IvanLabrie

PremiumGM gents, most people in crypto circles (Crypto Twitter sphere of influence and former Tradingview posters who evolved into influencers there) seem to have the consensus view that the market has little time to rise from here, and appear to signal a wall of worry sentiment. This resonates with variables observed in Pendle Finance implied vs realized yields for...

The market seems to be pricing in a possible truce between Ukraine and Russia, since Trump gave Russia a 2 week deadline to achieve it or risk further sanctions. The technical chart has a picture perfect short signal in the daily timeframe with good reward to risk here. Best of luck! Cheers, Ivan Labrie.

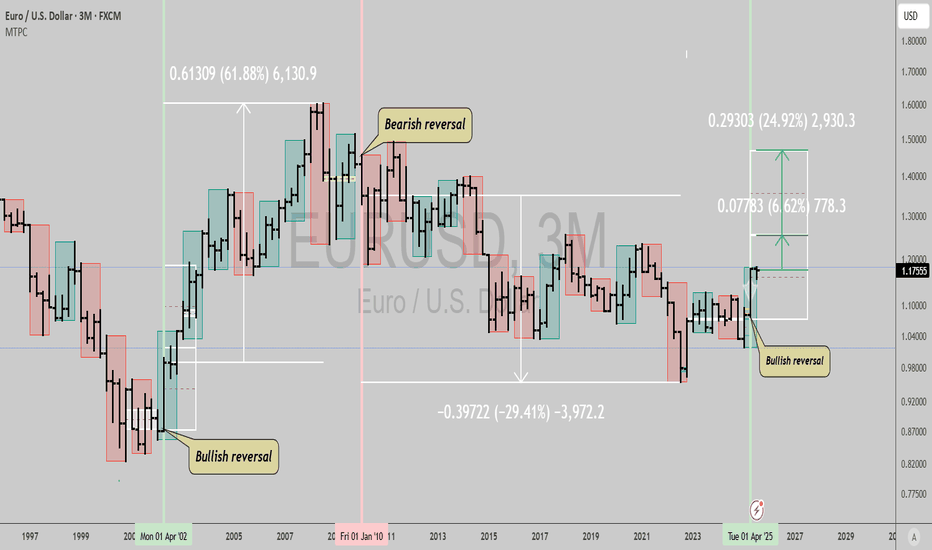

GM gents, wanted to bring your attention to the Euro here. This type of signal hasn't happened since 2002, which makes it a very big deal and a very real risk if you're in Europe and holding USD exposure. We could see a 7% to 25% rally in the coming 2 years from this spot, with pretty high probability, and maybe even a series of similar signals in the same...

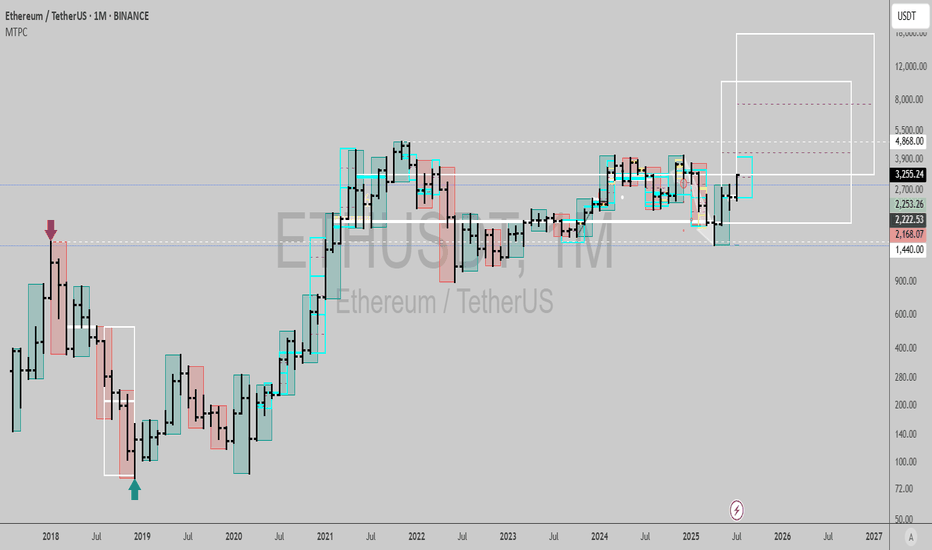

Monthly chart signal gives me a 17,975 United States of America Dollars per Vitalik Coin target🎯, within 19 months from now... I don't think many people can fathom this but it is entirely possible, and probable now. (few bulls and those bullish mention 10k as a target, but nothing as high as this) Best of luck! Cheers, Ivan Labrie.

NASDAQ:MSTR long term signal triggered... Up trend in monthly scale until end of 2025. Heard it here first, lads. Best of luck! Cheers, Ivan Labrie.

GN gents, interestingly, Ripple is one of the strongest charts in crypto currently, and it has flashed long term buy signals indicating the bull market continues NOW. The last trade netted 305% upside, I estimate at least 224% can be achieved from here, with very low risk. Best of luck! Cheers, Ivan Labrie.

Uber is on the verge of a major transformation, with robotaxis set to become a game-changing profit engine. Technical charts indicate we can enter a long position today with low risk, while aiming for a long term rally resumption from here. Monthly and quarterly timeframe Time@Mode trends are bullish, suggesting price can reach heights between $111, $176 and...

GM gents, it seems OANDA:XAUUSD will reverse the advance here, a weekly timeframe down trend has fired just now. It's either the start of a correction or a reversal of the huge trend it had since Oct 2023. The arrows on chart show the spots where the weekly timeframe trend reversed, so you get an idea of what to expect. Best of luck! Cheers, Ivan Labrie.

Ethereum vs Bitcoin shows that the strong surge that kicked off during May might not be a one off... If you take a look at monthly BITSTAMP:ETHUSD and BITSTAMP:BTCUSD , both charts show a bullish trend that is active until EOY at least (maybe even during the first half of the whole of 2026 depending on how you look at it). But lately, it became clear that the...

Interesting time at mode signal with good upside here. Best of luck! Cheers, Ivan Labrie.

Monthly trend is active, daily now suggests momentum to the upside is intact... Best of luck! Cheers, Ivan Labrie.

For now, ETF buyers are down since inception, but that is about to change. The Trend Navigator algo is flashing a buy signal today, as weekly flashes a Time@Mode signal. (obligatory to mention that the Trend Navigator algo is up 30% ish in this chart in the same period) A lot of people are either sidelined or looking to exit the market right as it's about to...

CSECY:PENGU is about to stage a sharp advance from here. The chart is coiling up and looks ready to send it. If you still haven't acquired your 88,888+ CSECY:PENGU bag to get the multiplier for the Abstract Chain airdrop, you might as well do it now before it costs a lot more. The airdrop isn't a direct handout; holding the tokens gives you an XP boost, so...

GM gents, looks like BINANCE:AVAXUSDT will surge from here, very nice setup. (same in other L1s too btw) Best of luck! Cheers, Ivan Labrie.

GM gents, we have a nice trade setup in this pair, spotted courtesy of my RPT Reversal indicator, which you can find in my profile. Best of luck! Cheers, Ivan Labrie.

Ethereum is ready to move higher, as I anticipated when the BINANCE:ETHBTC signal flashed... Best of luck lads! Cheers, Ivan Labrie.

OANDA:XAGUSD lagging OANDA:XCUUSD in this move... Daily up trend signal flashed today in Silver, seems like a good trade to play catch up vs Copper next. Best of luck! Cheers, Ivan Labrie.

Good reward to risk to go long here with a stop at yesterday's open. Exit at the targets on chart or in 4 days. Best of luck! Cheers, Ivan Labrie.