look at the Weekly (W) timeframe chart, it can be noticed that a crucial zone of support has been reached. Zooming down to the lower timeframe graphs, it can be inferred that the price has been consolidating around this area for quite a while now while being unable to break below the zone of support illustrated on the chart. Looking at the recent price...

Taking a look at the 4H timeframe chart, we can witness the beauty of price action. Accumulation+Distribution phases, a massive descending channel and many other details. Mr. Wyckoff was not the only person enjoying this incredible art. Any individual that is a fan of naked trading and of monitoring the price decline/grow gradually, will spot...

As it can be clearly observed from the 3H timeframe graph, after breaking out of the ascending channel illustrated on the chart, the price has managed to re-test the area of the 0.618 Fibonacci retracement level and complete the break+retest pattern. At the moment, the price is trading within the borders of the rectangular range portrayed on the graph....

As it can be observed from the 3h timeframe graph, the price is currently sitting on a previous zone of resistance which now acts as an area of support. We can identify several attempts of the price trying to break below this level but failing and leaving long wick candles. This gives us confidence that a potential bottom has been formed and the price is preparing...

As it can be inferred from the 3h timeframe graph, after ranging within the borders of the sideways-moving range illustrated on the chart, the price has spiked above the upper boundary of it and rejected the area of previous support which now acts as a resistance that lines up with the 0.382 Fibonacci retracement level. From here, we are closely monitoring the...

As it can be observed from the 2H timeframe graph of EUR/GBP, an ascending channel has been formed and the price has rejected the upper boundary of it. Currently, we can witness how the recent candle has closed below the local area of support and is now re-testing the same zone. From here, we are closely monitoring the price development and waiting for short...

As mentioned several times before, we risk 1% of our total trading capital per transaction. In simple terms, we risk 1 egg out of the 100 that we have in the basket in an attempt to get more eggs. However, even though the average price mark where we place our Stop Loss is 30-60 pips away from the entry price, SL levels set differ from one trade to another, and...

As it can be observed from the 8H timeframe chart, the price has rejected the 0.871 key area of resistance and started printing bearish moves. At the moment, we can notice how the price is rejecting the local area of resistance and possibly forming a top before continuing its bearish impulsive movements. All in all, we are expecting for the price to keep...

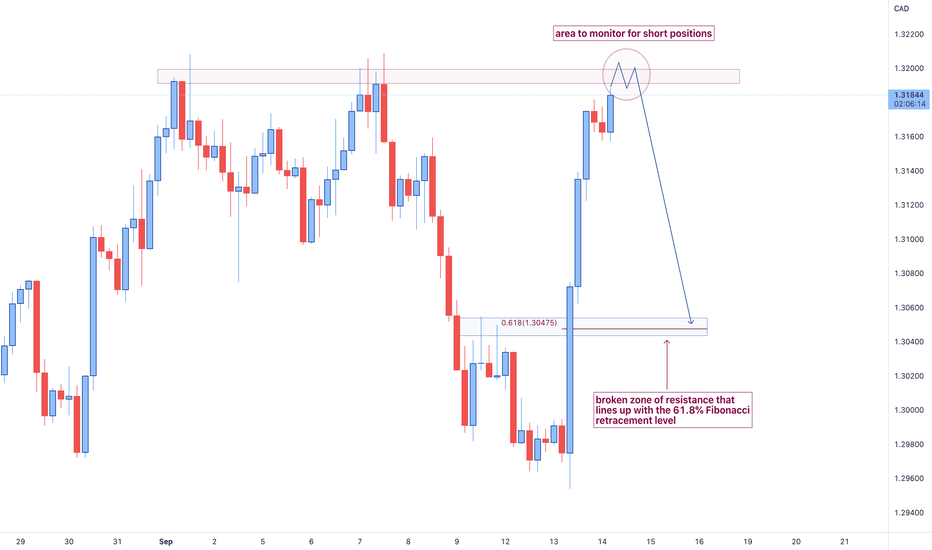

As it can be noticed from the 4h timeframe chart, the price has made a massive impulsive bullish move to the upside and has now approached a key level of resistance. After an impulsive move, a correctional leg should follow. Thus, we are patiently waiting for the price to form a valid top at the local key zone before charging up for a short-term bearish rally....

As it can be inferred from the H8 timeframe graph of USD/CHF, the price is currently re-testing an area of crucial support. After the boundary of the descending channel that is pictured on the graph was broken, we were closely monitoring the price action and expecting for the price to re-touch the current local area of support. Now that we can notice some...

Looking at the H8 timeframe chart of EUR/USD, it can be inferred how nicely the price is lining up. By using the simple "accumulation, manipulation, distribution" strategy, we will attempt to forecast the future price movement of this pair. With time and experience, it is relatively easy to spot familiar historical patterns. For example, the current price...

Looking at the recent price development, we may observe how the 0.99 area of support has been impulsively bounced off from. Plus, the 1.01 - 1.012 area of previous support which now acts as a level of resistance has not been re-tested yet. Therefore, considering the above-stated facts, we believe there is more room for the price to keep rising to the upside....

As it can be observed from the 8H timeframe chart, the price has rejected the area of resistance plotted on the chart. Looking at the recent price development, we can notice how a massive impulsive bullish run has taken place after the breakout of the descending channel portrayed on the graph. Currently, it can be inferred that the price is headed towards the...

After rising for quite a while, the price has finally reached an important area of resistance. Looking at the historical price action, we can observe how a nice double top was formed earlier in July of this year before a bearish rally happened. Paying a close attention to the current price development, we can infer that there is a high possibility for another...