Analysis Price action is following a similar pattern to 2017 where there was a hefty consolidation after an insane price surge Price this year had surged to over $4000 in a short time frame which resulted in an over 60% crash to $1600 This crash was to the 61.8% fibonacci retracement, just as the previous 2017 cycle had crashed to Following the 2017,...

Analysis: Bitcoin bears losing momentum Price action showing deceleration given by the rate of price decline slowing RSI supports this showing bullish divergence and strength leaning bullish Price is largely following the same reversal pattern compared to when reversing from the ATH Trend-line tested roughly 3 times after reversing due to RSI divergence and...

Analysis Inverse head and shoulders pattern invalidated and now seeking an ascending triangle breakout 100MA serving as resistance turned support on the 4H chart Breakout targeting the 61.8% fibonacci resistance at ~$3400 before retesting the resistance turned support Targeting a multi-week ascending triangle on the macro time-frame, akin to 2017 (see post...

Analysis We may be at the point where the crash is over and the bull market is about to resume again We are in the midst of fully printing an inverted head and shoulders pattern with the right shoulder about to finish forming Current price has retraced and bounced from the local right-shoulder 61.8% fibonacci retracement level The entire correction, from...

Analysis 61.8% local fibonacci retracement met, serving as a bounce region Equilibrium (symmetrical triangle) pattern forming post crash Multi-day, post-crash consolidation winding pattern to reset indicators and oscillators Stochastic at oversold levels and about to reverse Inverse head & shoulders pattern close to completion with the right shoulder...

Analysis Price has crashed severely and a bottom seems to be in given the extent of the recent crash See the ideas linked below for further macro and micro analysis on Ethereum There are 2 options from here Bearish: Ascending wedge breakout to the downside to the 61.8% fibonacci retracement level Bullish: Trend-line bounce upwards to the 61.8% retracement ...

Conclusion: Once price overcomes the 4H 21 moving average, bullish momentum return. Until then, we remain bearish but I believe we have bottomed given the 61.8% retracement and the 2017 fractal shown in the idea linked below.

Analysis Price action has been following very similarly to the Bitcoin price action as seen in the post linked below Price action has been very explosive over the past year and became highly unsustainable This resorted in the ~60% crash from the ATH which was very much needed given the euphoric state of Ethereum This is vastly similar to price action in the...

Analysis Bitcoin repeated this very similar price action back in 2013 In both cases, price had printed several consecutive green candle months This price action is highly unhealthy and unsustainable which resorts to extreme corrections as we have just seen recently in the week commencing Monday 17th May 2021 where we saw 60+% corrections from the ATH across...

An update on my previous TSLA forecast (linked below). Price hit the 61.8% fibonacci as expected and retraced upwards, again as expected. It has now hit serious resistance and formed an A-B-C correction pattern. The way the chart is setup with price action, stochastic and RSI, there is valid reason to believe we have just corrected after selling off deeply...

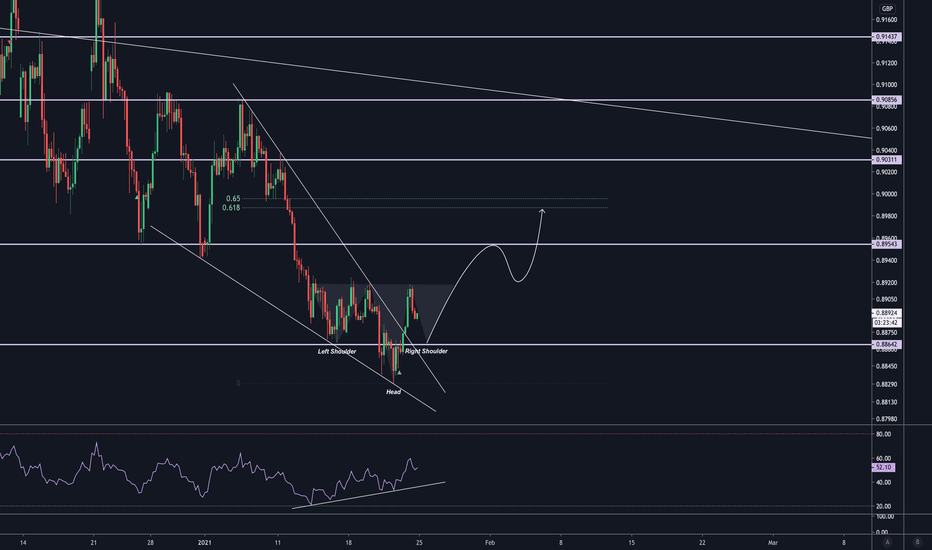

EUR/GBP broke a major support level during the start of 2021 As a result, a massive sell of spewed over the course of Q1 2021 Stochastic and RSI is showing heavy divergence on the daily and given the oversold conditions of the market a reversal may be pending A long position has been executed with 2 targets: Target 1 - initial major support level Target 2...

Proposition: EV Stocks have exploded in value from all types and all countries in all sectors Tesla has been among them as the most explosive stock over the last year Price has inflated far more than the company has grown It is without a doubt that Tesla is a highly prosperous company and will continue being the leader in innovation and services so the long...

Bitcoin alt coin decoupling may be happening however market direction is still preserved with the magnitude differing Hence, since bitcoin is bearish (see idea linked below) and the ethereum chart itself is bearish, it is looking like a crash is imminent Given the ascending wedge, a breakout out of this formation will trigger the collapse and begin the journey...

Recent updated price action on bitcoin hasn't changed my initial outlook on price action and direction as per my previous idea linked below The head and shoulders target was invalidation however a descending triangle has formed instead and bulls are losing energy as days pass without another breakout As a result, the descending triangle target would take us...

After price reached historically proven strong support, printed bullish RSI divergence, and broken out an ascending wedge, price has managed to hold even after dropping below support Both the daily and weekly candles closing above the support after wicking below is an indication of a demand zone Possibility of an inverse head and shoulders pattern is forming...

I am bullish due to the fact that, although the dollar has been heavily inflated, it has been oversold and there becomes a point where there's demand and a good value My previous idea showed a similar inverse head and shoulders idea however that didn't play out and the structure broke apart However, the adjusted formation shows that it can indeed still be in...

See linked below my previous EUR/GBP idea where I planned a bullish forecast Although price has dropped noticeably lower, the RSI bearish divergence is still printing tThis indicates that although we are dropping below a significant support level, the strength of the bearish price is getting lower and lower As a result, I still believe we will retrace upwards...

Potential exit strategy for Bitcoin I will begin selling (only) small amounts past $100,000 in order to secure profit before a collapse Past $150,000 I will begin selling a significant size of my holdings in order to secure and realise the tremendous gains I would be perfectly happy and satisfied with selling at this price even if price goes to $200,000+ I...