This chart presents a technical analysis of the Gold Spot (XAU/USD) on a 30-minute timeframe, published on TradingView by Joan_Pro_Trader. The current price is $3,232.195, showing a slight drop of -5.735 (-0.18%). Key Features and Annotations: Ascending Channel: The price has been moving within an ascending channel, marked by two solid blue trendlines. This...

Bitcoin (BTC/USD) 1H Chart Analysis – April 14, 2025 The chart illustrates a recent bullish move in Bitcoin on the 1-hour timeframe, successfully reaching a key target level. Initial Drop: The price initially declined from around $80,741, finding a local bottom at approximately $78,009. Fair Value Gap (FVG): An FVG zone was marked around the mid-range of the...

Chart Analysis for Bitcoin (BTC/USD) – April 10, 2025 Key Observations: 1. Price Action & Trend: - Bitcoin has been moving within a downward channel indicated by the blue trendlines. The price formed a series of lower highs and lower lows in this channel, showing a typical bearish trend. - The price is currently testing the resistance zone around 84,329, a...

Here’s a structured breakdown of potential discrepancies or unclear elements in the provided --- ### *Discrepancies/Observations* 1. *Inconsistent Data Formatting*: - The price "0.1,195.66" appears unusual. Is this a typo (e.g., missing a digit like "1,195.66") or a misplaced decimal? - The target "3165,47" uses a comma as a decimal separator...

Chart Analysis for Gold (XAU/USD) – April 10, 2025 Key Observations: 1. Price Action and Trend: - Gold has been moving within a downtrend pattern, indicated by the blue trendlines. The price has been forming a series of lower highs and lower lows, which is characteristic of a bearish trend. - Currently, the price is approaching resistance near 3,132.06. It...

Here’s a possible discrepancy or contradiction you could highlight based on the provided chart: --- *Discrepancy:* The chart shows Bitcoin's price at *84,923* (likely the current or recent price) with an identified "order block" at this level, suggesting a potential reversal or consolidation zone. However, the "target complete" annotation near *74,755* (the...

*Discrepancy Analysis:* 1. *Unrealistic Price Values:* - The listed high price of *18,051.05* for Gold Spot is implausible. Gold typically trades in the range of hundreds to a few thousand USD per ounce (e.g., ~$2,000 in 2023). A value of 18,051.05 suggests a formatting error or misplaced decimal (e.g., *1,805.10* if corrected). 2. *Inconsistent Targets:* ...

This chart shows the price action for WTI Crude Oil (1-hour timeframe). The price is currently trading within a range, with a resistance level at 66.49 and a support level at 58.93. The current target for the price is 62.41, which is near the midpoint between the resistance and support zones. If the price moves upwards, it is expected to reach 62.41 before...

Chart Analysis for Bitcoin (BTC/USD) – April 08, 2025 – 4-Hour Timeframe Key Observations: 1. Trend and Price Action: - The price of Bitcoin (BTC) has been trading within a descending channel as shown by the blue trendlines. This indicates a bearish market structure. The price has recently broken below previous levels of support and continues to decline,...

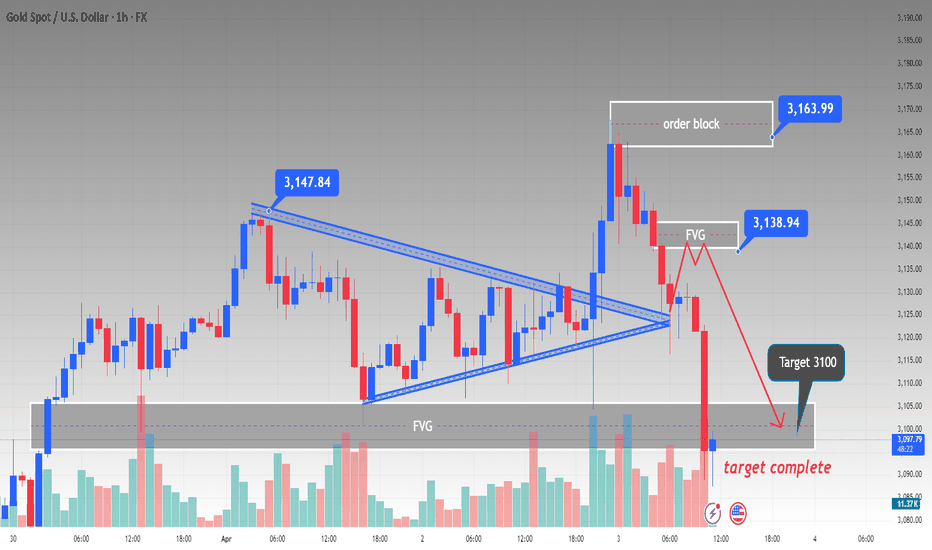

Chart Analysis for Gold (XAU/USD) – April 08, 2025 – 1-Hour Timeframe Key Observations: 1. Trend and Price Action: - The price of Gold (XAU/USD) has been trading in a descending channel, marked by blue trendlines, indicating a bearish structure. The recent price movement shows a breakdown from an upper resistance zone near 3,138.95, followed by a move toward...

This chart shows Silver (XAG/USD) on a 4-hour timeframe with important levels and technical patterns marked. Here's a breakdown and analysis of the chart: Key Observations: 1. Price Structure: - The price of Silver has been moving in an ascending channel (marked by the blue trendlines), indicating a bullish trend over the period shown on the chart. The price...

This chart shows Gold (XAU/USD) on a 1-hour timeframe, with various key technical levels identified, including order blocks, FVG (Fair Value Gap), and target zones. Here's an analysis based on the chart: Key Observations: 1. Price Action: - The price of Gold has been moving in an ascending triangle pattern (denoted by the blue trendlines). Ascending triangles...

This chart shows Bitcoin (BTC/USDT) on a 1-hour timeframe, with several key levels identified and a potential bullish continuation setup. Here's a breakdown of the chart and its components: Key Observations: 1. Price Channel: - The price is currently moving within an ascending channel between 82,579.97 (lower boundary) and 85,576.69 (upper boundary). The...

This chart shows the WTI Crude Oil (CL) on a 1-hour timeframe with key levels and potential trade setups based on the FVG (Fair Value Gap) and support and resistance zones. Here's a breakdown of the analysis: Key Observations: 1. Support and Resistance Levels: - Support Level: The price has recently tested the support level around 69.00. This area has acted...

The chart displays Gold (XAU/USD) on a 1-hour timeframe, showcasing a possible reversal and price target. Here’s a detailed analysis of the chart: Key Observations: 1. FVG (Fair Value Gap): - The FVG zone is highlighted between 3,130.68 and 3,138.94. This represents a price imbalance that typically acts as a resistance zone. The price has recently tested the...

The chart shows Gold (XAU/USD) on a 1-hour timeframe, demonstrating a potential retracement and target completion. Below is a detailed analysis of the key points: Key Observations: 1. FVG (Fair Value Gap): - The FVG (Fair Value Gap) is shown in the area between 3,007.175 and 3,009.895, which represents a price imbalance. This area often acts as a support zone...

The chart shows British Pound (GBP/USD) on a 4-hour timeframe, with key levels of support and resistance, and an area of Fair Value Gap (FVG). Here’s the detailed analysis: Key Observations: 1. FVG (Fair Value Gap): - The chart highlights two FVG zones. One is located above the current price, indicating a gap in price action that could act as a resistance...

The chart shows Silver (XAG/USD) on a 4-hour timeframe, with clear indications of an FVG (Fair Value Gap) and a potential pullback to a key support level. Here's the detailed analysis: Key Observations: 1. FVG (Fair Value Gap): - The FVG zones are marked above and below the price, with the first one at the top of the chart around 33.1747. This represents an...