JZ_Trading

I placed a short quick trade after noticing 1. The up trend channel was broken 2. A gap to the down side at highs is formed 3. Previous swing low broken and stock made a Lower High and a Lower Low ( Good signal of a change in trend) 4. The Indicators - being Volume and Oscillators - changed to negative 5. Target to the weekly 50% Fib retracement 6. The broader...

3 conditions that are making me thinking that there will be a price correction for NVDA stock chart: 1. Price broke the 61.8 Fib retracement of the opposing long 2. Combined some indicators one against the other 3. Volume vs Price To note that this stock has reached the 52 week high last week and I try to sell relatively to the broader market the NQ & SPX

Very interesting where yesterday's session has closed! Price action is locked between the 50% Fib retracement long level of the shorter intraday time frame i.e. 15 minute chart and between the 50% Fib retracement level long of daily time frame, while on the daily time frame the opposing short has been traded and price moving to it's -123% target to close some of...

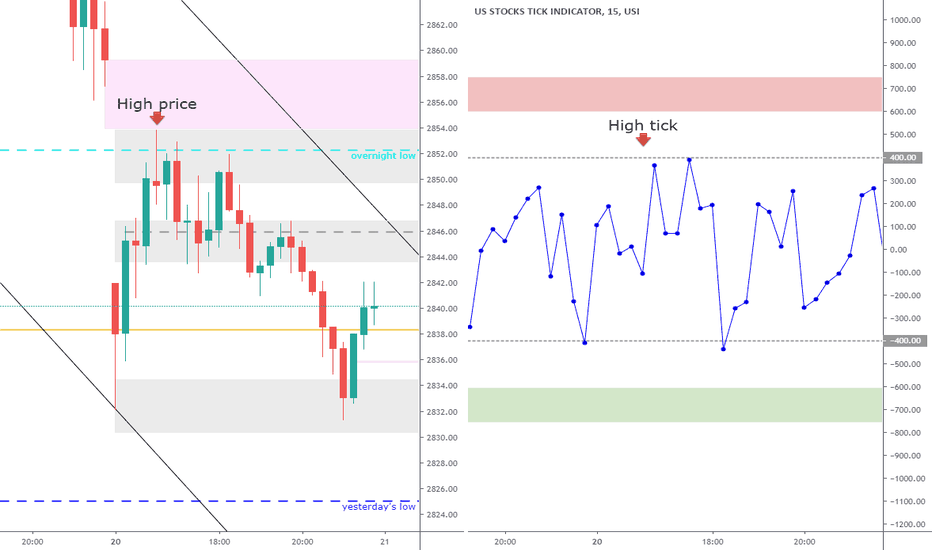

The Advance/Decline Line or ‘A/D Line’ for short, is the second most important of the internals. This indicator tells us the net sum of advancing stocks minus declining stocks. The A/D Line is expressed: # of Advancing Stocks – # of Declining Stocks There are roughly 3000 stocks listed on the NYSE and 3000 on the NASDAQ. An A/D Line reading of 1,500+ is very...

Using HeikIn Ashi candle stick study combined with the Fibonacci; Last week on the 15 minute chart there was price rejection and a triple top was formed at the Fib 50% retracement short. The rally to the up side between June 4th - 10th seems it is in a pause now and awaiting a pull back down to the loading zone box somewhere between the 50-61.8% retracement...

The NYSE Tick Index gives us the relationship of stocks up ticking versus down ticking. The Tick is an extremely useful tool for intraday traders. For Example: If there are 3000 stocks trading on the NYSE and 1500 trade higher from their previous price and 500 trade lower than their last price the Tick will read +1000. But wait what about the other 1000 stocks?...

Identify the trend on higher time frame and market internals using the NYSE tick and the NYSE advance/decline; it is visible for the SPX will reach the 2300.

It can be seen a choppy and more bearish market. Nothing to worry as this is a correction in price and it is normal for any commodity to experience such drop. At some point - which no one knows when - this will bring new investors that will push the price back again to 3000 or more sellers that will push the market to 2000. Using Fibonacci sequence with the anchor...

Using simple Fibonacci replacements price bounced the 61.8% from the all time high and passed the 50% which means the down trend is being broken. Further more observations the pennant which indicated a slow in the trend; is broken. Based on these analysis market price will be heading to resistance 2815 to close above gaps.

The renko chart is showing well that this market is battling around the 2900. Volume is building around this price - 2900 either for a move to a new high or to retest the 2855 level. So here we go again; levels to watch next week Resistance 2916 2908 2900 Support 2887 2880 2871 2857

From the renko chart volume is accumulating near the 2872 area while the 2880 was rejected twice already. While we are in an other correction phase; overall market is still in an uptrend unless the support area 2855 is broken. Resistance levels: 2900 2880 Support levels: 2870 2862 2855 2842

An extremely strong uptrend last week! Many here are posting a market crash but it is going strongly in the opposite. From the renko chart there is high volume near the 2860 - a strong resistance - and market is spending a lot of time near 2680. While the 2820 region as the loading zone. Hence thanks for the power of renko chart here are the levels where the price...

last week the choppy market price action continued to play. It tested the 2800 strong support level and then quickly bounced back to the resistance level 2853. From the renko chart there is high volume near the 2853, 2840 & the 2810 areas and with the power of renko chart here are the levels where the price is expected to...

Friday's session was like, Market started the correction phase before it goes to the 3000 level. Last week the Renko chart showed us the 2860 area as a strong resistance & spend three whole days up there. In fact many doji candles were appearing near that level which is a sign of indecision. The area around 2800 is acting like the loading zone for buyers to spin...

The area around 2800 is where is market is pivoting. Although there is a bullish sentiment due to the fact that 78% of the companies topped Wall Street estimate. Market needs corrections before it goes to the 3000 level. Hence from the Renko chart I expect the market to the following levels Resistance 2855 2842 2823 Support 2814 2807 2797 2776

It seems 2800 which was resistance before is now support with a possibility that a fair price is somewhere around it. The 2840 as resistance . Hence from the Renko chart I expect the market travelling into a correction phase and to the following levels Resistance levels: 2840 2828 2817 Support levels: 2804 2796 2784 2771

Market structure has temporary shifted direction to a downtrend holding resistance at around 2815. It seems 2800 which was resistance before is now support & that a fair price is somewhere around it. Hence from the Renko chart I expect the market travelling to the following levels: Resistance levels: 2815 2810 2806 Support levels: 2800 2795 2776