SP500 is still expected to make a reversal towards downside. the key levels are marked.A better than expected value can cancel the bearish momentum only if the price action breaks 4010 level and gives a daily closing above these levels. my bias is still bearish on SP500. but i will wait for the data results before making any entry.

US500 is highly overbought on all time frames less than one day. the price action of US500 got strong rejection from 4000. my idea for this week is to take entry after rejection from 4000 with a target of 3900. key levels are marked. i hope they are going to help. If you like this or if you think the opposite of this or if there is any other opinion, mention it...

Head and shoulders candle stick chart pattern forming in 45min time frame along with an inside candle at 2hr and 4hr time frame near the supply zone of 3800-3820. my idea is to go short from here with tp of 3750 and 3700

a breakout in 4H time frame in SP500 is detected . this may lead the SP500 to 3800. The price action is still consolidating on daily time frame.

US500 Intraweek Technical Analysis: after rejection from 3925 the SP500 found some support at 3790. The US500 reversed from 3890 and after testing the support of 3700 twice the US500 gave a weekly closure at 3763. The US500 is expected to test the resistance of 3900 in coming week. 3800 is the key resistance for tomorrow where we can see some rejection. My idea...

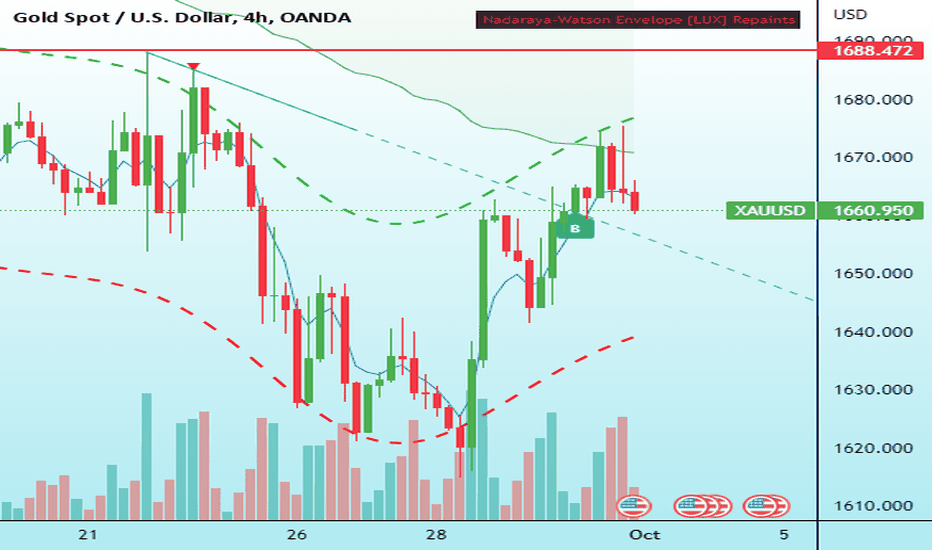

Gold Intraweek Technical Analysis: after staying consolidated between 1630 to 1650 the gold finally broke out from 1650 and 1670 resistance levels and made a weekly closure at 1680. The gold is expected to continue the momentum in coming week .a retracement to 50% and 61.8% fib levels is expected ,the 50% fib levels lies at 1652 whilw 61.8% lies at 1644. My idea...

an inside candle forming on daily time frame in sp500. a breakout above 3840 will push the index in a bullish move while a breakdown below 3700 will push the index in a bearish move.

a cup and handle candle stick pattern is forming in gold. if this holds good we can see levels of 1660 in intraday.

US500 Intraday Technical Analysis: the US500 took rejection from 3900 validating the double top resistance with bearish divergence on all major indicators. The price action of US500 is currently in two rising wedge formations one in intraday with rising wedge upper breakout at 3870 and lower breakdown at 3868. While the larger one has an upper breakout level at...

Gold Intraweek Technical Analysis : Gold has been in a down trend for a while now. The strong support of 1625 has been tested twice now. The next time gold testes the support of 1625 it will be make or break. For bulls ,even the idea of testing the support of 1625 is scary. That is why they will try to hold the price above 1640 till Wednesday and then do a...

The US500 had a fourth bullish week after taking support from 50% retracement level of weekly time frame. The American index is now due for correction, despite of the strong bullish rally on Friday, the us500 opened gap down on Monday showing no interest in the buying side from Asian investors. My idea for current week is to look for short positions in us500 above...

Gold Intraweek Technical Analysis: the move made by gold was very obvious the week, everyone was waiting for the gold to test the support of 1625 atleast once again so that it can be tested and the volumes can be observed.gold tested the support of 1625 with a false breakout towards 1620 and then made a rally to all the way till 1660,giving a weekly and daily...

US500 Intraweek Technical Analysis: After being sideways for three weeks around 3635 , the sp500 finally took support from 3635 and moved all the way to 3760. The sp500 opened at 3583 and closed at 3760 with intraweek highs and lows of 3765 and 3583.the price action made a double bottom at 3584. The price action is overbought at all time frames lower than 1 week....

the SP500 maintained its downside move triggered by the interest rate increase and inflation surge, the SP500 lost another 100 points this week with an intraweek low of 3586 and intraweek high of 3737. For intraweek the SP500 may have found a bottom from where it can pull back for a short interval of time. For coming week we will first look for a strong support...

In previous week we were at the same point in gold where we are in SP500 now, there was not any support below 1660 and we were looking for a strong support below 1660. Now we are looking at a clear morning star formation on gold in weekly time frame. Which indicates an upside move towards 1700 which is the first resistance ahead.On daily time frame we are looking...

Apparently the Bitcoin has found support at 18500. The leading cryptocurrency is hovering around the same levels for more than two weeks now, we are looking at an increase of significant volumes gradually. Long term weekly or fortnightly entries can be made at 18500 for intraweek with target price of 20000.in coming week I am expecting the bitcoin to test the...

Gold made stayed in a rangebound zone in the start of the week and then broke the support of 1700 and went all the way till 1660. Gold is highly oversold In this range. My idea is to accumulate gold from this zone with initial selling target of 1800. Only long term entries can be made from this level. For short term trading one should wait before interest rate...

Last week I was looking for short positions in US30 and I was expecting US30 to test its supports of 31000 and went all the way to 30500 extending its downtrend below the previous low of 31000. The US30 took support from a very strong support point where a lot of upper channel trendlines are passing . this level of 31000 is very crucial for the bull to maintain...